Intro

Explore CA health insurance options, including individual, family, and group plans, with coverage for medical, dental, and vision care, to find affordable and comprehensive health insurance solutions in California.

The state of California offers a wide range of health insurance options to its residents, catering to diverse needs and budgets. With the ever-changing landscape of healthcare, it's essential to stay informed about the available choices to make the best decision for yourself and your loved ones. In this article, we'll delve into the various CA health insurance options, exploring their benefits, drawbacks, and everything in between. Whether you're an individual, family, or business owner, understanding the intricacies of California's health insurance market will empower you to make informed decisions about your healthcare.

California's health insurance market is characterized by a mix of private insurers, government-sponsored programs, and non-profit organizations. The state's commitment to providing affordable healthcare options has led to the development of innovative programs, such as Covered California, which offers subsidized health insurance to eligible residents. Additionally, California has expanded its Medicaid program, known as Medi-Cal, to cover more low-income individuals and families. These initiatives have significantly reduced the number of uninsured Californians, but there's still more work to be done to ensure everyone has access to quality healthcare.

The importance of having health insurance cannot be overstated. It provides financial protection against unexpected medical expenses, allowing individuals to focus on their recovery rather than worrying about the cost of treatment. Moreover, health insurance encourages preventive care, which can help detect and manage chronic conditions, reducing the risk of complications and improving overall well-being. With the numerous CA health insurance options available, residents can choose the plan that best suits their needs, budget, and lifestyle.

Private Health Insurance Options in California

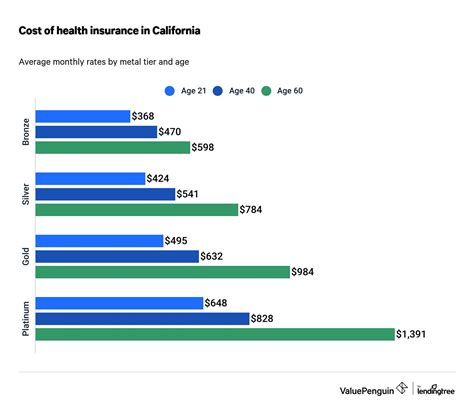

Private health insurance options in California are offered by various insurance companies, including Anthem Blue Cross, Blue Shield of California, and Kaiser Permanente. These plans can be purchased directly from the insurer or through a licensed agent or broker. Private health insurance plans in California are categorized into different metal tiers, including Bronze, Silver, Gold, and Platinum, each with varying levels of coverage and out-of-pocket costs. Bronze plans, for example, have lower premiums but higher deductibles, while Platinum plans have higher premiums but lower deductibles.

Advantages of Private Health Insurance

Some advantages of private health insurance in California include:

- Flexibility: Private health insurance plans offer a range of options, allowing individuals to choose the plan that best fits their needs and budget.

- Network: Private health insurance plans often have extensive networks of healthcare providers, giving individuals access to a wide range of doctors and hospitals.

- Customization: Private health insurance plans can be tailored to meet specific needs, such as adding dental or vision coverage.

Disadvantages of Private Health Insurance

Some disadvantages of private health insurance in California include:

- Cost: Private health insurance plans can be expensive, especially for individuals who do not qualify for subsidies.

- Limited coverage: Some private health insurance plans may have limited coverage, excluding essential health benefits or having high out-of-pocket costs.

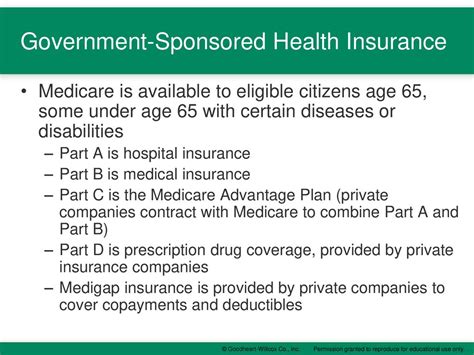

Government-Sponsored Health Insurance Options in California

Government-sponsored health insurance options in California include Medi-Cal, Covered California, and Medicare. These programs provide affordable health insurance to eligible residents, including low-income individuals and families, children, and people with disabilities.

Medi-Cal

Medi-Cal is California's Medicaid program, which provides free or low-cost health insurance to eligible residents. To qualify for Medi-Cal, individuals must meet certain income and resource requirements. Medi-Cal covers a range of essential health benefits, including doctor visits, hospital stays, prescription medications, and preventive care.

Covered California

Covered California is the state's health insurance marketplace, where individuals and families can purchase subsidized health insurance plans. Covered California offers a range of plans from various insurance companies, including Anthem Blue Cross, Blue Shield of California, and Kaiser Permanente. To qualify for subsidies, individuals must meet certain income requirements and be eligible for coverage.

Medicare

Medicare is a federal health insurance program for people 65 or older, certain younger people with disabilities, and people with End-Stage Renal Disease (permanent kidney failure requiring dialysis or a transplant). Medicare has several parts, including Part A (hospital insurance), Part B (medical insurance), and Part D (prescription drug coverage).

Non-Profit Health Insurance Options in California

Non-profit health insurance options in California include health maintenance organizations (HMOs) and preferred provider organizations (PPOs). These plans are offered by non-profit organizations, such as Kaiser Permanente, which aim to provide affordable and high-quality healthcare to their members.

Advantages of Non-Profit Health Insurance

Some advantages of non-profit health insurance in California include:

- Affordability: Non-profit health insurance plans can be more affordable than private health insurance plans.

- Quality care: Non-profit health insurance plans often prioritize preventive care and have a strong focus on patient satisfaction.

- Community involvement: Non-profit health insurance plans may be involved in local community health initiatives and outreach programs.

Disadvantages of Non-Profit Health Insurance

Some disadvantages of non-profit health insurance in California include:

- Limited network: Non-profit health insurance plans may have limited networks of healthcare providers.

- Limited coverage: Some non-profit health insurance plans may have limited coverage, excluding essential health benefits or having high out-of-pocket costs.

Short-Term Health Insurance Options in California

Short-term health insurance options in California are temporary health insurance plans that provide coverage for a limited period, usually up to 12 months. These plans are designed for individuals who are between jobs, waiting for group coverage to start, or need temporary coverage.

Advantages of Short-Term Health Insurance

Some advantages of short-term health insurance in California include:

- Flexibility: Short-term health insurance plans can provide temporary coverage, giving individuals time to find a more permanent solution.

- Affordability: Short-term health insurance plans can be more affordable than private health insurance plans.

- Quick enrollment: Short-term health insurance plans often have quick enrollment processes, allowing individuals to get coverage quickly.

Disadvantages of Short-Term Health Insurance

Some disadvantages of short-term health insurance in California include:

- Limited coverage: Short-term health insurance plans may have limited coverage, excluding essential health benefits or having high out-of-pocket costs.

- Pre-existing conditions: Short-term health insurance plans may not cover pre-existing conditions or may have waiting periods before coverage begins.

California Health Insurance Costs

The cost of health insurance in California varies depending on several factors, including age, location, income level, and plan type. On average, the cost of health insurance in California ranges from $300 to $1,000 per month for an individual, depending on the plan and provider.

Factors Affecting Health Insurance Costs

Some factors that affect health insurance costs in California include:

- Age: Older individuals may pay more for health insurance due to increased health risks.

- Location: Health insurance costs can vary depending on the location, with urban areas tend to have higher costs than rural areas.

- Income level: Individuals with lower incomes may be eligible for subsidies or Medicaid, reducing their health insurance costs.

- Plan type: Different plan types, such as HMOs or PPOs, can affect health insurance costs, with some plans having higher premiums or out-of-pocket costs.

Choosing the Right Health Insurance Plan in California

Choosing the right health insurance plan in California can be overwhelming, with numerous options available. To make an informed decision, individuals should consider their health needs, budget, and lifestyle.

Steps to Choose the Right Health Insurance Plan

Some steps to choose the right health insurance plan in California include:

- Assessing health needs: Individuals should consider their health needs, including any pre-existing conditions or ongoing treatments.

- Evaluating budget: Individuals should evaluate their budget, considering the cost of premiums, deductibles, and out-of-pocket costs.

- Comparing plans: Individuals should compare different health insurance plans, considering factors such as network, coverage, and customer service.

- Seeking advice: Individuals may seek advice from a licensed insurance agent or broker to help navigate the health insurance market.

What is the difference between an HMO and a PPO?

+An HMO (Health Maintenance Organization) is a type of health insurance plan that requires individuals to receive medical care from a specific network of providers, while a PPO (Preferred Provider Organization) is a type of plan that allows individuals to receive care from any provider, with higher out-of-pocket costs for out-of-network care.

Can I purchase health insurance outside of the open enrollment period?

+Yes, individuals can purchase health insurance outside of the open enrollment period if they experience a qualifying life event, such as losing job-based coverage, getting married, or having a baby.

What is the difference between Medicare and Medicaid?

+Medicare is a federal health insurance program for people 65 or older, certain younger people with disabilities, and people with End-Stage Renal Disease, while Medicaid is a joint federal-state program that provides health insurance to low-income individuals and families.

In conclusion, the CA health insurance market offers a wide range of options, catering to diverse needs and budgets. By understanding the different types of health insurance plans, including private, government-sponsored, and non-profit options, individuals can make informed decisions about their healthcare. Remember to assess your health needs, evaluate your budget, and compare different plans to choose the right health insurance plan for you. If you have any questions or need further guidance, don't hesitate to reach out to a licensed insurance agent or broker. Share your experiences and tips for choosing the right health insurance plan in the comments below, and help others make informed decisions about their healthcare.