Intro

Discover affordable Covered California insurance plans, including health, dental, and vision options, with expert guidance on enrollment, subsidies, and benefits, to find the best coverage for your needs.

The healthcare landscape in California has undergone significant changes over the years, with the Affordable Care Act (ACA) playing a pivotal role in shaping the state's insurance market. For Californians, having access to comprehensive and affordable health insurance is crucial for maintaining their well-being and financial stability. Covered California, the state's health insurance marketplace, has been instrumental in providing individuals and families with a range of insurance plans that cater to their diverse needs. In this article, we will delve into the world of Covered California insurance plans, exploring their benefits, working mechanisms, and the steps involved in selecting the right plan.

The importance of health insurance cannot be overstated, as it provides individuals with financial protection against unexpected medical expenses and ensures they receive necessary care without breaking the bank. Covered California has been at the forefront of this effort, offering a variety of insurance plans from prominent carriers such as Kaiser Permanente, Blue Shield of California, and Health Net. These plans are designed to provide comprehensive coverage, including essential health benefits like doctor visits, hospital stays, prescription medications, and preventive care services.

For many Californians, navigating the complex world of health insurance can be daunting. With numerous plans available, each with its unique features and pricing, it can be challenging to determine which plan best suits one's needs. However, Covered California has implemented various measures to simplify the process, including an online enrollment platform and a network of certified enrollment counselors who provide guidance and support throughout the selection process. By understanding the different types of plans available and the factors that influence their costs, individuals can make informed decisions and select a plan that provides the right balance of coverage and affordability.

Covered California Insurance Plan Options

Covered California offers a range of insurance plans, each with its unique characteristics and benefits. The plans are categorized into four metal tiers: Bronze, Silver, Gold, and Platinum. The metal tier system is designed to provide a clear indication of the plan's actuarial value, which represents the percentage of medical expenses covered by the insurance carrier. The Bronze tier, for example, has an actuarial value of 60%, meaning that the insurance carrier covers 60% of medical expenses, while the individual is responsible for the remaining 40%. In contrast, the Platinum tier has an actuarial value of 90%, providing more comprehensive coverage but at a higher premium cost.

Understanding the Metal Tier System

The metal tier system is an essential aspect of Covered California insurance plans, as it helps individuals understand the level of coverage they can expect from their plan. The system is designed to provide a clear and transparent way of comparing plans, allowing individuals to make informed decisions based on their unique needs and budget. The four metal tiers are: * Bronze: 60% actuarial value * Silver: 70% actuarial value * Gold: 80% actuarial value * Platinum: 90% actuarial valueBenefits of Covered California Insurance Plans

Covered California insurance plans offer numerous benefits, including comprehensive coverage, financial protection, and access to a network of healthcare providers. One of the most significant advantages of these plans is the essential health benefits they provide, which include:

- Doctor visits and hospital stays

- Prescription medications and laboratory services

- Preventive care services, such as annual check-ups and screenings

- Maternity and newborn care

- Mental health and substance use disorder services

Financial Protection and Affordability

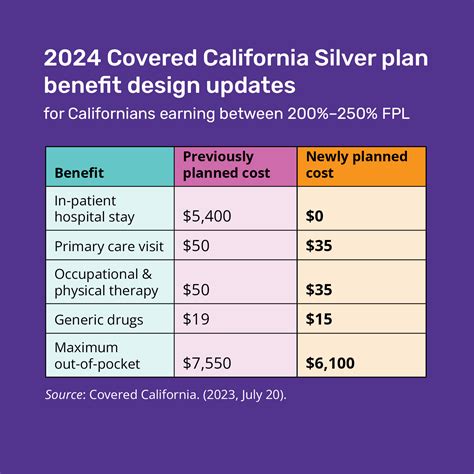

In addition to providing comprehensive coverage, Covered California insurance plans also offer financial protection and affordability. The plans are designed to limit out-of-pocket expenses, ensuring that individuals do not face excessive medical bills. Furthermore, many individuals and families may be eligible for financial assistance, such as premium subsidies or cost-sharing reductions, which can help make their plan more affordable.How to Choose the Right Covered California Insurance Plan

Choosing the right Covered California insurance plan involves careful consideration of several factors, including the individual's or family's unique needs, budget, and health status. Here are some steps to follow:

- Determine eligibility: Check if you or your family members are eligible for Covered California insurance plans.

- Explore plan options: Research the different plans available, including their metal tiers, benefits, and costs.

- Consider network and providers: Ensure that your preferred healthcare providers are part of the plan's network.

- Evaluate costs: Calculate the total cost of the plan, including premiums, deductibles, and out-of-pocket expenses.

- Seek guidance: Consult with a certified enrollment counselor or licensed insurance agent to get personalized advice and support.

Enrollment and Application Process

The enrollment and application process for Covered California insurance plans is designed to be straightforward and user-friendly. Individuals can apply online, by phone, or in person with the help of a certified enrollment counselor. The application process typically involves providing personal and financial information, as well as documentation to verify eligibility.Covered California Insurance Plan Costs and Financial Assistance

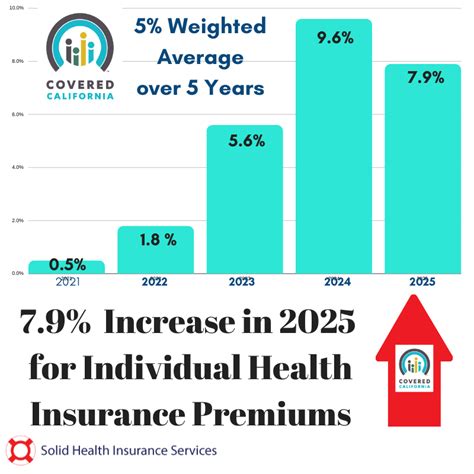

The cost of Covered California insurance plans varies depending on several factors, including the metal tier, age, and location. However, many individuals and families may be eligible for financial assistance, which can help reduce the cost of their plan. There are two types of financial assistance available:

- Premium subsidies: These subsidies help lower the monthly premium cost of the plan.

- Cost-sharing reductions: These reductions help lower the out-of-pocket expenses, such as deductibles and copays, associated with the plan.

Special Enrollment Periods and Qualifying Events

In addition to the annual open enrollment period, Covered California also offers special enrollment periods for individuals who experience qualifying events, such as: * Losing job-based coverage * Getting married or divorced * Having a baby or adopting a child * Moving to a new area * Becoming a U.S. citizen or lawfully present individualCovered California Insurance Plan Providers and Networks

Covered California insurance plans are offered by a range of providers, including Kaiser Permanente, Blue Shield of California, and Health Net. Each provider has its own network of healthcare professionals and facilities, which may vary depending on the plan and location. It is essential to ensure that your preferred healthcare providers are part of the plan's network to avoid out-of-network costs and ensure seamless care.

Quality and Ratings of Covered California Insurance Plans

The quality and ratings of Covered California insurance plans are closely monitored by the state's Department of Managed Health Care and the federal Centers for Medicare and Medicaid Services. These agencies evaluate plans based on various metrics, including: * Patient satisfaction * Quality of care * Network adequacy * Customer serviceConclusion and Next Steps

In conclusion, Covered California insurance plans offer a range of benefits and options for individuals and families seeking comprehensive and affordable health insurance. By understanding the different types of plans available, the metal tier system, and the factors that influence costs, individuals can make informed decisions and select a plan that meets their unique needs. If you are interested in learning more about Covered California insurance plans or would like to enroll in a plan, we encourage you to visit the Covered California website or consult with a certified enrollment counselor.

We invite you to share your thoughts and experiences with Covered California insurance plans in the comments section below. Your feedback and insights can help others make informed decisions and navigate the complex world of health insurance. Additionally, if you found this article helpful, please consider sharing it with your friends and family who may be seeking health insurance coverage.

What is Covered California, and how does it work?

+Covered California is the state's health insurance marketplace, where individuals and families can purchase comprehensive and affordable health insurance plans. The marketplace offers a range of plans from various providers, and individuals can enroll during the annual open enrollment period or special enrollment periods.

What are the different types of Covered California insurance plans available?

+Covered California offers a range of insurance plans, including Bronze, Silver, Gold, and Platinum plans. Each plan has its unique characteristics and benefits, and individuals can choose a plan that meets their unique needs and budget.

How do I determine if I am eligible for Covered California insurance plans?

+To determine eligibility, individuals can visit the Covered California website or consult with a certified enrollment counselor. They will need to provide personal and financial information, as well as documentation to verify eligibility.

What is the metal tier system, and how does it work?

+The metal tier system is a way of categorizing health insurance plans based on their actuarial value, which represents the percentage of medical expenses covered by the insurance carrier. The four metal tiers are Bronze, Silver, Gold, and Platinum, each with its unique level of coverage and cost.

How do I enroll in a Covered California insurance plan?

+Individuals can enroll in a Covered California insurance plan online, by phone, or in person with the help of a certified enrollment counselor. The application process typically involves providing personal and financial information, as well as documentation to verify eligibility.