Intro

Compare HMO vs PPO health insurance plans, understanding key differences in network, costs, flexibility, and coverage to make informed decisions about managed care, healthcare providers, and out-of-pocket expenses.

The world of health insurance can be complex and overwhelming, with numerous options available to individuals and families. Two of the most popular types of health insurance plans are Health Maintenance Organization (HMO) and Preferred Provider Organization (PPO) plans. While both types of plans have their advantages and disadvantages, there are significant differences between them. Understanding these differences is crucial in making an informed decision when selecting a health insurance plan. In this article, we will delve into the 5 key differences between HMO and PPO plans, exploring their characteristics, benefits, and drawbacks.

When it comes to health insurance, it's essential to consider factors such as network, costs, and flexibility. HMO and PPO plans differ significantly in these areas, and understanding these differences can help individuals and families make the best choice for their healthcare needs. Whether you're a young professional, a family with children, or a retiree, having the right health insurance plan can provide peace of mind and financial protection. In the following sections, we will examine the key differences between HMO and PPO plans, including their network, costs, and flexibility.

HMO Plans: Understanding the Basics

Key Characteristics of HMO Plans

Some of the key characteristics of HMO plans include: * A network of healthcare providers who have contracted with the insurance company to provide care at a discounted rate * A requirement to choose a PCP from the network * A need for referrals from the PCP to see specialists * Lower out-of-pocket costs, such as copays and deductibles * A focus on preventive care and wellness programsPPO Plans: Understanding the Basics

Key Characteristics of PPO Plans

Some of the key characteristics of PPO plans include: * A network of healthcare providers who have contracted with the insurance company to provide care at a discounted rate * The option to see healthcare providers outside of the network, although at a higher cost * No requirement to choose a PCP or obtain referrals to see specialists * Higher out-of-pocket costs, such as copays and deductibles * A greater emphasis on member flexibility and choiceNetwork: HMO vs PPO

Network Considerations

When considering the network of an HMO or PPO plan, it's essential to think about the following factors: * The size and quality of the network * The availability of specialists and hospitals * The convenience of locations and office hours * The reputation and credentials of the healthcare providersCosts: HMO vs PPO

Cost Considerations

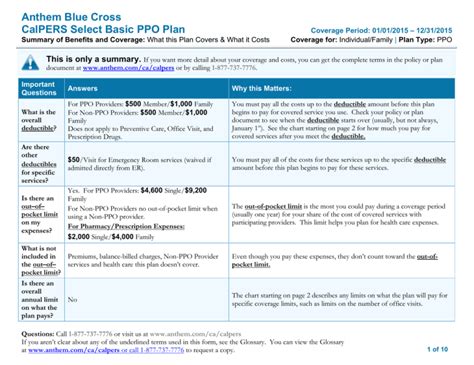

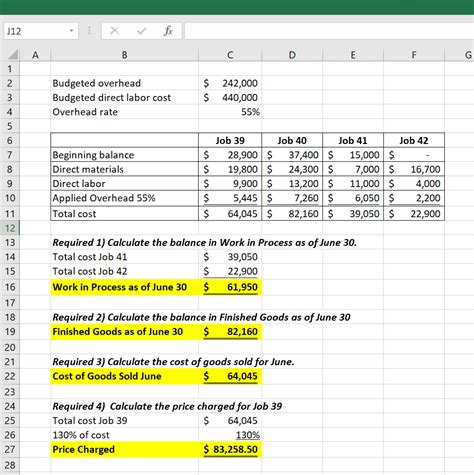

When considering the costs of an HMO or PPO plan, it's essential to think about the following factors: * The premium, copays, and deductibles * The out-of-pocket maximum and annual limits * The costs of prescriptions and other services * The potential for surprise medical billsFlexibility: HMO vs PPO

Flexibility Considerations

When considering the flexibility of an HMO or PPO plan, it's essential to think about the following factors: * The ability to see specialists without a referral * The freedom to choose any healthcare provider * The convenience of online portals and mobile apps * The availability of telemedicine servicesAdditional Differences: HMO vs PPO

Additional Considerations

When considering these additional factors, it's essential to think about the following: * The reputation and ratings of the insurance company * The quality of care and patient satisfaction ratings * The availability of online resources and support * The potential for changes in coverage and rate increasesWhat is the main difference between HMO and PPO plans?

+The main difference between HMO and PPO plans is the network of healthcare providers and the flexibility to choose providers. HMO plans have a more restrictive network, while PPO plans offer more flexibility and freedom to choose providers.

Which plan is more affordable, HMO or PPO?

+HMO plans are typically more affordable, with lower premiums, copays, and deductibles. However, PPO plans offer more flexibility and freedom to choose healthcare providers, which can result in higher out-of-pocket costs.

Can I see any healthcare provider I choose with a PPO plan?

+Yes, with a PPO plan, you can see any healthcare provider you choose, both in-network and out-of-network. However, seeing an out-of-network provider may result in higher out-of-pocket costs.

Do HMO plans require a referral to see a specialist?

+Yes, HMO plans typically require a referral from a primary care physician (PCP) to see a specialist. This is designed to ensure that members receive coordinated care and to control costs.

Which plan is better for individuals who want more control over their healthcare?

+PPO plans are generally better for individuals who want more control over their healthcare, as they offer more flexibility and freedom to choose healthcare providers. However, this flexibility may come at a higher cost.

In conclusion, the decision between an HMO and PPO plan depends on various factors, including network, costs, flexibility, and individual preferences. By understanding the key differences between these plans, individuals and families can make an informed decision that meets their healthcare needs and budget. We invite you to share your thoughts and experiences with HMO and PPO plans in the comments below. If you found this article helpful, please share it with others who may be considering their health insurance options.