Intro

Discover key differences between HMO and PPO health plans, including network flexibility, out-of-pocket costs, and provider choice, to make informed decisions about your healthcare coverage and insurance needs.

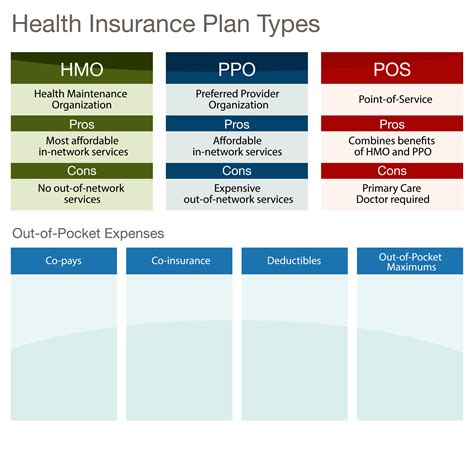

When it comes to choosing a health insurance plan, two of the most popular options are HMO (Health Maintenance Organization) and PPO (Preferred Provider Organization). Both types of plans have their own set of benefits and drawbacks, and understanding the differences between them is crucial to making an informed decision. In this article, we will delve into the world of HMOs and PPOs, exploring their characteristics, advantages, and disadvantages, as well as providing practical examples and statistical data to help you make the best choice for your healthcare needs.

The importance of choosing the right health insurance plan cannot be overstated. With the rising costs of healthcare, having a plan that meets your needs and budget is essential to maintaining your physical and financial well-being. HMOs and PPOs are two of the most common types of health insurance plans, and while they share some similarities, they also have some key differences. By understanding these differences, you can make an informed decision and choose the plan that best suits your needs.

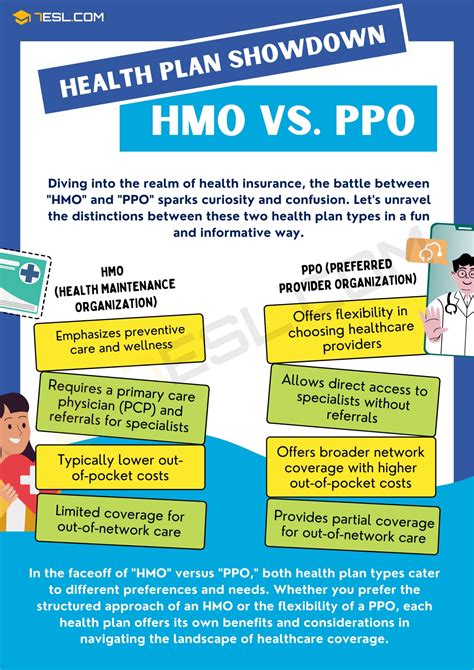

One of the primary reasons to choose between an HMO and a PPO is the level of flexibility and control you want to have over your healthcare. HMOs are known for their structured approach to healthcare, with a focus on preventive care and a primary care physician (PCP) who coordinates your medical treatment. PPOs, on the other hand, offer more flexibility and freedom to choose your healthcare providers, both in-network and out-of-network. This difference in approach can have a significant impact on your healthcare experience, and it's essential to consider your individual needs and preferences when deciding between an HMO and a PPO.

Overview of HMOs

Benefits of HMOs

Some of the benefits of HMOs include: * Lower premiums compared to PPOs * Emphasis on preventive care and early intervention * Coordination of care through a primary care physician * Reduced administrative burden for members * Incentives for healthcare providers to deliver high-quality, cost-effective careOverview of PPOs

Benefits of PPOs

Some of the benefits of PPOs include: * Greater flexibility and freedom to choose healthcare providers * No requirement to choose a primary care physician or obtain referrals * Coverage for out-of-network care, although at a higher cost * Ability to see specialists without a referral * More convenience and flexibility, especially for members with complex medical needsKey Differences Between HMOs and PPOs

Choosing Between an HMO and a PPO

When choosing between an HMO and a PPO, it's essential to consider your individual needs and preferences. If you value flexibility and freedom to choose your healthcare providers, a PPO may be the better choice. However, if you prioritize preventive care and are willing to work within a more structured network, an HMO may be the better option. Ultimately, the decision between an HMO and a PPO depends on your unique circumstances and healthcare needs.Practical Examples and Statistical Data

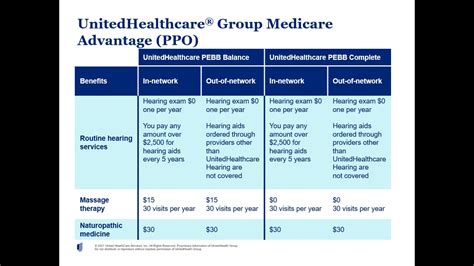

In terms of statistical data, a study by the Kaiser Family Foundation found that HMOs tend to have lower premiums compared to PPOs, with an average premium difference of $100 per month. However, the same study also found that PPOs offer more flexibility and freedom to choose healthcare providers, which can be an important consideration for members with complex medical needs.

Conclusion and Next Steps

We invite you to share your thoughts and experiences with HMOs and PPOs in the comments section below. Have you had a positive or negative experience with one of these plans? Do you have any questions or concerns about choosing between an HMO and a PPO? We're here to listen and provide guidance to help you make the best decision for your healthcare needs.

What is the main difference between an HMO and a PPO?

+The main difference between an HMO and a PPO is the level of flexibility and control you have over your healthcare. HMOs have a more restrictive network and require members to choose a primary care physician, while PPOs offer more flexibility and freedom to choose healthcare providers, both in-network and out-of-network.

Which type of plan is better for someone with a chronic condition?

+A PPO may be the better choice for someone with a chronic condition, as it offers more flexibility and freedom to choose healthcare providers, including specialists. However, an HMO may also be a good option if you have a chronic condition, as it emphasizes preventive care and coordination of care through a primary care physician.

How do I choose between an HMO and a PPO?

+To choose between an HMO and a PPO, consider your individual needs and preferences. Think about your healthcare needs, your budget, and your priorities. If you value flexibility and freedom to choose your healthcare providers, a PPO may be the better choice. However, if you prioritize preventive care and are willing to work within a more structured network, an HMO may be the better option.