Intro

Discover 5 essential tips for family insurance, including health, life, and disability coverage, to protect your loved ones from unforeseen medical and financial risks with comprehensive plans and policies.

Family insurance is a crucial aspect of securing the well-being and financial stability of your loved ones. With the ever-increasing costs of healthcare, accidents, and other unforeseen events, having the right insurance coverage can provide peace of mind and protect your family from financial ruin. In this article, we will delve into the world of family insurance, exploring its importance, types, and benefits, as well as providing valuable tips for selecting the right policy for your family.

The importance of family insurance cannot be overstated. It provides a financial safety net in the event of unexpected medical expenses, accidents, or even the loss of a breadwinner. Without proper insurance coverage, families may struggle to make ends meet, leading to debt, bankruptcy, and a reduced quality of life. Furthermore, family insurance can also provide protection against long-term care expenses, disability, and other unforeseen events that may impact your family's financial stability.

Family insurance comes in various forms, including health insurance, life insurance, disability insurance, and long-term care insurance. Each type of insurance serves a unique purpose, and it is essential to understand the benefits and limitations of each policy. For instance, health insurance provides coverage for medical expenses, while life insurance provides a death benefit to your loved ones in the event of your passing. Disability insurance, on the other hand, provides financial support in the event of a disability or illness that prevents you from working.

Understanding Family Insurance Needs

To select the right family insurance policy, it is crucial to understand your family's unique needs and circumstances. This includes assessing your family's health, financial situation, and lifestyle. For example, if you have young children, you may want to consider a policy that provides additional coverage for pediatric care. Similarly, if you have a family history of certain medical conditions, you may want to consider a policy that provides coverage for those conditions.

Assessing Family Insurance Options

When assessing family insurance options, it is essential to consider the following factors: * Premium costs: The cost of the premium will depend on various factors, including the type of policy, coverage limits, and deductible. * Coverage limits: The coverage limit refers to the maximum amount of money the insurance company will pay out in the event of a claim. * Deductible: The deductible refers to the amount of money you must pay out-of-pocket before the insurance company begins to pay. * Exclusions: Exclusions refer to certain conditions or events that are not covered by the policy.Benefits of Family Insurance

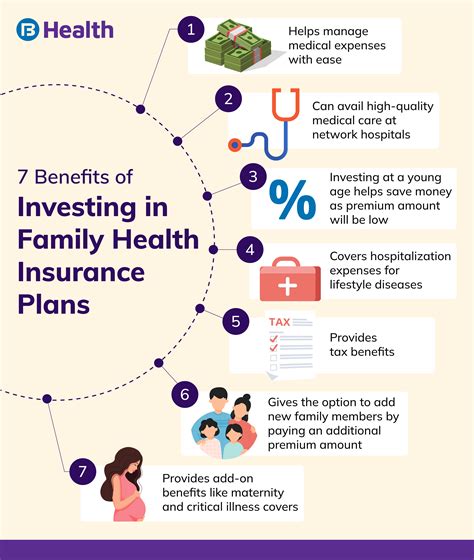

The benefits of family insurance are numerous. Some of the most significant benefits include:

- Financial protection: Family insurance provides a financial safety net in the event of unexpected medical expenses, accidents, or other unforeseen events.

- Peace of mind: Knowing that your family is protected against unforeseen events can provide peace of mind and reduce stress.

- Tax benefits: Certain types of family insurance, such as life insurance, may provide tax benefits.

- Flexibility: Many family insurance policies offer flexible coverage options, allowing you to tailor the policy to your family's unique needs.

Common Mistakes to Avoid

When selecting a family insurance policy, there are several common mistakes to avoid, including: * Underinsuring: Failing to purchase sufficient coverage can leave your family vulnerable to financial ruin in the event of an unforeseen event. * Overinsuring: Purchasing too much coverage can result in unnecessary expenses and wasted premiums. * Failing to read the fine print: It is essential to carefully read and understand the policy terms and conditions before purchasing.5 Tips for Selecting the Right Family Insurance Policy

Selecting the right family insurance policy can be a daunting task, but by following these 5 tips, you can make an informed decision:

- Assess your family's needs: Consider your family's unique needs and circumstances, including health, financial situation, and lifestyle.

- Compare policies: Compare different policies from various insurance providers to find the best coverage and premium rates.

- Read the fine print: Carefully read and understand the policy terms and conditions before purchasing.

- Consider additional coverage options: Consider additional coverage options, such as disability insurance or long-term care insurance, to provide extra protection for your family.

- Seek professional advice: Consider seeking professional advice from an insurance broker or financial advisor to help you navigate the complex world of family insurance.

Family Insurance Policy Riders

Family insurance policy riders refer to additional coverage options that can be added to a standard policy. Some common riders include: * Waiver of premium rider: This rider waives the premium payments in the event of a disability or illness. * Accidental death benefit rider: This rider provides an additional death benefit in the event of an accidental death. * Critical illness rider: This rider provides coverage for critical illnesses, such as cancer or heart disease.Conclusion and Next Steps

In conclusion, family insurance is a vital aspect of securing your family's financial stability and well-being. By understanding your family's unique needs, assessing different policy options, and avoiding common mistakes, you can select the right family insurance policy for your loved ones. Remember to consider additional coverage options, read the fine print, and seek professional advice to ensure you make an informed decision.

We invite you to share your thoughts and experiences with family insurance in the comments section below. Have you ever had to make a claim on a family insurance policy? What tips do you have for selecting the right policy? Share your story and help others make informed decisions about their family's insurance needs.

What is family insurance, and why is it important?

+Family insurance provides financial protection against unforeseen events, such as medical expenses, accidents, and disability. It is essential for securing your family's financial stability and well-being.

What types of family insurance are available?

+There are several types of family insurance available, including health insurance, life insurance, disability insurance, and long-term care insurance. Each type of insurance serves a unique purpose and provides different benefits.

How do I select the right family insurance policy for my family?

+To select the right family insurance policy, consider your family's unique needs and circumstances, compare different policies, read the fine print, and seek professional advice. It is also essential to assess your family's health, financial situation, and lifestyle.