Intro

Discover FSA HSA eligible expenses with our guide, covering medical, dental, and vision costs, plus pharmacy and healthcare necessities, to maximize tax-free savings.

The world of healthcare can be complex and overwhelming, especially when it comes to managing expenses. One way to make healthcare more affordable is by utilizing tax-advantaged accounts such as Flexible Spending Accounts (FSAs) and Health Savings Accounts (HSAs). These accounts allow individuals to set aside pre-tax dollars for qualified medical expenses, reducing their taxable income and lowering their overall healthcare costs. However, navigating the rules and regulations surrounding FSA and HSA eligible expenses can be daunting. In this article, we will delve into the world of FSA and HSA eligible expenses, providing a comprehensive guide to help individuals make the most of these valuable accounts.

Understanding the basics of FSAs and HSAs is essential to maximizing their benefits. FSAs are employer-sponsored accounts that allow employees to contribute pre-tax dollars for qualified medical expenses. HSAs, on the other hand, are individual accounts that can be opened by anyone with a High-Deductible Health Plan (HDHP). Both accounts offer tax advantages, but they have different rules and regulations regarding eligible expenses. By understanding these differences, individuals can make informed decisions about which account is best for their needs and how to use their account funds wisely.

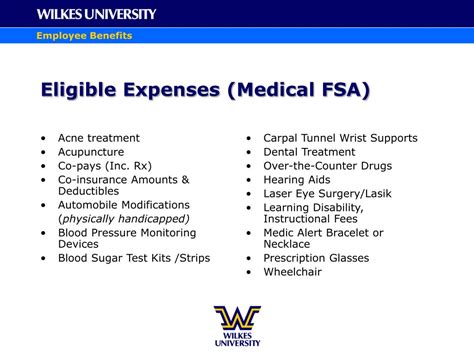

FSA Eligible Expenses

Qualified Medical Expenses

Qualified medical expenses are expenses that are eligible for reimbursement under an FSA. These expenses can include: * Doctor visits and copays * Hospital stays and surgical procedures * Prescription medications and copays * Medical equipment such as wheelchairs and crutches * Vision care, including eye exams and glasses * Dental care, including cleanings and fillings * Mental health care, including therapy sessions and psychiatric care * Transportation costs related to medical care, including gas and parkingHSA Eligible Expenses

Preventive Care Expenses

Preventive care expenses are expenses related to preventive care services, including: * Annual physicals and health screenings * Vaccinations and immunizations * Mammograms and colonoscopies * Blood tests and lab work * Health coaching and wellness programsOver-the-Counter Medications and Supplies

Eligible OTC Medications and Supplies

Some examples of eligible OTC medications and supplies include: * Pain relievers such as acetaminophen and ibuprofen * Antihistamines such as Benadryl and Claritin * Anti-diarrheal medications such as Immodium and Pepto-Bismol * Bandages and band-aids * First aid kits and suppliesDental and Vision Care Expenses

Eligible Dental Care Expenses

Some examples of eligible dental care expenses include: * Cleanings and fluoride treatments * Fillings and crowns * Root canals and extractions * Dental implants and dentures * Orthodontic care and bracesMental Health Care Expenses

Eligible Mental Health Care Expenses

Some examples of eligible mental health care expenses include: * Therapy sessions and counseling services * Psychiatric care and medication management * Substance abuse treatment and rehabilitation * Mental health coaching and wellness programs * Stress management and anxiety therapyTransportation and Lodging Expenses

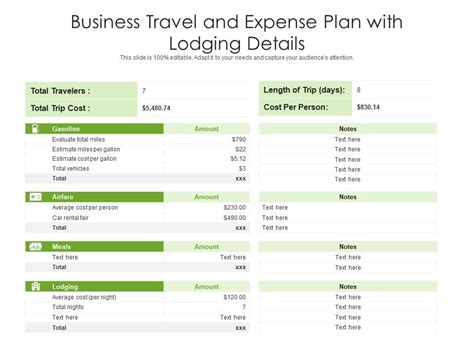

Eligible Transportation and Lodging Expenses

Some examples of eligible transportation and lodging expenses include: * Gas and parking expenses related to medical care * Tolls and transportation fees related to medical care * Hotel stays and meal expenses related to medical care * Ambulance and medical transportation servicesWhat is the difference between an FSA and an HSA?

+FSAs and HSAs are both tax-advantaged accounts that can be used for qualified medical expenses, but they have different rules and regulations. FSAs are employer-sponsored accounts that allow employees to contribute pre-tax dollars for qualified medical expenses, while HSAs are individual accounts that can be opened by anyone with a High-Deductible Health Plan (HDHP).

Can I use my FSA or HSA funds for over-the-counter medications?

+Yes, you can use your FSA or HSA funds for over-the-counter medications, but only if they are purchased with a prescription. Some common examples of eligible over-the-counter medications include pain relievers, antihistamines, and bandages.

Can I use my FSA or HSA funds for dental and vision care expenses?

+Yes, you can use your FSA or HSA funds for dental and vision care expenses, including cleanings, fillings, crowns, eye exams, glasses, and contact lenses. However, these expenses must be qualified medical expenses to be eligible for reimbursement.

Can I use my FSA or HSA funds for mental health care expenses?

+Yes, you can use your FSA or HSA funds for mental health care expenses, including therapy sessions, psychiatric care, and counseling services. However, these expenses must be qualified medical expenses to be eligible for reimbursement.

Can I use my FSA or HSA funds for transportation and lodging expenses?

+Yes, you can use your FSA or HSA funds for transportation and lodging expenses related to medical care, including gas, parking, tolls, hotel stays, and meal expenses. However, these expenses must be necessary for medical care and qualified medical expenses to be eligible for reimbursement.

In conclusion, navigating the world of FSA and HSA eligible expenses can be complex, but with the right guidance, individuals can make the most of these valuable accounts. By understanding the rules and regulations surrounding FSA and HSA eligible expenses, individuals can make informed decisions about which account is best for their needs and how to use their account funds wisely. We encourage readers to share their experiences and ask questions in the comments section below. Additionally, we invite readers to share this article with others who may benefit from this information. By working together, we can make healthcare more affordable and accessible for everyone.