Intro

Understand health insurance charges, premiums, and deductibles. Learn how costs, copays, and coverage impact your medical expenses and financial planning with our expert guide to navigating healthcare costs and insurance plans effectively.

The world of health insurance can be complex and overwhelming, especially when it comes to understanding the various charges associated with it. With the rising costs of healthcare, it's essential to grasp the different components that make up your health insurance premiums. In this article, we will delve into the intricacies of health insurance charges, exploring the factors that influence them, and providing insights into how you can navigate the system to find the best coverage for your needs.

Understanding health insurance charges is crucial for individuals, families, and businesses alike. The costs associated with health insurance can be significant, and it's vital to be aware of the various factors that contribute to these expenses. From premiums and deductibles to copayments and coinsurance, the terminology can be confusing, but it's essential to comprehend these concepts to make informed decisions about your health insurance coverage. By the end of this article, you will have a clearer understanding of the health insurance landscape and be better equipped to manage your healthcare expenses.

The health insurance industry is a multi-billion-dollar market, with countless providers offering a wide range of plans and policies. With so many options available, it can be challenging to determine which plan is right for you. Health insurance charges vary significantly depending on factors such as age, location, and pre-existing conditions. Additionally, the type of plan you choose, whether it's an individual, family, or group plan, can also impact the costs. As we navigate the complexities of health insurance charges, we will explore the different types of plans, their benefits, and drawbacks, to help you make an informed decision about your healthcare coverage.

Introduction to Health Insurance Charges

Health insurance charges refer to the various fees and expenses associated with purchasing and maintaining health insurance coverage. These charges can include premiums, deductibles, copayments, coinsurance, and other out-of-pocket expenses. Understanding these components is essential to navigating the health insurance landscape and finding a plan that meets your needs and budget. In this section, we will explore the different types of health insurance charges, their definitions, and how they impact your overall healthcare costs.

Types of Health Insurance Charges

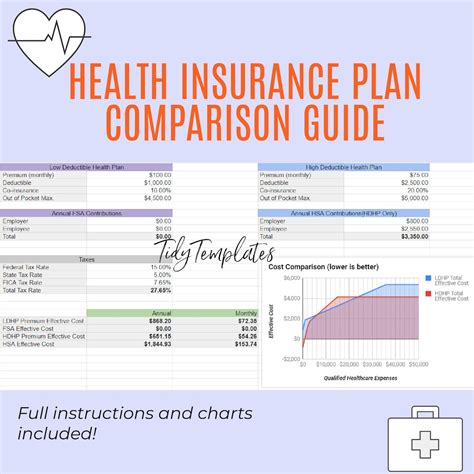

Health insurance charges can be broadly categorized into several types, including: * Premiums: The monthly or annual fee paid to the insurance provider to maintain coverage. * Deductibles: The amount paid out-of-pocket before the insurance provider begins to cover expenses. * Copayments: The fixed amount paid for specific services, such as doctor visits or prescription medications. * Coinsurance: The percentage of expenses paid by the insured after meeting the deductible. * Out-of-pocket expenses: The total amount paid by the insured for healthcare services, including deductibles, copayments, and coinsurance.Factors Influencing Health Insurance Charges

Several factors can influence health insurance charges, including:

- Age: Older individuals tend to pay more for health insurance due to increased health risks.

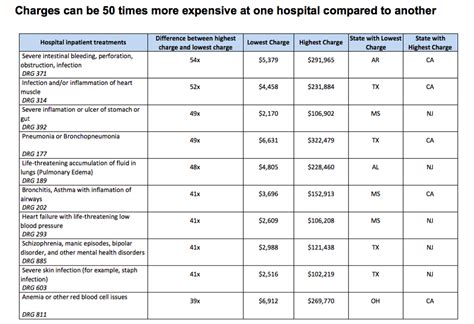

- Location: Healthcare costs vary significantly depending on the region, with urban areas tend to be more expensive than rural areas.

- Pre-existing conditions: Individuals with pre-existing conditions may face higher premiums or limited coverage options.

- Plan type: The type of plan chosen, such as an HMO or PPO, can impact the costs and benefits.

- Network: The size and quality of the provider network can influence the costs and availability of healthcare services.

How to Choose the Right Health Insurance Plan

With so many health insurance plans available, it can be challenging to determine which one is right for you. Here are some tips to consider: * Assess your healthcare needs: Consider your medical history, current health, and potential future needs. * Evaluate the plan's network: Ensure the plan's provider network includes your preferred doctors and hospitals. * Compare costs: Calculate the total costs, including premiums, deductibles, copayments, and coinsurance. * Review the plan's benefits: Consider the plan's coverage, including prescription medications, mental health services, and preventive care.Managing Health Insurance Charges

Managing health insurance charges requires a proactive approach. Here are some strategies to help you reduce your healthcare expenses:

- Take advantage of preventive care: Many health insurance plans cover preventive services, such as annual check-ups and screenings, at no additional cost.

- Use in-network providers: Staying within the plan's network can significantly reduce out-of-pocket expenses.

- Negotiate medical bills: If you receive a high medical bill, don't hesitate to negotiate with the provider to reduce the costs.

- Consider a health savings account (HSA): HSAs allow you to set aside pre-tax dollars for medical expenses, reducing your taxable income.

Common Health Insurance Terms

Understanding health insurance terminology is essential to navigating the system. Here are some common terms to know: * Premium: The monthly or annual fee paid to the insurance provider. * Deductible: The amount paid out-of-pocket before the insurance provider begins to cover expenses. * Copayment: The fixed amount paid for specific services, such as doctor visits or prescription medications. * Coinsurance: The percentage of expenses paid by the insured after meeting the deductible. * Out-of-pocket maximum: The maximum amount paid by the insured for healthcare services, including deductibles, copayments, and coinsurance.Health Insurance Charges and the Affordable Care Act (ACA)

The Affordable Care Act (ACA) has significantly impacted the health insurance landscape, introducing new regulations and protections for consumers. The ACA prohibits insurance providers from denying coverage based on pre-existing conditions, and it requires plans to cover essential health benefits, such as prescription medications and mental health services. Additionally, the ACA established the health insurance marketplace, where individuals and families can purchase subsidized coverage.

ACA and Health Insurance Charges

The ACA has also influenced health insurance charges, with the following provisions: * Premium subsidies: The ACA provides subsidies to eligible individuals and families to reduce premium costs. * Cost-sharing reductions: The ACA offers cost-sharing reductions to eligible individuals and families, reducing out-of-pocket expenses. * Medicaid expansion: The ACA expanded Medicaid eligibility to millions of Americans, providing access to affordable healthcare coverage.Conclusion and Next Steps

In conclusion, health insurance charges are complex and influenced by various factors. Understanding these charges is essential to navigating the health insurance landscape and finding a plan that meets your needs and budget. By considering the factors that influence health insurance charges, choosing the right plan, and managing your healthcare expenses, you can reduce your costs and ensure access to quality healthcare services. As you move forward, remember to stay informed about changes in the health insurance industry, and don't hesitate to seek guidance from a licensed insurance professional.

We invite you to share your thoughts and experiences with health insurance charges in the comments below. Have you struggled to understand the complexities of health insurance? How have you managed to reduce your healthcare expenses? Your insights can help others navigate the system and make informed decisions about their healthcare coverage. Additionally, if you found this article informative, please share it with your friends and family to help spread awareness about the importance of understanding health insurance charges.

What is the difference between a premium and a deductible?

+A premium is the monthly or annual fee paid to the insurance provider to maintain coverage, while a deductible is the amount paid out-of-pocket before the insurance provider begins to cover expenses.

How do I choose the right health insurance plan for my needs?

+To choose the right health insurance plan, consider your healthcare needs, evaluate the plan's network, compare costs, and review the plan's benefits, including coverage for prescription medications, mental health services, and preventive care.

What is the Affordable Care Act (ACA), and how has it impacted health insurance charges?

+The Affordable Care Act (ACA) is a federal law that introduced new regulations and protections for consumers, including prohibiting insurance providers from denying coverage based on pre-existing conditions, requiring plans to cover essential health benefits, and establishing the health insurance marketplace. The ACA has also influenced health insurance charges, with provisions such as premium subsidies, cost-sharing reductions, and Medicaid expansion.