Intro

Reduce premiums with 5 ways to cut insurance cost, including policy optimization, risk reduction, and smart shopping, to lower rates and save money on auto, home, and life insurance coverage.

Cutting insurance costs is a crucial aspect of managing personal and business finances effectively. Insurance, whether it's health, auto, home, or life insurance, is a necessary expense for most people. However, the costs associated with these policies can sometimes be prohibitive, leading many to seek ways to reduce their insurance expenditures without compromising on the coverage they need. Understanding the intricacies of insurance policies and how to navigate the market to find the best deals is essential for minimizing costs.

The importance of insurance cannot be overstated. It provides financial protection against unforeseen events, ensuring that individuals and businesses can recover from adversities such as accidents, illnesses, natural disasters, and even death. Despite its importance, the cost of insurance premiums can be a significant burden, especially for those on limited budgets. Therefore, finding strategies to cut insurance costs is not only beneficial but also necessary for many individuals and businesses.

The insurance market is highly competitive, with numerous providers offering a wide range of policies. This competition can work in favor of consumers, as insurance companies often offer discounts and promotions to attract and retain customers. Furthermore, advancements in technology have made it easier for consumers to compare insurance quotes, understand policy terms, and manage their insurance portfolios more efficiently. By leveraging these market dynamics and technological tools, individuals can make informed decisions that help reduce their insurance costs.

Understanding Insurance Policies

Key Components of Insurance Policies

Understanding the key components of insurance policies is vital for making informed decisions. These components include: - **Premiums**: The amount paid by the policyholder to the insurer for coverage. - **Deductible**: The amount the policyholder must pay out of pocket before the insurer starts paying for covered losses. - **Coverage Limits**: The maximum amount the insurer will pay for covered losses. - **Exclusions**: Events or circumstances not covered by the policy.Strategies to Cut Insurance Costs

1. Shop Around

One of the most effective ways to cut insurance costs is to shop around. Comparing quotes from different insurance providers can help individuals find the best rates for their needs. With the advent of online insurance platforms, it's easier than ever to compare policies and prices.2. Bundle Policies

Many insurance companies offer discounts to customers who bundle multiple policies together. For example, purchasing auto and home insurance from the same provider can lead to significant savings.3. Improve Your Risk Profile

Insurance companies assess risk when determining premium rates. Improving your risk profile, whether it's by installing security systems in your home, driving safely to avoid accidents, or maintaining good health, can lead to lower premiums.4. Increase Deductibles

Opting for higher deductibles can lower premium costs. However, it's essential to ensure that the deductible amount is manageable in case of a claim.5. Leverage Discounts

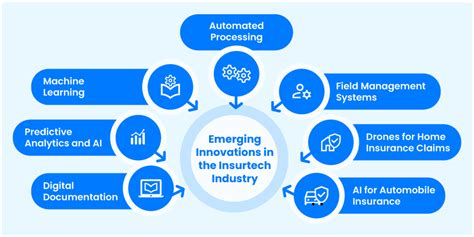

Insurance companies often offer various discounts for students, military personnel, and individuals with certain professions. Additionally, some insurers provide discounts for policyholders who pay their premiums annually instead of monthly.Technological Advancements in Insurance

Impact of Technology on Insurance Costs

Technology has played a crucial role in making insurance more accessible and affordable. Online platforms allow for easier comparison of insurance quotes, and digital tools help in assessing risk more accurately, leading to more personalized and potentially cheaper insurance options.Conclusion and Future Outlook

Final Thoughts on Insurance Cost Savings

Encouragement for Further Engagement

What is the most effective way to cut insurance costs?

+Shopping around and comparing quotes from different insurance providers is one of the most effective ways to cut insurance costs. This allows individuals to find the best rates for their specific needs.

How does bundling policies affect insurance costs?

+Bundling policies, such as purchasing auto and home insurance from the same provider, can lead to significant discounts and overall savings on insurance costs.

What role does technology play in reducing insurance costs?

+Technology plays a significant role in reducing insurance costs by providing tools for easier comparison of insurance quotes, more accurate risk assessment, and personalized insurance options, leading to more affordable premiums.