Intro

Discover 5 essential tips for choosing the best health insurance for your family, covering medical needs, premiums, and policy benefits, ensuring comprehensive family health coverage and financial protection with affordable plans and flexible options.

When it comes to securing the well-being of your loved ones, health insurance is a vital consideration. It not only provides financial protection against unexpected medical expenses but also ensures that your family receives the best possible care when needed. With the myriad of health insurance plans available, selecting the right one for your family can be a daunting task. Here are a few key points to consider, which will be explored in more detail throughout this article, to help you make an informed decision.

The importance of health insurance for families cannot be overstated. Medical emergencies can arise at any time, and without adequate insurance coverage, these events can lead to significant financial strain. Health insurance helps mitigate these risks, ensuring that you and your family can focus on recovery rather than worrying about the cost of care. Moreover, many health insurance plans offer preventive care services, which can help in early detection and management of health issues, potentially preventing more serious conditions from developing.

Understanding the nuances of health insurance plans and how they cater to family needs is crucial. Different plans offer varying levels of coverage, from basic medical expenses to comprehensive packages that include dental, vision, and even mental health services. The cost of these plans can vary widely, depending on the coverage, deductibles, copays, and the insurance provider. It's essential to evaluate these factors based on your family's specific health needs and financial situation to choose a plan that offers the best balance of coverage and affordability.

Choosing the Right Health Insurance Plan

Choosing the right health insurance plan for your family involves several key considerations. First, you need to assess the health needs of your family members. If anyone has a pre-existing condition, you'll want to ensure that the plan you choose provides adequate coverage for that condition without excessive out-of-pocket costs. Next, consider the network of healthcare providers included in the plan. It's beneficial to choose a plan that includes your family's current healthcare providers to avoid having to switch doctors or hospitals.

Another critical aspect is the plan's coverage for essential health benefits, which typically includes services like hospital stays, prescription drugs, maternity care, and mental health services. Some plans may offer additional benefits such as dental and vision coverage, which can be particularly important for families with children. The cost of the plan, including premiums, deductibles, copays, and coinsurance, must also be carefully evaluated. While a plan with a lower premium might seem appealing, it's essential to consider the overall cost, including out-of-pocket expenses, to ensure it fits within your family's budget.

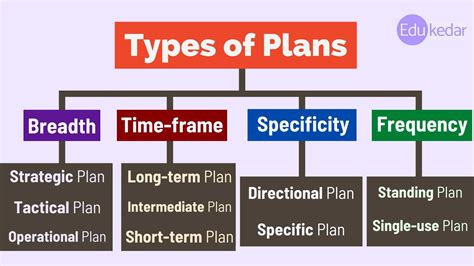

Understanding Plan Types

There are several types of health insurance plans available, each with its own set of characteristics. Health Maintenance Organization (HMO) plans, for example, provide coverage for care within a specific network of providers, except in emergency situations. Preferred Provider Organization (PPO) plans offer more flexibility, allowing you to see any healthcare provider, both in and out of network, though out-of-network care typically costs more. Exclusive Provider Organization (EPO) plans combine elements of HMOs and PPOs, covering care from providers within the plan's network, except in emergencies, but without the higher costs of out-of-network care seen in PPOs.

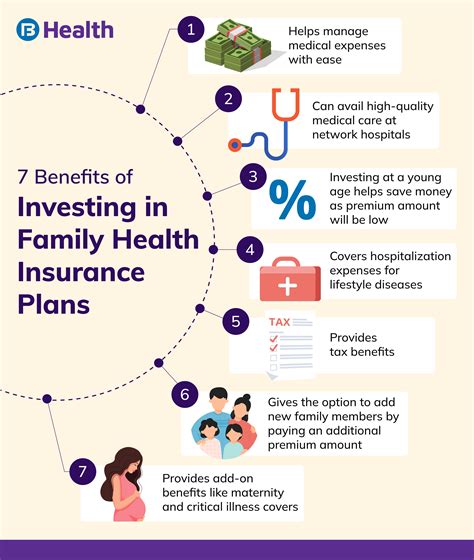

Benefits of Family Health Insurance

The benefits of family health insurance are multifaceted. Firstly, it provides financial security against the high costs of medical care, ensuring that your family can afford the treatment needed without facing financial ruin. Secondly, health insurance encourages preventive care, which can lead to better health outcomes by detecting and managing health issues early. Many plans also cover wellness programs and health screenings, further promoting health and well-being.

Moreover, having health insurance can reduce stress and anxiety related to healthcare costs, allowing families to focus on their well-being rather than worrying about how to afford medical care. For families with children, health insurance is especially crucial, as it covers essential services like pediatric care, vaccinations, and dental and vision services, which are vital for children's development and health.

How to Apply for Family Health Insurance

Applying for family health insurance involves several steps. First, you'll need to determine the eligibility criteria for the plans you're interested in, which may include income level, family size, and residency requirements. Next, you'll want to gather all necessary documents, such as proof of income, family size, and residency, as well as any required health information.

You can apply for health insurance through the Health Insurance Marketplace, directly through an insurance company, or with the help of a licensed insurance agent or broker. The application process typically involves filling out a form with your personal and family information, income details, and any relevant health information. After submitting your application, you'll receive information about the plans you're eligible for, including their costs and coverage details, which you can then use to select the best plan for your family.

Tips for Selecting the Best Family Health Insurance Plan

When selecting the best family health insurance plan, there are several tips to keep in mind:

- Assess Your Needs: Consider the health needs of your family, including any pre-existing conditions, to choose a plan that provides adequate coverage.

- Evaluate the Network: Ensure the plan's network includes your family's current healthcare providers to maintain continuity of care.

- Compare Costs: Look beyond the premium to consider all costs, including deductibles, copays, and coinsurance, to understand the total out-of-pocket expenses.

- Consider Additional Benefits: Think about whether additional benefits like dental, vision, and mental health coverage are important for your family.

- Read Reviews and Ask Questions: Research the insurance company's reputation and ask questions about the plan to ensure you understand what's covered and what's not.

Common Mistakes to Avoid

There are several common mistakes to avoid when selecting a family health insurance plan:

- Not Reading the Fine Print: Failing to fully understand the plan's terms, including what's covered and what's not, can lead to unexpected expenses.

- Choosing Based on Premium Alone: While cost is an important factor, choosing a plan solely based on the premium can lead to higher out-of-pocket expenses in the long run.

- Not Considering Network Restrictions: Failing to check if your healthcare providers are in the plan's network can result in higher costs for out-of-network care.

- Not Accounting for All Family Members: Ensure that the plan you choose covers all family members and meets their specific health needs.

Conclusion and Next Steps

In conclusion, selecting the right health insurance plan for your family is a critical decision that requires careful consideration of several factors, including health needs, provider networks, coverage details, and costs. By understanding the different types of plans available, evaluating the benefits of family health insurance, and avoiding common mistakes, you can make an informed decision that provides your family with the protection and care they deserve.

As you move forward in selecting a health insurance plan, remember to take your time, do your research, and don't hesitate to seek advice from insurance professionals if needed. Your family's health and financial security are paramount, and with the right health insurance plan, you can ensure they are well-protected against life's uncertainties.

What is the main purpose of family health insurance?

+The main purpose of family health insurance is to provide financial protection against medical expenses and ensure that all family members receive necessary healthcare services without incurring significant out-of-pocket costs.

How do I choose the best health insurance plan for my family?

+To choose the best health insurance plan for your family, consider factors such as the health needs of your family members, the network of healthcare providers, coverage details, and the total cost of the plan, including premiums, deductibles, copays, and coinsurance.

What are the benefits of having family health insurance?

+The benefits of having family health insurance include financial security, access to necessary healthcare services, promotion of preventive care, and reduction of stress related to healthcare costs. It also covers essential services like pediatric care, vaccinations, and dental and vision services for children.

We hope this comprehensive guide has provided you with valuable insights and practical advice for selecting the right health insurance plan for your family. If you have any further questions or would like to share your experiences with health insurance, please don't hesitate to comment below. Your feedback and stories can help others make more informed decisions about their family's health insurance needs.