Intro

Discover affordable Family Health Insurance Plans, covering medical, dental, and vision care, with flexible policy options, deductibles, and copays, ensuring comprehensive protection for your loved ones wellbeing and financial security.

The importance of having a comprehensive health insurance plan cannot be overstated, especially when it comes to family health insurance plans. With the rising costs of medical care, having a reliable insurance plan in place can provide peace of mind and financial security for families. Family health insurance plans are designed to cover the medical expenses of all family members, ensuring that they receive the necessary medical attention without breaking the bank. In this article, we will delve into the world of family health insurance plans, exploring their benefits, types, and what to consider when selecting a plan.

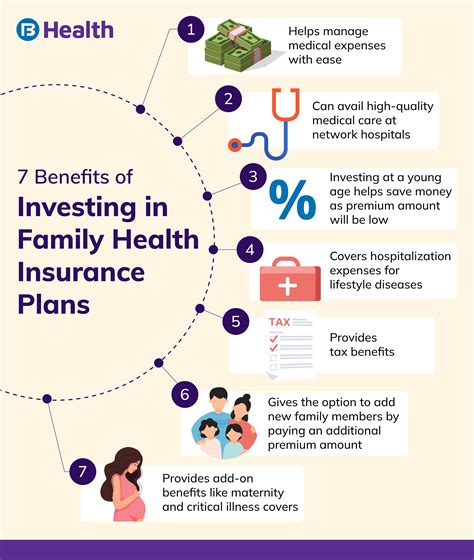

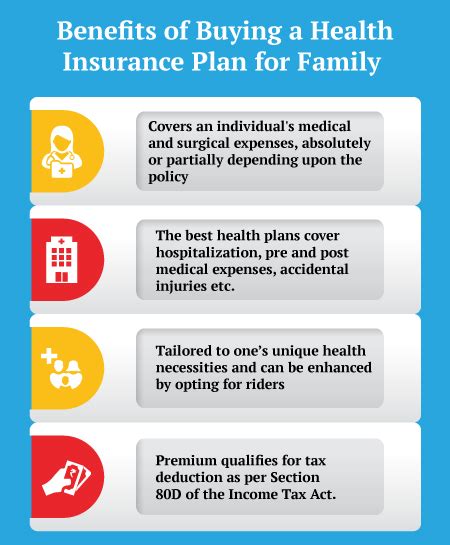

Having a family health insurance plan is crucial for several reasons. Firstly, it provides financial protection against unexpected medical expenses, which can be devastating for families who are not prepared. Medical bills can quickly add up, and without insurance, families may be forced to dip into their savings or take on debt to cover these expenses. Secondly, family health insurance plans encourage preventive care, which is essential for maintaining good health and detecting potential health issues early on. By covering routine check-ups, screenings, and vaccinations, family health insurance plans help families stay healthy and avoid more costly medical interventions down the line.

The benefits of family health insurance plans extend beyond financial protection and preventive care. They also provide access to a network of healthcare providers, including specialists and hospitals, which can be particularly important for families with chronic health conditions or special needs. Additionally, family health insurance plans often include additional benefits, such as dental and vision coverage, mental health services, and wellness programs, which can enhance overall well-being and quality of life. With so many options available, it's essential to understand the different types of family health insurance plans and what to look for when selecting a plan.

Types of Family Health Insurance Plans

There are several types of family health insurance plans available, each with its unique features and benefits. The most common types of plans include Health Maintenance Organization (HMO) plans, Preferred Provider Organization (PPO) plans, Exclusive Provider Organization (EPO) plans, and Point of Service (POS) plans. HMO plans, for example, require families to receive medical care from a specific network of providers, except in emergency situations. PPO plans, on the other hand, offer more flexibility, allowing families to see any healthcare provider they choose, both in and out of network. EPO plans are similar to PPO plans but do not cover out-of-network care, except in emergency situations. POS plans combine features of HMO and PPO plans, requiring families to choose a primary care physician from a network of providers but also allowing them to see out-of-network providers at a higher cost.

Key Considerations for Selecting a Family Health Insurance Plan

When selecting a family health insurance plan, there are several key considerations to keep in mind. Firstly, families should consider their budget and the cost of premiums, deductibles, copays, and coinsurance. They should also think about their healthcare needs, including any chronic conditions or special needs, and choose a plan that provides adequate coverage. Additionally, families should research the network of healthcare providers included in the plan, ensuring that their preferred doctors and hospitals are part of the network. Other important considerations include the plan's coverage of prescription medications, mental health services, and wellness programs.Benefits of Family Health Insurance Plans

The benefits of family health insurance plans are numerous and well-documented. Firstly, they provide financial protection against unexpected medical expenses, which can be devastating for families who are not prepared. Secondly, family health insurance plans encourage preventive care, which is essential for maintaining good health and detecting potential health issues early on. By covering routine check-ups, screenings, and vaccinations, family health insurance plans help families stay healthy and avoid more costly medical interventions down the line. Additionally, family health insurance plans often include additional benefits, such as dental and vision coverage, mental health services, and wellness programs, which can enhance overall well-being and quality of life.

How to Choose the Right Family Health Insurance Plan

Choosing the right family health insurance plan can be a daunting task, especially with so many options available. To make the process easier, families should start by assessing their healthcare needs and budget. They should consider the cost of premiums, deductibles, copays, and coinsurance, as well as the plan's coverage of prescription medications, mental health services, and wellness programs. Families should also research the network of healthcare providers included in the plan, ensuring that their preferred doctors and hospitals are part of the network. Additionally, they should read reviews and ask for referrals from friends, family members, or healthcare providers to get a sense of the plan's quality and customer service.Common Mistakes to Avoid When Selecting a Family Health Insurance Plan

When selecting a family health insurance plan, there are several common mistakes to avoid. Firstly, families should not choose a plan based solely on cost, as cheaper plans may not provide adequate coverage. Secondly, they should not assume that all plans are created equal, as different plans may have different networks of healthcare providers, coverage options, and benefits. Additionally, families should not fail to read the fine print, as plans may have exclusions, limitations, or pre-existing condition clauses that can affect coverage. By avoiding these common mistakes, families can choose a plan that meets their healthcare needs and budget, providing peace of mind and financial security.

Family Health Insurance Plan Options for Small Businesses and Self-Employed Individuals

For small businesses and self-employed individuals, finding affordable family health insurance plans can be challenging. However, there are several options available, including group health insurance plans, individual health insurance plans, and association health plans. Group health insurance plans, for example, allow small businesses to pool their resources and negotiate better rates with insurance companies. Individual health insurance plans, on the other hand, provide coverage for self-employed individuals and their families. Association health plans, which are designed for small businesses and self-employed individuals, offer a more affordable alternative to traditional group health insurance plans.Family Health Insurance Plan Enrollment and Eligibility

Family health insurance plan enrollment and eligibility can be complex, with different rules and regulations applying to different types of plans. Generally, families can enroll in a health insurance plan during the annual open enrollment period, which typically runs from November to December. However, families may also be eligible for special enrollment periods, which are triggered by certain life events, such as marriage, divorce, or the birth of a child. To be eligible for a family health insurance plan, families must meet certain requirements, including residency, income, and family size. They must also choose a plan that meets the minimum essential coverage requirements, which include coverage of essential health benefits, such as hospitalization, prescription medications, and preventive care.

Family Health Insurance Plan Costs and Expenses

The costs and expenses associated with family health insurance plans can be significant, including premiums, deductibles, copays, and coinsurance. Premiums, which are typically paid monthly, can range from a few hundred to several thousand dollars per month, depending on the plan and family size. Deductibles, which are the amounts families must pay out-of-pocket before insurance kicks in, can range from a few hundred to several thousand dollars per year. Copays, which are the fixed amounts families pay for doctor visits, prescriptions, and other services, can range from $10 to $50 per visit. Coinsurance, which is the percentage of medical expenses families pay after meeting the deductible, can range from 10% to 30% of the total bill.Family Health Insurance Plan Networks and Providers

Family health insurance plan networks and providers play a critical role in determining the quality and accessibility of care. A plan's network refers to the group of healthcare providers, including doctors, hospitals, and specialists, who have contracted with the insurance company to provide care to plan members. Families should research the network of healthcare providers included in the plan, ensuring that their preferred doctors and hospitals are part of the network. They should also consider the plan's referral policies, which may require a primary care physician referral to see a specialist. By choosing a plan with a strong network of healthcare providers, families can ensure that they receive high-quality care and avoid out-of-network costs.

Family Health Insurance Plan Customer Service and Support

Family health insurance plan customer service and support are essential for ensuring that families receive the care and assistance they need. A plan's customer service team should be available to answer questions, resolve issues, and provide guidance on plan benefits and coverage. Families should research the plan's customer service reputation, reading reviews and asking for referrals from friends, family members, or healthcare providers. They should also consider the plan's support services, including online portals, mobile apps, and phone support, which can make it easier to manage their care and benefits.Conclusion and Next Steps

In conclusion, family health insurance plans are a critical component of maintaining good health and financial security. By understanding the different types of plans, benefits, and what to consider when selecting a plan, families can make informed decisions about their healthcare coverage. Whether you're a family of two or ten, having a comprehensive family health insurance plan in place can provide peace of mind and protect against unexpected medical expenses. If you're currently without health insurance or looking to switch plans, we encourage you to explore your options and take the next step towards securing your family's health and well-being.

We invite you to comment below with any questions or concerns you may have about family health insurance plans. Share this article with your friends and family to help them make informed decisions about their healthcare coverage. Take the first step towards securing your family's health and well-being by researching and comparing family health insurance plans today.

What is the difference between an HMO and a PPO plan?

+HMO plans require families to receive medical care from a specific network of providers, except in emergency situations. PPO plans, on the other hand, offer more flexibility, allowing families to see any healthcare provider they choose, both in and out of network.

How do I choose the right family health insurance plan for my family?

+To choose the right family health insurance plan, consider your budget, healthcare needs, and the plan's network of healthcare providers. Research the plan's coverage options, benefits, and customer service reputation to ensure that it meets your family's needs.

Can I enroll in a family health insurance plan at any time?

+Families can typically enroll in a health insurance plan during the annual open enrollment period, which runs from November to December. However, families may also be eligible for special enrollment periods, which are triggered by certain life events, such as marriage, divorce, or the birth of a child.