Intro

Explore Georgia health insurance options, including individual, family, and group plans, with coverage for medical, dental, and vision care, to find affordable and comprehensive healthcare solutions.

The state of Georgia offers a range of health insurance options for its residents, catering to diverse needs and budgets. With the ever-changing landscape of healthcare, it's essential for individuals and families to stay informed about the available choices. In this article, we will delve into the various health insurance options in Georgia, exploring their benefits, working mechanisms, and key information to help readers make informed decisions.

Health insurance is a vital aspect of overall well-being, providing financial protection against unexpected medical expenses. In Georgia, residents can choose from multiple options, including individual and family plans, group plans, Medicare, and Medicaid. Each option has its unique features, advantages, and eligibility criteria. Understanding these differences is crucial for selecting the most suitable plan.

The health insurance market in Georgia is constantly evolving, with new plans and providers emerging regularly. This dynamic environment can be overwhelming, especially for those who are new to the state or unfamiliar with the healthcare system. However, by grasping the fundamentals of Georgia's health insurance options, individuals can navigate the market with confidence and find the perfect plan to meet their needs.

Individual and Family Plans

The main advantage of individual and family plans is their flexibility, allowing policyholders to select the coverage that best suits their needs and budget. Additionally, these plans often provide access to a wide network of healthcare providers, both in-state and out-of-state. However, the costs of individual and family plans can be higher compared to group plans, and the application process may involve medical underwriting.

Benefits of Individual and Family Plans

Some of the key benefits of individual and family plans include: * Flexibility in choosing coverage and premium levels * Access to a broad network of healthcare providers * Ability to purchase additional coverage, such as dental and vision insurance * Potential for lower costs compared to group plans, depending on the policyholder's health status and ageGroup Plans

The main advantage of group plans is their cost-effectiveness, as the premiums are typically lower due to the shared risk. Additionally, group plans often provide access to a wide network of healthcare providers and may include additional benefits, such as wellness programs and disease management services. However, group plans may have limitations, such as eligibility requirements and waiting periods, and the coverage may be tied to employment or membership status.

Benefits of Group Plans

Some of the key benefits of group plans include: * Lower premiums due to shared risk * More comprehensive coverage, including additional benefits * Access to a broad network of healthcare providers * Potential for improved employee morale and retention, as a valuable benefitMedicare

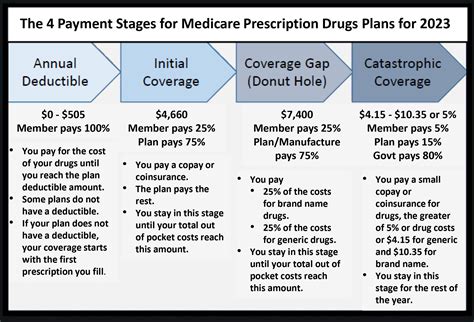

The main advantage of Medicare is its comprehensive coverage, including hospital stays, doctor visits, and prescription medications. Additionally, Medicare provides access to a wide network of healthcare providers and has a reputation for being a reliable and stable program. However, Medicare may have limitations, such as deductibles, copays, and coinsurance, and the coverage may not include certain services, such as dental and vision care.

Benefits of Medicare

Some of the key benefits of Medicare include: * Comprehensive coverage, including hospital stays and prescription medications * Access to a broad network of healthcare providers * Reliability and stability, as a federal program * Potential for lower costs compared to individual and family plans, depending on the policyholder's age and health statusMedicaid

The main advantage of Medicaid is its affordability, as the program is designed for low-income individuals and families. Additionally, Medicaid provides access to a wide network of healthcare providers and has a reputation for being a vital safety net for vulnerable populations. However, Medicaid may have limitations, such as eligibility requirements and waiting periods, and the coverage may not include certain services, such as dental and vision care.

Benefits of Medicaid

Some of the key benefits of Medicaid include: * Affordability, as a program designed for low-income individuals and families * Comprehensive coverage, including doctor visits and prescription medications * Access to a broad network of healthcare providers * Potential for improved health outcomes, as a vital safety net for vulnerable populationsWhat is the difference between Medicare and Medicaid?

+Medicare is a federal health insurance program designed for people aged 65 or older, certain younger people with disabilities, and individuals with End-Stage Renal Disease (ESRD). Medicaid, on the other hand, is a joint federal and state program designed for low-income individuals and families, including children, pregnant women, and people with disabilities.

Can I purchase individual and family plans outside of the Health Insurance Marketplace?

+What is the eligibility criteria for Medicaid in Georgia?

+To be eligible for Medicaid in Georgia, you must meet certain income and resource requirements, which vary depending on your family size and circumstances. You can apply for Medicaid through the Georgia Gateway website or by contacting your local Department of Family and Children Services office.

In conclusion, the state of Georgia offers a range of health insurance options, each with its unique features, advantages, and eligibility criteria. By understanding the differences between individual and family plans, group plans, Medicare, and Medicaid, residents can make informed decisions about their health insurance coverage. Whether you're a young professional, a family with children, or a retiree, there's a health insurance option in Georgia that can meet your needs and budget. We invite you to share your thoughts and experiences with health insurance in Georgia, and to explore the various options available to you.