Intro

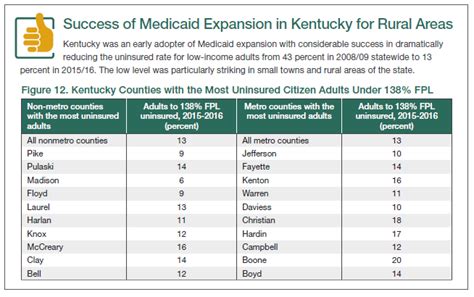

The state of Kentucky has undergone significant changes in its healthcare landscape over the past few years, with the Affordable Care Act (ACA) bringing about new opportunities for residents to access affordable health insurance. For individuals and families living in Kentucky, understanding the various health insurance options available is crucial for making informed decisions about their healthcare coverage. In this article, we will delve into the different Kentucky health insurance options, exploring their benefits, drawbacks, and eligibility requirements.

The importance of having health insurance cannot be overstated, as it provides financial protection against unexpected medical expenses and ensures access to essential healthcare services. Without health insurance, individuals may struggle to afford necessary treatments, leading to delayed or foregone care, which can have severe consequences for their health and wellbeing. Fortunately, Kentucky residents have a range of health insurance options to choose from, including private plans, Medicaid, and the health insurance marketplace.

For many individuals and families in Kentucky, the health insurance marketplace is a vital resource for finding affordable health insurance. The marketplace, also known as the exchange, offers a range of plans from different insurance companies, allowing consumers to compare prices and benefits to find the best option for their needs. Additionally, the marketplace provides financial assistance to eligible individuals, in the form of tax credits and subsidies, to help make health insurance more affordable.

Kentucky Health Insurance Marketplace

Benefits of the Health Insurance Marketplace

The health insurance marketplace provides several benefits to Kentucky residents, including: * Affordable premiums: The marketplace offers financial assistance to eligible individuals, making health insurance more affordable. * Comprehensive coverage: Marketplace plans must cover essential health benefits, including doctor visits, hospital stays, and prescription medications. * Choice and flexibility: The marketplace allows consumers to compare prices and benefits from different insurance companies, giving them the flexibility to choose the best plan for their needs.Medicaid in Kentucky

Benefits of Medicaid

Medicaid provides several benefits to eligible individuals, including: * Comprehensive coverage: Medicaid covers essential health benefits, including doctor visits, hospital stays, and prescription medications. * Low or no premiums: Medicaid is a low-cost or no-cost health insurance option for eligible individuals. * Access to healthcare services: Medicaid provides access to necessary healthcare services, including preventive care, diagnostic testing, and treatment.Private Health Insurance Options in Kentucky

Types of Private Health Insurance Plans

There are several types of private health insurance plans available in Kentucky, including: * Individual and family plans: These plans are designed for individuals and families who do not have access to employer-sponsored coverage. * Group plans: These plans are designed for employers who want to offer health insurance coverage to their employees. * Short-term plans: These plans provide temporary coverage for individuals who are between jobs or waiting for other coverage to begin.Self-Employed Health Insurance Options in Kentucky

Benefits of Self-Employed Health Insurance

Self-employed health insurance provides several benefits, including: * Tax deductions: Self-employed individuals may be able to deduct their health insurance premiums as a business expense. * Flexibility: Self-employed individuals can choose from a range of plans and providers to find the best option for their needs. * Comprehensive coverage: Self-employed health insurance plans must cover essential health benefits, including doctor visits, hospital stays, and prescription medications.Small Business Health Insurance Options in Kentucky

Benefits of Small Business Health Insurance

Small business health insurance provides several benefits, including: * Attracting and retaining employees: Offering health insurance coverage can help small businesses attract and retain top talent. * Tax benefits: Small businesses may be eligible for tax credits and deductions for offering health insurance coverage. * Comprehensive coverage: Group health insurance plans must cover essential health benefits, including doctor visits, hospital stays, and prescription medications.Short-Term Health Insurance Options in Kentucky

Benefits of Short-Term Health Insurance

Short-term health insurance provides several benefits, including: * Affordable premiums: Short-term plans may offer more affordable premiums than major medical plans. * Flexibility: Short-term plans can provide temporary coverage for individuals who are between jobs or waiting for other coverage to begin. * Limited benefits: Short-term plans may have limited benefits and exclusions, so it's essential to carefully review the plan's terms and conditions.Dental and Vision Insurance Options in Kentucky

Benefits of Dental and Vision Insurance

Dental and vision insurance provides several benefits, including: * Preventive care: Dental and vision insurance plans cover routine care, such as cleanings and exams, to help prevent more serious health problems. * Comprehensive coverage: Dental and vision insurance plans may cover more comprehensive services, such as fillings, crowns, and glasses. * Affordability: Dental and vision insurance plans may offer more affordable premiums than major medical plans.What is the Kentucky health insurance marketplace?

+The Kentucky health insurance marketplace is a platform where individuals and families can purchase health insurance plans during the annual open enrollment period or during special enrollment periods.

What are the benefits of Medicaid in Kentucky?

+Medicaid provides comprehensive coverage, including doctor visits, hospital stays, and prescription medications, as well as low or no premiums for eligible individuals.

What are the different types of private health insurance plans available in Kentucky?

+There are several types of private health insurance plans available in Kentucky, including individual and family plans, group plans, and short-term plans.

What is self-employed health insurance, and how does it work?

+Self-employed health insurance is a type of health insurance plan designed for self-employed individuals, which can provide comprehensive coverage and tax benefits.

What are the benefits of small business health insurance in Kentucky?

+Small business health insurance provides comprehensive coverage, tax benefits, and can help attract and retain employees.

In conclusion, Kentucky residents have a range of health insurance options to choose from, including the health insurance marketplace, Medicaid, private plans, and self-employed health insurance. By understanding the benefits and drawbacks of each option, individuals and families can make informed decisions about their healthcare coverage. We encourage readers to share their experiences and ask questions in the comments below, and to explore the various resources available to help them navigate the complex world of health insurance. Whether you're an individual, family, or small business owner, there's a health insurance option available to meet your needs and budget. Take the first step towards protecting your health and wellbeing by exploring the Kentucky health insurance options today!