Intro

Unlock the benefits of High Deductible Health Plans (HDHPs) with 5 expert tips, exploring health savings accounts, preventive care, and deductible management to maximize your healthcare savings and minimize costs, optimizing your HDHP experience.

High-Deductible Health Plans (HDHPs) have become increasingly popular in recent years due to their potential to reduce healthcare costs and promote consumerism in healthcare. These plans are designed to provide lower premiums in exchange for higher deductibles, which can be a cost-effective option for individuals and families who are relatively healthy and do not require frequent medical care. However, navigating the complexities of HDHPs can be challenging, and it is essential to understand the benefits and drawbacks of these plans to make informed decisions about healthcare coverage.

The importance of understanding HDHPs cannot be overstated, as they require individuals to take a more active role in managing their healthcare expenses. With the rising costs of healthcare, it is crucial to explore options that can help reduce expenses while still providing adequate coverage. HDHPs offer a unique approach to healthcare coverage, and by understanding how they work, individuals can make the most of their benefits and minimize their drawbacks. In this article, we will delve into the world of HDHPs, exploring their benefits, working mechanisms, and providing tips for getting the most out of these plans.

As the healthcare landscape continues to evolve, it is essential to stay informed about the latest developments and trends in healthcare coverage. HDHPs are an integral part of this landscape, and understanding their intricacies can help individuals and families make informed decisions about their healthcare coverage. Whether you are considering enrolling in an HDHP or are already a participant, this article will provide you with valuable insights and practical tips to help you navigate the complexities of these plans. By the end of this article, you will be equipped with the knowledge and expertise to make the most of your HDHP and take control of your healthcare expenses.

Understanding HDHPs

One of the primary benefits of HDHPs is their potential to reduce healthcare costs. By requiring individuals to pay a higher deductible, HDHPs encourage individuals to take a more active role in managing their healthcare expenses. This can lead to more informed decision-making and a greater emphasis on preventive care, which can help reduce healthcare costs over time. Additionally, HDHPs often come with tax advantages, such as the ability to contribute to a Health Savings Account (HSA), which can provide a tax-free way to save for healthcare expenses.

Benefits of HDHPs

The benefits of HDHPs are numerous, and they can provide a range of advantages for individuals and families. Some of the most significant benefits of HDHPs include: * Lower premiums: HDHPs often come with lower premiums than traditional health insurance plans, which can make them a more affordable option for individuals and families. * Tax advantages: HDHPs often come with tax advantages, such as the ability to contribute to an HSA, which can provide a tax-free way to save for healthcare expenses. * Increased consumerism: HDHPs encourage individuals to take a more active role in managing their healthcare expenses, which can lead to more informed decision-making and a greater emphasis on preventive care. * Reduced healthcare costs: By requiring individuals to pay a higher deductible, HDHPs can help reduce healthcare costs over time by encouraging individuals to seek out more cost-effective care options.Working Mechanisms of HDHPs

One of the primary mechanisms of HDHPs is the deductible, which is the amount that individuals must pay out-of-pocket before their insurance coverage kicks in. HDHPs often come with higher deductibles than traditional health insurance plans, which can make them a more cost-effective option for individuals and families who are relatively healthy and do not require frequent medical care. Additionally, HDHPs often come with other out-of-pocket expenses, such as copayments and coinsurance, which can add up quickly.

Steps to Get the Most Out of HDHPs

To get the most out of an HDHP, it is essential to follow a range of steps. Some of the most important steps include: * Understanding the plan's benefits and drawbacks: Before enrolling in an HDHP, it is essential to understand the plan's benefits and drawbacks, including the deductible, copayments, and coinsurance. * Setting aside money for healthcare expenses: HDHPs often come with higher out-of-pocket expenses, so it is essential to set aside money for healthcare expenses, such as the deductible and copayments. * Taking advantage of preventive care: HDHPs often cover preventive care services, such as annual physicals and screenings, which can help reduce healthcare costs over time. * Shopping around for care: HDHPs encourage individuals to take a more active role in managing their healthcare expenses, which can lead to more informed decision-making and a greater emphasis on cost-effective care options.Practical Examples of HDHPs

Another example is an individual who enrolls in an HDHP with a $5,000 deductible and 10% coinsurance. If this individual requires medical care, they will be responsible for paying the first $5,000 out-of-pocket, plus 10% of any additional expenses. However, if this individual is able to take advantage of preventive care services, such as annual physicals and screenings, they may be able to reduce their healthcare costs over time.

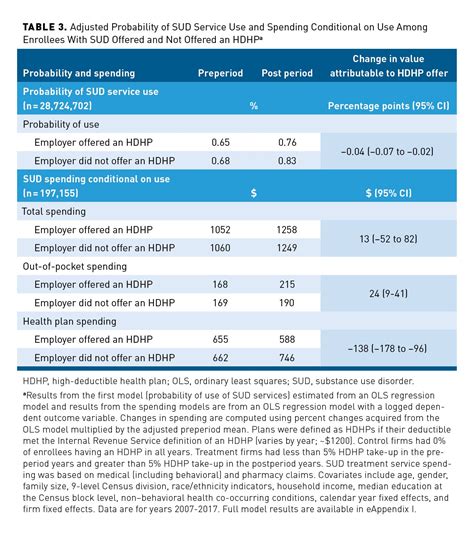

Statistical Data on HDHPs

According to recent statistical data, HDHPs are becoming increasingly popular, with over 20% of individuals and families enrolled in these plans. Additionally, HDHPs have been shown to reduce healthcare costs, with one study finding that individuals enrolled in HDHPs spent 10% less on healthcare expenses than those enrolled in traditional health insurance plans. However, HDHPs also come with drawbacks, such as higher deductibles and out-of-pocket expenses, which can make them a less affordable option for some individuals and families.Conclusion and Next Steps

To take the next step, we invite you to comment below with your thoughts and experiences with HDHPs. Have you enrolled in an HDHP and seen a reduction in your healthcare costs? Do you have any tips or advice for individuals considering enrolling in an HDHP? By sharing your experiences and insights, you can help others make informed decisions about their healthcare coverage and get the most out of their HDHP.

What is an HDHP?

+An HDHP is a type of health insurance plan that provides lower premiums in exchange for higher deductibles.

How do HDHPs work?

+HDHPs work by requiring individuals to pay a higher deductible before their insurance coverage kicks in, which can help reduce healthcare costs over time.

What are the benefits of HDHPs?

+The benefits of HDHPs include lower premiums, tax advantages, and the potential to save money on healthcare expenses.