Intro

Explore individual health plans options, including affordable insurance, medical coverage, and personalized benefits, to find the best fit for your unique needs and budget.

The world of health insurance can be overwhelming, especially when it comes to choosing the right plan for your individual needs. With so many options available, it's essential to understand the different types of plans, their benefits, and how to select the one that best suits your lifestyle and budget. In this article, we'll delve into the world of individual health plans, exploring the various options, their advantages, and what to consider when making your decision.

As the healthcare landscape continues to evolve, it's crucial to stay informed about the latest developments and changes in the industry. The Affordable Care Act (ACA), also known as Obamacare, has had a significant impact on the health insurance market, providing more options and protections for individuals and families. However, with the ever-changing political climate, it's essential to stay up-to-date on the latest news and updates that may affect your health insurance choices.

When it comes to individual health plans, there are several options to consider, each with its unique features, benefits, and drawbacks. From traditional plans to more modern alternatives, understanding the different types of plans can help you make an informed decision that meets your specific needs and budget. Whether you're a young adult, a family, or an individual with pre-existing conditions, there are options available that can provide you with the coverage and protection you need.

Understanding Individual Health Plans

Individual health plans are designed to provide coverage for individuals and families who are not eligible for group health insurance through their employer or other organizations. These plans can be purchased directly from insurance companies, through online marketplaces, or with the help of a licensed insurance agent. With so many options available, it's essential to understand the different types of plans, their benefits, and how to choose the right one for your needs.

Types of Individual Health Plans

Individual health plans can be categorized into several types, including:- Major Medical Plans: These plans provide comprehensive coverage for essential health benefits, including doctor visits, hospital stays, and prescription medications.

- Short-Term Limited-Duration Insurance (STLDI): These plans provide temporary coverage for a limited period, usually up to 12 months.

- Catastrophic Plans: These plans provide minimal coverage for catastrophic events, such as accidents or serious illnesses.

- Medicare Supplement Plans: These plans provide additional coverage for Medicare beneficiaries, helping to fill gaps in original Medicare coverage.

Benefits of Individual Health Plans

Individual health plans offer several benefits, including:

- Flexibility: Individual plans can be tailored to meet your specific needs and budget.

- Portability: Individual plans can be taken with you if you change jobs or move to a different state.

- Customization: Individual plans can be customized to include additional benefits, such as dental or vision coverage.

- Tax benefits: Individual plans may be eligible for tax deductions or credits, helping to reduce your premium costs.

How to Choose the Right Individual Health Plan

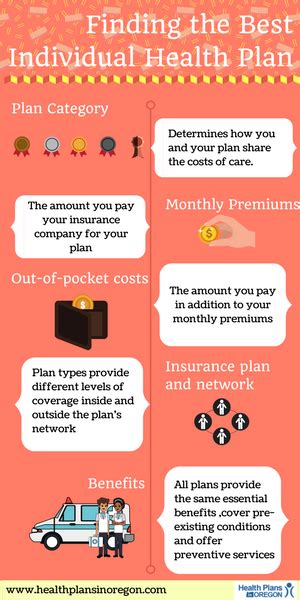

Choosing the right individual health plan can be a daunting task, but by considering the following factors, you can make an informed decision:- Premium costs: Consider the monthly premium costs and how they fit into your budget.

- Deductibles and copays: Consider the out-of-pocket costs associated with the plan, including deductibles and copays.

- Network: Consider the network of providers and whether your preferred doctors and hospitals are included.

- Coverage: Consider the level of coverage provided, including essential health benefits and additional benefits.

Popular Individual Health Plan Options

Some popular individual health plan options include:

- Blue Cross Blue Shield: One of the largest and most recognized health insurance companies in the US.

- UnitedHealthcare: A leading health insurance company offering a range of individual and family plans.

- Aetna: A well-established health insurance company providing individual and family plans with a range of benefits.

- Cigna: A global health insurance company offering individual and family plans with a focus on wellness and prevention.

Special Considerations for Individual Health Plans

When selecting an individual health plan, it's essential to consider the following special circumstances:- Pre-existing conditions: If you have a pre-existing condition, consider a plan that provides comprehensive coverage and does not exclude your condition.

- Pregnancy: If you're pregnant or planning to become pregnant, consider a plan that provides maternity coverage and does not have a waiting period.

- Mental health: If you have a mental health condition, consider a plan that provides comprehensive coverage for mental health services.

Conclusion and Next Steps

In conclusion, individual health plans offer a range of options for individuals and families who are not eligible for group health insurance. By understanding the different types of plans, their benefits, and how to choose the right one, you can make an informed decision that meets your specific needs and budget. Whether you're a young adult, a family, or an individual with pre-existing conditions, there are options available that can provide you with the coverage and protection you need.

We invite you to share your thoughts and experiences with individual health plans in the comments below. If you have any questions or concerns, please don't hesitate to reach out. Share this article with friends and family who may be interested in learning more about individual health plans.

What is the difference between a major medical plan and a short-term limited-duration insurance plan?

+A major medical plan provides comprehensive coverage for essential health benefits, while a short-term limited-duration insurance plan provides temporary coverage for a limited period, usually up to 12 months.

Can I customize my individual health plan to include additional benefits?

+Yes, individual health plans can be customized to include additional benefits, such as dental or vision coverage.

How do I choose the right individual health plan for my needs and budget?

+Consider factors such as premium costs, deductibles and copays, network, and coverage when choosing an individual health plan. It's also essential to research and compares different plans to find the one that best meets your needs and budget.