Intro

Medical insurance is a crucial aspect of family planning, as it provides financial protection against unexpected medical expenses. With the rising cost of healthcare, having a comprehensive medical insurance plan in place can help ensure that your family receives the best possible care without breaking the bank. In this article, we will delve into the world of medical insurance for families, exploring the importance of having a plan, the different types of plans available, and the factors to consider when selecting a policy.

Having medical insurance for your family can bring peace of mind, knowing that you are protected against unexpected medical bills. Medical emergencies can arise at any time, and without insurance, the costs can be overwhelming. According to a recent study, medical bills are the leading cause of bankruptcy in the United States, with over 60% of bankruptcies attributed to medical expenses. By having a medical insurance plan in place, you can avoid financial ruin and ensure that your family receives the medical care they need.

The cost of healthcare is constantly rising, making it essential to have a medical insurance plan that covers your family's needs. With the increasing cost of doctor visits, hospital stays, and prescription medications, having insurance can help reduce out-of-pocket expenses. Moreover, many medical insurance plans offer preventive care services, such as routine check-ups and screenings, which can help detect health problems early on, reducing the risk of costly medical procedures down the line.

Types of Medical Insurance Plans for Families

There are several types of medical insurance plans available for families, each with its unique features and benefits. The most common types of plans include:

- HMO (Health Maintenance Organization) plans: These plans require you to receive medical care from a specific network of providers, with the exception of emergency situations.

- PPO (Preferred Provider Organization) plans: These plans offer more flexibility than HMO plans, allowing you to see any healthcare provider, both in and out of network.

- EPO (Exclusive Provider Organization) plans: These plans combine elements of HMO and PPO plans, requiring you to receive care from a specific network of providers, except in emergency situations.

- POS (Point of Service) plans: These plans allow you to choose between receiving care from a primary care physician or a specialist, with the option to see out-of-network providers at a higher cost.

Factors to Consider When Selecting a Medical Insurance Plan

When selecting a medical insurance plan for your family, there are several factors to consider. These include:- Premium costs: The monthly or annual cost of the plan, which can vary depending on the type of plan, network, and level of coverage.

- Deductible: The amount you must pay out-of-pocket before the insurance plan kicks in, which can range from a few hundred to several thousand dollars.

- Co-payments and co-insurance: The amount you must pay for medical services, such as doctor visits or prescription medications, after meeting the deductible.

- Network: The list of healthcare providers who participate in the plan's network, which can impact the cost and quality of care.

- Maximum out-of-pocket expenses: The maximum amount you must pay for medical expenses in a given year, after which the insurance plan covers 100% of eligible expenses.

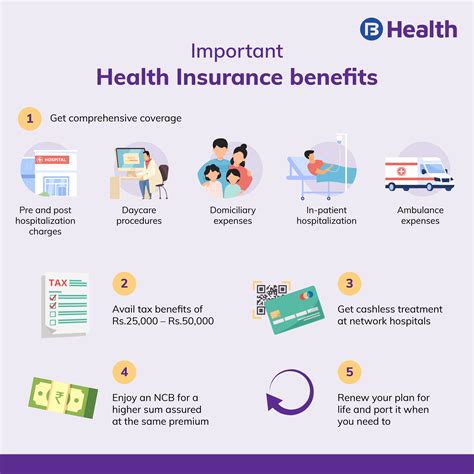

Benefits of Medical Insurance for Families

Having medical insurance for your family can provide numerous benefits, including:

- Financial protection: Medical insurance can help protect your family from financial ruin in the event of unexpected medical expenses.

- Access to quality care: Medical insurance can provide access to a network of healthcare providers, ensuring that your family receives the best possible care.

- Preventive care services: Many medical insurance plans offer preventive care services, such as routine check-ups and screenings, which can help detect health problems early on.

- Reduced out-of-pocket expenses: Medical insurance can help reduce out-of-pocket expenses for medical services, such as doctor visits, hospital stays, and prescription medications.

How to Choose the Right Medical Insurance Plan for Your Family

Choosing the right medical insurance plan for your family can be a daunting task, but by considering the following factors, you can make an informed decision:- Assess your family's needs: Consider the age, health, and medical needs of your family members when selecting a plan.

- Compare plans: Research and compare different medical insurance plans, considering factors such as premium costs, deductible, co-payments, and network.

- Read reviews and ask for referrals: Read reviews from other policyholders and ask for referrals from friends, family, or healthcare providers to get a sense of the plan's quality and customer service.

- Check the plan's reputation: Research the insurance company's reputation, financial stability, and customer service ratings to ensure you are working with a reputable provider.

Common Mistakes to Avoid When Selecting a Medical Insurance Plan

When selecting a medical insurance plan, there are several common mistakes to avoid, including:

- Not reading the fine print: Failing to read and understand the plan's terms and conditions can lead to unexpected surprises and expenses.

- Not considering the network: Failing to consider the plan's network of healthcare providers can result in higher costs and reduced access to quality care.

- Not assessing your family's needs: Failing to assess your family's medical needs can result in a plan that does not provide adequate coverage.

- Not comparing plans: Failing to compare different medical insurance plans can result in a plan that is not the best value for your family.

Tips for Getting the Most Out of Your Medical Insurance Plan

To get the most out of your medical insurance plan, consider the following tips:- Understand your plan's benefits and limitations: Take the time to read and understand your plan's terms and conditions, including benefits, limitations, and exclusions.

- Keep track of your expenses: Keep track of your medical expenses, including receipts, invoices, and explanations of benefits, to ensure you are taking advantage of your plan's benefits.

- Ask questions: Don't be afraid to ask questions or seek clarification on any aspect of your plan, including benefits, coverage, or claims.

- Take advantage of preventive care services: Take advantage of preventive care services, such as routine check-ups and screenings, to help detect health problems early on and reduce the risk of costly medical procedures.

Conclusion and Next Steps

In conclusion, having medical insurance for your family is a crucial aspect of family planning, providing financial protection against unexpected medical expenses and access to quality care. By understanding the different types of medical insurance plans available, considering factors such as premium costs, deductible, and network, and avoiding common mistakes, you can make an informed decision and select a plan that meets your family's needs. Remember to take advantage of preventive care services, keep track of your expenses, and ask questions to get the most out of your plan.

We invite you to share your thoughts and experiences with medical insurance for families in the comments below. Have you had a positive or negative experience with a medical insurance plan? What factors do you consider when selecting a plan? Share your story and help others make informed decisions about their family's healthcare.

What is the difference between an HMO and a PPO plan?

+An HMO plan requires you to receive medical care from a specific network of providers, while a PPO plan offers more flexibility, allowing you to see any healthcare provider, both in and out of network.

How do I choose the right medical insurance plan for my family?

+Consider factors such as premium costs, deductible, co-payments, and network, and assess your family's medical needs to select a plan that provides adequate coverage.

What are the benefits of having medical insurance for my family?

+Having medical insurance for your family provides financial protection against unexpected medical expenses, access to quality care, and preventive care services, which can help detect health problems early on and reduce the risk of costly medical procedures.