Intro

Discover the ultimate Medicare Insurance Plans Guide, covering Medicare Advantage, Supplement, and Part D plans, to help you navigate retirement insurance options and choose the best coverage for your healthcare needs.

The world of healthcare can be complex and overwhelming, especially when it comes to navigating the various insurance options available. For individuals aged 65 and older, as well as certain younger people with disabilities, Medicare is a vital program that provides essential health coverage. With numerous Medicare insurance plans to choose from, it's crucial to understand the different types, their benefits, and how to enroll. In this comprehensive guide, we'll delve into the world of Medicare, exploring its history, the various plans, and the enrollment process, to help you make informed decisions about your healthcare.

As the US population ages, the importance of Medicare continues to grow. Established in 1965, Medicare has evolved over the years to meet the changing needs of its beneficiaries. Today, it provides coverage to over 64 million people, offering a range of benefits, including hospital stays, doctor visits, and prescription medication. With the rising costs of healthcare, having the right insurance plan in place is more critical than ever. Medicare insurance plans are designed to help individuals manage their healthcare expenses, ensuring they receive the necessary care without breaking the bank.

The Medicare program is divided into several parts, each covering specific healthcare services. Understanding these parts is essential to selecting the right plan for your needs. Medicare Part A, also known as hospital insurance, covers inpatient care, skilled nursing facility care, and hospice care. Medicare Part B, or medical insurance, covers doctor visits, outpatient care, and medical equipment. Additionally, Medicare Part D provides prescription drug coverage, while Medicare Advantage plans, also known as Part C, offer an alternative to Original Medicare, often including additional benefits like dental, vision, and hearing coverage.

Understanding Medicare Insurance Plans

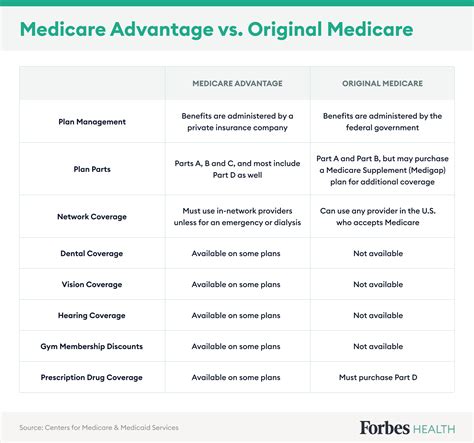

Medicare insurance plans can be broadly categorized into two main types: Original Medicare and Medicare Advantage. Original Medicare, which includes Part A and Part B, is the traditional fee-for-service program, where the government pays healthcare providers directly for services rendered. Medicare Advantage plans, on the other hand, are offered by private insurance companies approved by Medicare. These plans often include additional benefits, such as fitness programs, transportation services, and meal delivery, which can enhance the overall healthcare experience.

Original Medicare

Original Medicare is the most basic form of Medicare coverage, consisting of Part A and Part B. Part A covers hospital stays, skilled nursing facility care, and hospice care, while Part B covers doctor visits, outpatient care, and medical equipment. With Original Medicare, you can see any healthcare provider who accepts Medicare, without needing a referral. However, you'll typically need to pay deductibles, copays, and coinsurance for services received.Medicare Advantage Plans

Medicare Advantage plans, also known as Medicare Part C, are offered by private insurance companies approved by Medicare. These plans must cover all the services that Original Medicare covers, but they can also include additional benefits, such as dental, vision, and hearing coverage. Medicare Advantage plans often have different costs, provider networks, and rules than Original Medicare. Some popular types of Medicare Advantage plans include Health Maintenance Organization (HMO) plans, Preferred Provider Organization (PPO) plans, and Private Fee-for-Service (PFFS) plans.Benefits of Medicare Insurance Plans

Medicare insurance plans offer numerous benefits, including coverage for essential healthcare services, access to a wide range of healthcare providers, and protection against high medical bills. With Medicare, you can receive necessary care without worrying about the financial burden. Additionally, Medicare insurance plans often include preventive services, such as annual wellness visits, flu shots, and cancer screenings, which can help prevent illnesses and detect health problems early.

Some of the key benefits of Medicare insurance plans include:

- Coverage for hospital stays, doctor visits, and prescription medication

- Access to a wide range of healthcare providers, including specialists and primary care physicians

- Protection against high medical bills, including deductibles, copays, and coinsurance

- Preventive services, such as annual wellness visits, flu shots, and cancer screenings

- Additional benefits, such as dental, vision, and hearing coverage, with Medicare Advantage plans

How to Choose the Right Medicare Insurance Plan

Choosing the right Medicare insurance plan can be overwhelming, with numerous options available. To make an informed decision, consider your healthcare needs, budget, and lifestyle. Start by researching the different types of Medicare plans, including Original Medicare and Medicare Advantage plans. Compare the costs, benefits, and provider networks of each plan, and consider factors such as deductibles, copays, and coinsurance.Some tips for choosing the right Medicare insurance plan include:

- Assess your healthcare needs, including any chronic conditions or medications

- Compare the costs, benefits, and provider networks of each plan

- Consider factors such as deductibles, copays, and coinsurance

- Research the insurance company's reputation and customer service

- Review the plan's star rating, which is based on quality and performance

Enrolling in Medicare Insurance Plans

Enrolling in Medicare insurance plans can be a complex process, but understanding the eligibility requirements and enrollment periods can help. To be eligible for Medicare, you must be a US citizen or permanent resident, and either be 65 or older, or have a disability. The initial enrollment period (IEP) for Medicare is typically seven months, starting three months before your 65th birthday and ending three months after.

There are several enrollment periods for Medicare, including:

- Initial Enrollment Period (IEP): Seven months, starting three months before your 65th birthday and ending three months after

- Annual Election Period (AEP): October 15 to December 7, during which you can change your Medicare plan or enroll in a new one

- Special Enrollment Period (SEP): Available for individuals who experience certain life events, such as moving to a new area or losing employer coverage

- General Enrollment Period (GEP): January 1 to March 31, during which you can enroll in Medicare Part B if you didn't sign up during your IEP

Medicare Enrollment Tips

Enrolling in Medicare insurance plans requires careful planning and attention to detail. To ensure a smooth enrollment process, start by researching the different types of Medicare plans and their eligibility requirements. Compare the costs, benefits, and provider networks of each plan, and consider factors such as deductibles, copays, and coinsurance.Some tips for enrolling in Medicare insurance plans include:

- Research the different types of Medicare plans and their eligibility requirements

- Compare the costs, benefits, and provider networks of each plan

- Consider factors such as deductibles, copays, and coinsurance

- Review the plan's star rating, which is based on quality and performance

- Seek guidance from a licensed insurance agent or broker if needed

Medicare Insurance Plans and Your Budget

Medicare insurance plans can have a significant impact on your budget, with costs varying depending on the type of plan and your healthcare needs. Understanding the different costs associated with Medicare, including premiums, deductibles, copays, and coinsurance, can help you make informed decisions about your coverage.

Some tips for managing your budget with Medicare insurance plans include:

- Research the costs associated with each plan, including premiums, deductibles, copays, and coinsurance

- Consider your healthcare needs and budget when selecting a plan

- Look for plans with low or no premiums, if available

- Take advantage of preventive services, which can help prevent illnesses and detect health problems early

Medicare Cost Savings Tips

Managing your Medicare costs requires careful planning and attention to detail. To save money on your Medicare insurance plan, consider the following tips: * Research the costs associated with each plan, including premiums, deductibles, copays, and coinsurance * Consider your healthcare needs and budget when selecting a plan * Look for plans with low or no premiums, if available * Take advantage of preventive services, which can help prevent illnesses and detect health problems early * Review your plan's star rating, which is based on quality and performanceConclusion and Next Steps

In conclusion, Medicare insurance plans are a vital component of healthcare coverage for individuals aged 65 and older, as well as certain younger people with disabilities. With numerous plans available, it's essential to understand the different types, their benefits, and how to enroll. By researching the various Medicare insurance plans, comparing costs and benefits, and considering your healthcare needs and budget, you can make informed decisions about your coverage.

To get started, take the following next steps:

- Research the different types of Medicare insurance plans, including Original Medicare and Medicare Advantage plans

- Compare the costs, benefits, and provider networks of each plan

- Consider your healthcare needs and budget when selecting a plan

- Review the plan's star rating, which is based on quality and performance

- Seek guidance from a licensed insurance agent or broker if needed

What is the difference between Original Medicare and Medicare Advantage plans?

+Original Medicare is the traditional fee-for-service program, while Medicare Advantage plans are offered by private insurance companies approved by Medicare. Medicare Advantage plans often include additional benefits, such as dental, vision, and hearing coverage.

How do I enroll in Medicare insurance plans?

+To enroll in Medicare insurance plans, you can sign up during your initial enrollment period, which is typically seven months, starting three months before your 65th birthday and ending three months after. You can also enroll during the annual election period, which is from October 15 to December 7.

What are the costs associated with Medicare insurance plans?

+The costs associated with Medicare insurance plans vary depending on the type of plan and your healthcare needs. These costs may include premiums, deductibles, copays, and coinsurance. It's essential to research the costs associated with each plan and consider your budget when selecting a plan.

We hope this comprehensive guide to Medicare insurance plans has provided you with the information you need to make informed decisions about your healthcare coverage. Remember to research the different types of Medicare plans, compare costs and benefits, and consider your healthcare needs and budget when selecting a plan. If you have any further questions or concerns, don't hesitate to reach out to a licensed insurance agent or broker for guidance. Share this article with friends and family who may be navigating the complex world of Medicare, and take the first step towards securing the healthcare coverage you deserve.