Intro

Discover how Medicare late enrollment penalties impact coverage. Learn about Part B, Part D, and IRMAA penalties, and understand enrollment periods to avoid fines and higher premiums, ensuring seamless healthcare transitions and minimizing late enrollment fees.

Medicare is a vital health insurance program for individuals 65 and older, as well as certain younger people with disabilities. While it provides comprehensive coverage, there are specific rules and timelines that beneficiaries must follow to avoid penalties. One critical aspect of Medicare is the importance of timely enrollment. Failing to enroll on time can lead to penalties, which can significantly increase the cost of healthcare for beneficiaries. In this article, we will explore the five ways Medicare penalizes late enrollment, helping individuals understand the importance of meeting enrollment deadlines.

The Medicare program is designed to provide affordable healthcare to eligible individuals. However, to maintain its affordability and ensure that beneficiaries take advantage of its benefits, Medicare has implemented rules that discourage late enrollment. These rules are in place to prevent individuals from waiting until they need medical care to enroll, which could lead to increased costs for the program. By understanding the penalties associated with late enrollment, individuals can make informed decisions about their healthcare coverage and avoid unnecessary costs.

Medicare's penalty system is structured to encourage timely enrollment. The program offers initial enrollment periods, during which individuals can sign up for Medicare without incurring penalties. However, if beneficiaries miss these windows, they may face penalties, depending on the specific circumstances of their late enrollment. The penalties can vary in severity, from increased premiums to delayed coverage. It is essential for individuals to comprehend these penalties to make the most of their Medicare benefits and minimize additional costs.

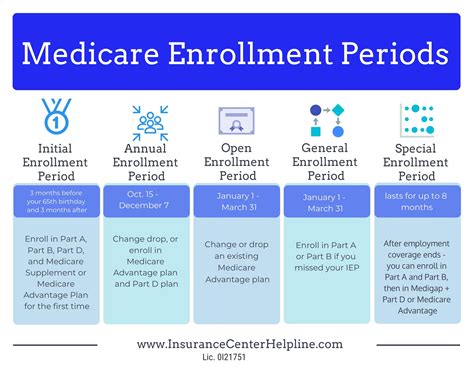

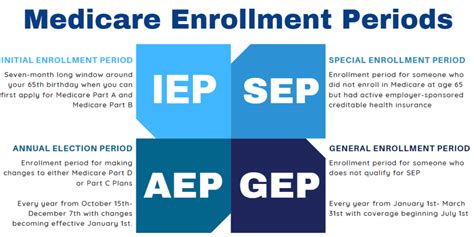

Understanding Medicare Enrollment Periods

Penalty for Late Enrollment in Medicare Part B

How the Part B Penalty Works

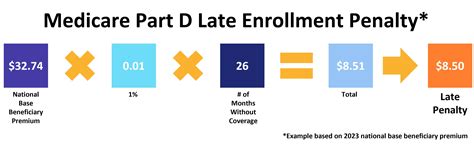

The Part B penalty is designed to discourage individuals from delaying their enrollment in Medicare Part B. For example, if a beneficiary delays enrollment for 30 months (2.5 years) after their Initial Enrollment Period, their Part B premium could increase by 20% to 25%. This increase is permanent and can significantly impact the beneficiary's healthcare costs over time.Penalty for Late Enrollment in Medicare Part D

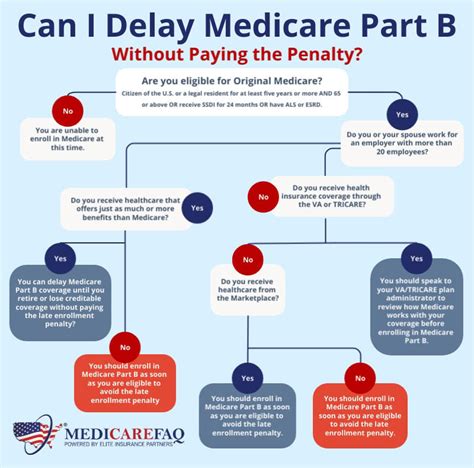

Understanding Credible Coverage

Credible coverage refers to prescription drug coverage that is at least as good as the standard Medicare Part D coverage. If beneficiaries have credible coverage, such as through an employer-sponsored plan, they may not face a Part D penalty when they eventually enroll in a Medicare Prescription Drug Plan. However, it is essential to ensure that the coverage is indeed credible, as not all plans meet this criterion.Penalty for Not Signing Up for Medicare Advantage

Understanding Medicare Advantage Enrollment

Medicare Advantage enrollment is tied to the Initial Enrollment Period and the Annual Election Period (AEP). During these periods, beneficiaries can enroll in, change, or disenroll from Medicare Advantage plans. If they miss these windows, they may face limited opportunities to make changes to their coverage, which could result in higher healthcare costs or reduced benefits.Penalty for Late Enrollment in Medicare Supplement Insurance

Understanding Medigap Enrollment

Medigap enrollment is critical for beneficiaries who want to minimize their out-of-pocket healthcare costs. During the Medigap Open Enrollment Period, beneficiaries can enroll in any Medigap plan available in their state, without undergoing medical underwriting. However, if they miss this window, they may face challenges in finding affordable coverage, which could impact their ability to access necessary healthcare services.Penalty for Not Meeting Special Enrollment Period Requirements

Understanding Special Enrollment Periods

SEPs are designed to provide flexibility for beneficiaries who experience changes in their circumstances. However, the rules surrounding SEPs can be complex, and beneficiaries must ensure they meet the specific requirements to avoid penalties. This may involve providing documentation to support their SEP eligibility, such as proof of a move or loss of coverage.In conclusion, understanding the penalties associated with late Medicare enrollment is crucial for beneficiaries to make informed decisions about their healthcare coverage. By recognizing the importance of timely enrollment and the potential penalties for late enrollment, individuals can avoid unnecessary costs and ensure they have comprehensive coverage when they need it.

To further assist with understanding the complexities of Medicare enrollment and potential penalties, the following FAQ section provides answers to common questions:

What is the Initial Enrollment Period for Medicare?

+The Initial Enrollment Period is the first opportunity for individuals to enroll in Medicare. It typically starts three months before the month of their 65th birthday and ends three months after.

How is the Part B penalty calculated?

+The Part B penalty is calculated as a 10% increase in the Part B premium for each 12-month period that the individual could have had Part B but did not.

What is credible coverage for Medicare Part D?

+Credible coverage refers to prescription drug coverage that is at least as good as the standard Medicare Part D coverage.

Can I enroll in Medicare Advantage at any time?

+No, Medicare Advantage enrollment is typically limited to the Initial Enrollment Period and the Annual Election Period.

How do I avoid penalties when enrolling in Medicare?

+To avoid penalties, it is essential to enroll in Medicare during the designated enrollment periods and to ensure that any existing coverage is credible.

We hope this information has been helpful in understanding the penalties associated with late Medicare enrollment. If you have further questions or would like to share your experiences with Medicare enrollment, please comment below. Additionally, consider sharing this article with friends and family who may benefit from this information, and follow our blog for more insightful articles on healthcare and insurance topics.