Intro

Discover 5 ways to pay bills efficiently, including online payments, autopay, and mobile wallets, to streamline your finances and avoid late fees with convenient billing options and payment methods.

Paying bills on time is essential for maintaining a good credit score, avoiding late fees, and reducing financial stress. With the advancement of technology, there are now various ways to pay bills, making it more convenient and efficient. In this article, we will explore the different methods of paying bills, their benefits, and how to choose the best option for your needs.

Paying bills has become a necessary part of our daily lives, and it's crucial to stay on top of our financial obligations. Late payments can lead to negative consequences, such as damage to credit scores, late fees, and even collection calls. However, with the right approach, paying bills can be a breeze. Whether you're a busy professional or a student, there are various ways to pay bills that can fit your lifestyle and preferences.

The importance of paying bills on time cannot be overstated. Not only does it help maintain a good credit score, but it also saves you money on late fees and interest charges. Moreover, paying bills on time can reduce financial stress and give you peace of mind. With the numerous options available, you can choose the method that works best for you and your financial situation. From online payments to mobile apps, we will delve into the different ways to pay bills and explore their benefits and drawbacks.

Introduction to Paying Bills

Types of Bills

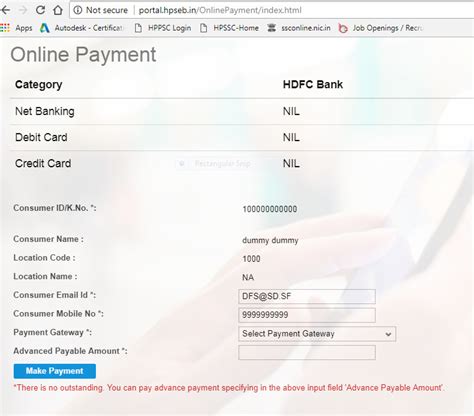

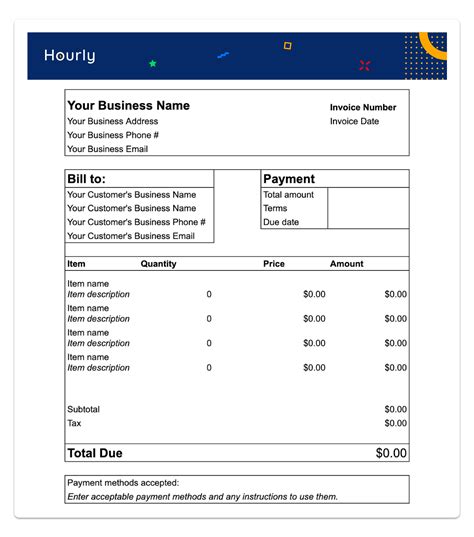

There are various types of bills, including utility bills, credit card bills, loan payments, and rent or mortgage payments. Each type of bill has its own payment terms and due dates, making it essential to stay organized and keep track of your payments. Utility bills, such as electricity, gas, and water bills, are typically paid monthly, while credit card bills and loan payments may have varying due dates.Online Bill Pay

Benefits of Online Bill Pay

The benefits of online bill pay are numerous. With online bill pay, you can avoid late fees, save time, and reduce paperwork. Online bill pay also allows you to track your payments and view your payment history, making it easier to stay on top of your finances. Additionally, online bill pay is environmentally friendly, reducing the need for paper bills and checks.Mobile Bill Pay

Benefits of Mobile Bill Pay

The benefits of mobile bill pay are numerous. With mobile bill pay, you can pay your bills anywhere, anytime, using your mobile device. Mobile bill pay also allows you to track your payments and view your payment history, making it easier to stay on top of your finances. Additionally, mobile bill pay is environmentally friendly, reducing the need for paper bills and checks.Phone Bill Pay

Benefits of Phone Bill Pay

The benefits of phone bill pay are numerous. With phone bill pay, you can pay your bills from the comfort of your own home, without having to leave your house. Phone bill pay also allows you to track your payments and view your payment history, making it easier to stay on top of your finances. Additionally, phone bill pay is environmentally friendly, reducing the need for paper bills and checks.Mail Bill Pay

Benefits of Mail Bill Pay

The benefits of mail bill pay are limited. With mail bill pay, you can pay your bills using a check or money order, which can be a secure way to make payments. However, mail bill pay can be time-consuming and may result in late fees if the payment is not received on time. Additionally, mail bill pay requires paperwork and can be environmentally unfriendly.In-Person Bill Pay

Benefits of In-Person Bill Pay

The benefits of in-person bill pay are limited. With in-person bill pay, you can pay your bills in person, which can be a secure way to make payments. However, in-person bill pay can be time-consuming and may require you to take time off work or school. Additionally, in-person bill pay requires paperwork and can be environmentally unfriendly.What is the best way to pay bills?

+The best way to pay bills depends on your personal preferences and financial situation. Online bill pay, mobile bill pay, and phone bill pay are convenient and efficient ways to pay bills, while mail bill pay and in-person bill pay are more traditional methods.

How can I avoid late fees?

+To avoid late fees, make sure to pay your bills on time. You can set up automatic payments or reminders to ensure that you never miss a payment. Additionally, you can contact your biller to negotiate a payment plan or temporary waiver of late fees.

What are the benefits of online bill pay?

+The benefits of online bill pay include convenience, efficiency, and security. Online bill pay allows you to pay your bills from the comfort of your own home, 24/7, and reduces the risk of late fees and lost payments.

Can I pay my bills using my mobile device?

+Yes, you can pay your bills using your mobile device. Mobile bill pay apps, such as Apple Pay and Google Pay, allow you to make payments on the go, using your mobile device.

What is the difference between online bill pay and mobile bill pay?

+Online bill pay and mobile bill pay are both convenient ways to pay bills, but they differ in terms of accessibility and convenience. Online bill pay allows you to pay your bills from the comfort of your own home, while mobile bill pay allows you to pay your bills on the go, using your mobile device.

In summary, paying bills is a critical aspect of personal finance, and there are various ways to pay bills, each with its own benefits and drawbacks. By understanding the different methods of paying bills, you can choose the best option for your needs and avoid late fees, reduce financial stress, and maintain a good credit score. Whether you prefer online bill pay, mobile bill pay, phone bill pay, mail bill pay, or in-person bill pay, the key is to find a method that works for you and your financial situation. We invite you to share your thoughts and experiences on paying bills in the comments section below. What is your preferred method of paying bills? Have you ever experienced late fees or financial stress due to unpaid bills? Share your story and help others learn from your experiences.