Intro

The San Diego County tax appraisal process is a crucial aspect of the local property tax system. It is essential for property owners to understand how their property's value is determined and how it affects their tax liability. In this article, we will delve into the world of San Diego County tax appraisal, exploring its importance, the process involved, and the factors that influence property values.

The tax appraisal process is a vital component of the property tax system, as it provides the basis for determining the amount of taxes owed by property owners. In San Diego County, the Office of the Assessor/Recorder/County Clerk is responsible for appraising properties and assessing their values. This process involves evaluating the market value of properties, taking into account various factors such as location, size, age, and condition.

Understanding the tax appraisal process is crucial for property owners, as it can have a significant impact on their tax liability. A higher appraised value can result in higher property taxes, while a lower appraised value can lead to lower taxes. Moreover, the tax appraisal process can also affect the overall economy of San Diego County, as it influences the amount of revenue generated by property taxes.

Introduction to San Diego County Tax Appraisal

How San Diego County Tax Appraisal Works

Factors Influencing San Diego County Tax Appraisal

The value of a property in San Diego County is influenced by a variety of factors, including: * Location: Properties located in desirable areas, such as coastal regions or areas with good schools, tend to have higher values. * Size and layout: Larger properties or those with desirable layouts, such as single-story homes, may have higher values. * Age and condition: Newer properties or those that have been well-maintained may have higher values than older properties or those that require significant repairs. * Amenities: Properties with desirable amenities, such as swimming pools or views, may have higher values.Benefits of San Diego County Tax Appraisal

Challenges Facing San Diego County Tax Appraisal

Best Practices for San Diego County Tax Appraisal

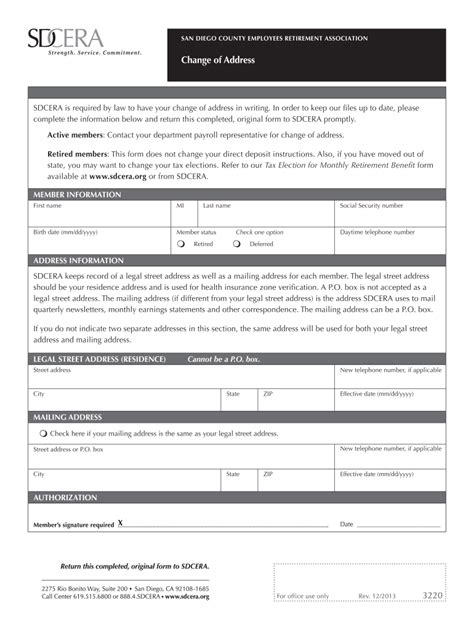

To ensure an accurate and efficient tax appraisal process, the following best practices should be followed: * Regular data updates: The Office of the Assessor/Recorder/County Clerk should regularly update its data to reflect changes in the market and property values. * Clear communication: Property owners should be kept informed about the tax appraisal process and any changes to their property's value. * Transparency: The tax appraisal process should be transparent, with clear explanations of the methodologies and data used to determine property values.San Diego County Tax Appraisal FAQs

What is the purpose of the tax appraisal process?

+The purpose of the tax appraisal process is to determine the value of properties in San Diego County for property tax purposes.

How is my property's value determined?

+Your property's value is determined by the Office of the Assessor/Recorder/County Clerk using a variety of methods, including the sales comparison approach, the income approach, and the cost approach.

What factors influence my property's value?

+Factors that influence your property's value include location, size, age, condition, and amenities.

Conclusion and Next Steps