Intro

Explore WA health insurance options, including individual and family plans, Medicare, and Medicaid, to find affordable coverage with top providers, benefits, and rates.

The state of Washington offers a wide range of health insurance options for its residents, making it easier for individuals and families to find affordable and comprehensive coverage. With the ever-changing landscape of healthcare, it's essential to stay informed about the various options available. Whether you're an individual, self-employed, or a business owner, understanding the different health insurance options in Washington can help you make informed decisions about your healthcare needs.

In recent years, the healthcare industry has experienced significant changes, from the implementation of the Affordable Care Act (ACA) to the rise of alternative health insurance models. As a result, Washington residents have more options than ever before to choose from, including private insurance plans, public programs, and specialized coverage for specific needs. With so many options available, it's crucial to navigate the complex world of health insurance and find the right fit for your unique situation.

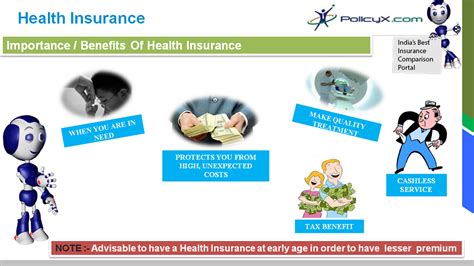

The importance of having health insurance cannot be overstated. Not only does it provide financial protection against unexpected medical expenses, but it also ensures access to essential healthcare services, including preventive care, diagnostic tests, and treatment for chronic conditions. In Washington, residents can choose from a variety of health insurance options, each with its own set of benefits, drawbacks, and eligibility requirements. By understanding the different options available, individuals and families can make informed decisions about their healthcare needs and find the right coverage to suit their budget and lifestyle.

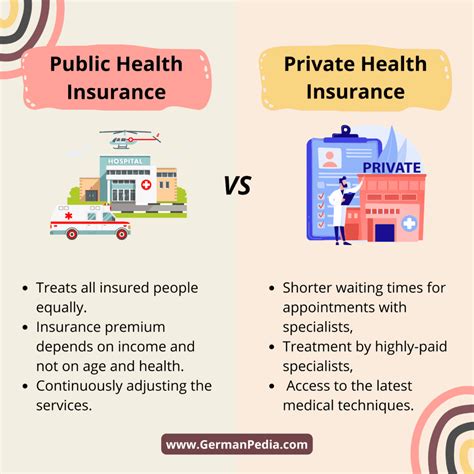

Private Health Insurance Options in Washington

Private health insurance plans in Washington are offered by various insurance companies, each with its own network of healthcare providers, coverage options, and premium rates. These plans can be purchased directly from the insurance company or through the Washington Healthplanfinder, the state's official health insurance marketplace. Private insurance plans in Washington are categorized into different metal tiers, including Bronze, Silver, Gold, and Platinum, each with varying levels of coverage and out-of-pocket costs.

Some of the private health insurance options available in Washington include:

- Major medical plans: These plans provide comprehensive coverage for essential health benefits, including doctor visits, hospital stays, and prescription medications.

- Short-term plans: These plans offer temporary coverage for a limited period, typically up to 12 months, and are designed for individuals who are between jobs or waiting for other coverage to start.

- Catastrophic plans: These plans provide limited coverage for essential health benefits and are designed for young adults or individuals who cannot afford other types of coverage.

Benefits of Private Health Insurance

Private health insurance plans in Washington offer several benefits, including:- Comprehensive coverage for essential health benefits

- Access to a wide network of healthcare providers

- Flexible premium payment options

- Tax credits and subsidies for eligible individuals and families

Public Health Insurance Options in Washington

Public health insurance options in Washington are designed for low-income individuals and families who meet specific eligibility requirements. These programs provide comprehensive coverage for essential health benefits, including doctor visits, hospital stays, and prescription medications.

Some of the public health insurance options available in Washington include:

- Medicaid: This program provides coverage for low-income individuals and families, including children, pregnant women, and people with disabilities.

- Apple Health: This program provides coverage for low-income individuals and families, including children, pregnant women, and people with disabilities.

- Children's Health Insurance Program (CHIP): This program provides coverage for children from low-income families who do not qualify for Medicaid.

Eligibility Requirements for Public Health Insurance

To be eligible for public health insurance in Washington, individuals and families must meet specific income and eligibility requirements. These requirements vary depending on the program and the individual's or family's circumstances.Some of the eligibility requirements for public health insurance in Washington include:

- Income limits: Individuals and families must have income below a certain level to qualify for public health insurance.

- Residency requirements: Individuals and families must be residents of Washington state to qualify for public health insurance.

- Citizenship requirements: Individuals and families must be U.S. citizens or qualified aliens to qualify for public health insurance.

Specialized Health Insurance Options in Washington

Specialized health insurance options in Washington are designed for individuals and families with specific needs or circumstances. These options include:

- Medicare: This program provides coverage for individuals 65 and older, as well as younger individuals with disabilities.

- TRICARE: This program provides coverage for military personnel, veterans, and their families.

- Student health insurance: This program provides coverage for students attending college or university in Washington.

Benefits of Specialized Health Insurance

Specialized health insurance options in Washington offer several benefits, including:- Comprehensive coverage for specific health needs or circumstances

- Access to a wide network of healthcare providers

- Flexible premium payment options

- Tax credits and subsidies for eligible individuals and families

Self-Employed Health Insurance Options in Washington

Self-employed health insurance options in Washington are designed for individuals who are self-employed or own a small business. These options include:

- Individual and family plans: These plans provide comprehensive coverage for essential health benefits, including doctor visits, hospital stays, and prescription medications.

- Group plans: These plans provide coverage for small businesses with employees, including sole proprietors and partners.

- Association health plans: These plans provide coverage for small businesses and self-employed individuals who are members of a professional association.

Benefits of Self-Employed Health Insurance

Self-employed health insurance options in Washington offer several benefits, including:- Comprehensive coverage for essential health benefits

- Access to a wide network of healthcare providers

- Flexible premium payment options

- Tax credits and subsidies for eligible individuals and families

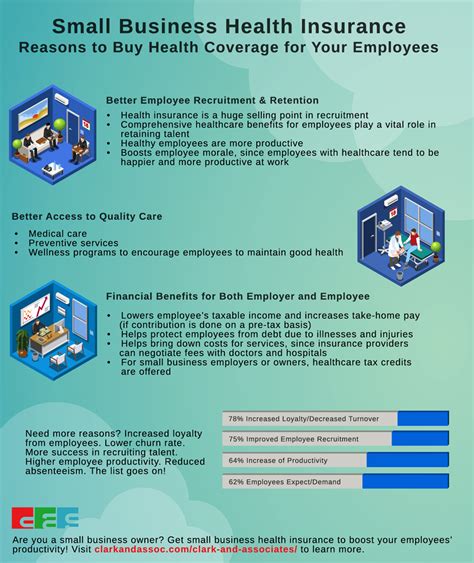

Small Business Health Insurance Options in Washington

Small business health insurance options in Washington are designed for businesses with 50 or fewer employees. These options include:

- Group plans: These plans provide coverage for small businesses with employees, including sole proprietors and partners.

- Association health plans: These plans provide coverage for small businesses and self-employed individuals who are members of a professional association.

- SHOP plans: These plans provide coverage for small businesses with employees, including sole proprietors and partners, through the Washington Healthplanfinder.

Benefits of Small Business Health Insurance

Small business health insurance options in Washington offer several benefits, including:- Comprehensive coverage for essential health benefits

- Access to a wide network of healthcare providers

- Flexible premium payment options

- Tax credits and subsidies for eligible small businesses

What are the eligibility requirements for public health insurance in Washington?

+To be eligible for public health insurance in Washington, individuals and families must meet specific income and eligibility requirements, including income limits, residency requirements, and citizenship requirements.

What are the benefits of private health insurance in Washington?

+Private health insurance plans in Washington offer several benefits, including comprehensive coverage for essential health benefits, access to a wide network of healthcare providers, flexible premium payment options, and tax credits and subsidies for eligible individuals and families.

What are the different types of health insurance options available in Washington?

+The different types of health insurance options available in Washington include private health insurance plans, public health insurance programs, specialized health insurance options, self-employed health insurance options, and small business health insurance options.

In conclusion, the state of Washington offers a wide range of health insurance options for its residents, including private insurance plans, public programs, and specialized coverage for specific needs. By understanding the different options available and their benefits, drawbacks, and eligibility requirements, individuals and families can make informed decisions about their healthcare needs and find the right coverage to suit their budget and lifestyle. We invite you to share your thoughts and experiences with health insurance in Washington, and to ask any questions you may have about the different options available.