Intro

Discover top health insurance policy options, including individual, family, and group plans, with benefits like medical, dental, and vision coverage, to find the best fit for your needs and budget, ensuring comprehensive healthcare protection.

The world of health insurance can be overwhelming, with numerous options available in the market. Choosing the best health insurance policy is crucial to ensure that you and your loved ones are protected against unexpected medical expenses. With the rising costs of healthcare, having a comprehensive health insurance policy can provide peace of mind and financial security. In this article, we will delve into the importance of health insurance, the different types of policies available, and provide guidance on how to select the best policy for your needs.

Health insurance is a vital investment that can help you avoid financial ruin in the event of a medical emergency. Without health insurance, you may be forced to pay out-of-pocket for medical expenses, which can be exorbitant. Moreover, health insurance can provide access to preventive care, such as routine check-ups and screenings, which can help detect health problems early on. This can lead to better health outcomes and reduced healthcare costs in the long run. With so many health insurance policy options available, it's essential to understand the different types of policies and their features to make an informed decision.

The healthcare landscape is constantly evolving, with new technologies and treatments emerging regularly. As a result, health insurance policies must also adapt to these changes. Some policies may offer coverage for alternative therapies, such as acupuncture or chiropractic care, while others may provide coverage for mental health services. With the rise of telemedicine, some policies may also offer virtual consultations with healthcare professionals. Understanding the different features and benefits of each policy can help you choose the best option for your needs.

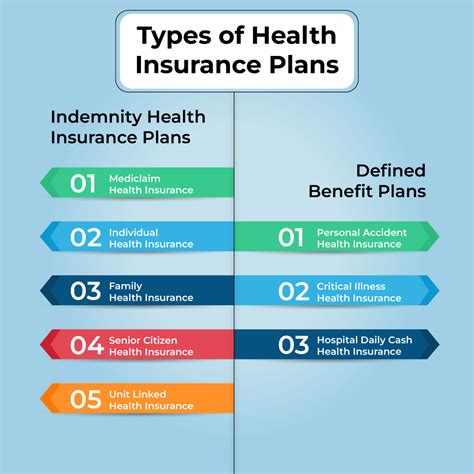

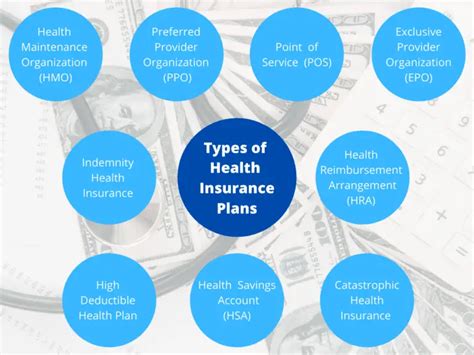

Types of Health Insurance Policies

There are several types of health insurance policies available, each with its unique features and benefits. Some of the most common types of policies include:

- Individual and family plans: These policies are designed for individuals and families who are not covered by an employer-sponsored plan.

- Group plans: These policies are offered by employers to their employees and are often more affordable than individual plans.

- Medicare and Medicaid: These government-sponsored programs provide coverage for seniors, people with disabilities, and low-income individuals.

- Short-term plans: These policies provide temporary coverage for a limited period, often up to 12 months.

- Catastrophic plans: These policies are designed for young adults and provide limited coverage at a lower cost.

Key Features of Health Insurance Policies

When selecting a health insurance policy, there are several key features to consider. These include:- Deductible: The amount you must pay out-of-pocket before your insurance coverage kicks in.

- Co-pay: The amount you pay for each doctor visit or prescription.

- Co-insurance: The percentage of medical expenses that you pay after meeting your deductible.

- Out-of-pocket maximum: The maximum amount you pay for medical expenses in a given year.

- Network: The group of healthcare providers who participate in your insurance plan.

Benefits of Health Insurance Policies

Health insurance policies offer numerous benefits, including:

- Financial protection: Health insurance can help you avoid financial ruin in the event of a medical emergency.

- Access to preventive care: Many policies cover routine check-ups and screenings, which can help detect health problems early on.

- Reduced healthcare costs: Health insurance can negotiate lower rates with healthcare providers, reducing your out-of-pocket expenses.

- Tax benefits: In some cases, health insurance premiums may be tax-deductible.

- Peace of mind: Knowing that you have health insurance coverage can provide peace of mind and reduce stress.

How to Choose the Best Health Insurance Policy

Choosing the best health insurance policy can be a daunting task, but there are several steps you can take to make an informed decision. These include:- Assessing your needs: Consider your age, health status, and financial situation when selecting a policy.

- Researching different policies: Compare the features and benefits of different policies to find the best option for your needs.

- Reading reviews: Check online reviews and ratings to get a sense of the insurance company's reputation and customer service.

- Consulting with a broker: A health insurance broker can help you navigate the complex world of health insurance and find the best policy for your needs.

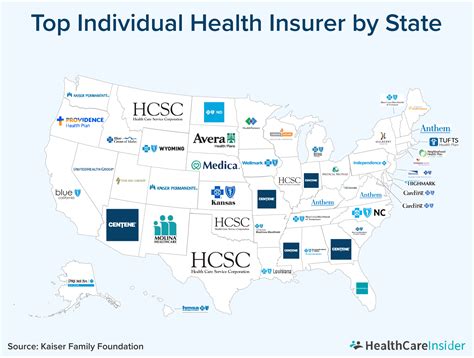

Top Health Insurance Companies

There are numerous health insurance companies operating in the market, each with its strengths and weaknesses. Some of the top health insurance companies include:

- UnitedHealthcare: One of the largest health insurance companies in the US, offering a wide range of policies and plans.

- Kaiser Permanente: A non-profit health insurance company that offers comprehensive coverage and a strong network of healthcare providers.

- Blue Cross Blue Shield: A nationwide health insurance company that offers a range of policies and plans, including individual and group plans.

- Aetna: A health insurance company that offers a range of policies and plans, including Medicare and Medicaid plans.

- Cigna: A global health insurance company that offers a range of policies and plans, including individual and group plans.

Health Insurance Policy Options for Different Age Groups

Health insurance needs can vary significantly depending on age. For example:- Young adults: May prefer catastrophic plans or short-term plans, which offer limited coverage at a lower cost.

- Families: May prefer family plans, which offer comprehensive coverage for spouses and dependents.

- Seniors: May prefer Medicare or Medicaid, which offer coverage for seniors and people with disabilities.

- Middle-aged adults: May prefer individual or group plans, which offer comprehensive coverage and a range of benefits.

Health Insurance Policy Options for Different Health Needs

Health insurance needs can also vary depending on health status. For example:

- People with chronic conditions: May prefer policies that offer comprehensive coverage for ongoing medical expenses.

- People with disabilities: May prefer policies that offer coverage for disability-related expenses.

- People with mental health conditions: May prefer policies that offer coverage for mental health services.

- People with substance abuse issues: May prefer policies that offer coverage for substance abuse treatment.

Health Insurance Policy Options for Different Budgets

Health insurance needs can also vary depending on budget. For example:- Low-income individuals: May prefer policies that offer low premiums and limited coverage.

- Middle-income individuals: May prefer policies that offer comprehensive coverage and a range of benefits.

- High-income individuals: May prefer policies that offer high-end coverage and additional benefits, such as concierge medicine.

Common Mistakes to Avoid When Choosing a Health Insurance Policy

When choosing a health insurance policy, there are several common mistakes to avoid. These include:

- Not reading the fine print: Failing to understand the policy's terms and conditions can lead to unexpected expenses and reduced coverage.

- Not comparing policies: Failing to compare different policies can lead to missing out on better coverage and lower premiums.

- Not considering network: Failing to consider the policy's network can lead to reduced coverage and higher out-of-pocket expenses.

- Not checking reviews: Failing to check online reviews and ratings can lead to choosing a policy from a company with poor customer service.

Health Insurance Policy Options for Small Business Owners

Small business owners may prefer health insurance policies that offer comprehensive coverage for employees and dependents. Some popular options include:- Group plans: Offer comprehensive coverage for employees and dependents.

- Small business health options program (SHOP): Offers comprehensive coverage for small businesses with up to 50 employees.

- Professional employer organizations (PEOs): Offers comprehensive coverage for small businesses and provides HR services.

Health Insurance Policy Options for Self-Employed Individuals

Self-employed individuals may prefer health insurance policies that offer comprehensive coverage and flexibility. Some popular options include:

- Individual plans: Offer comprehensive coverage for self-employed individuals and dependents.

- Short-term plans: Offer limited coverage for a limited period, often up to 12 months.

- Catastrophic plans: Offer limited coverage at a lower cost, often preferred by young adults.

Health Insurance Policy Options for Retirees

Retirees may prefer health insurance policies that offer comprehensive coverage and additional benefits, such as Medicare and Medicaid. Some popular options include:- Medicare: Offers comprehensive coverage for seniors and people with disabilities.

- Medicaid: Offers comprehensive coverage for low-income individuals and families.

- Medicare advantage plans: Offer comprehensive coverage and additional benefits, such as dental and vision coverage.

What is the best health insurance policy for me?

+The best health insurance policy for you will depend on your individual needs and circumstances. Consider factors such as your age, health status, and financial situation when selecting a policy.

How do I choose the best health insurance policy?

+Choose the best health insurance policy by assessing your needs, researching different policies, reading reviews, and consulting with a broker. Consider factors such as deductible, co-pay, co-insurance, and out-of-pocket maximum.

What are the different types of health insurance policies?

+There are several types of health insurance policies, including individual and family plans, group plans, Medicare and Medicaid, short-term plans, and catastrophic plans. Each type of policy has its unique features and benefits.

In final thoughts, choosing the best health insurance policy requires careful consideration of your individual needs and circumstances. By assessing your needs, researching different policies, reading reviews, and consulting with a broker, you can make an informed decision and select the best policy for your needs. Remember to avoid common mistakes, such as not reading the fine print and not comparing policies, to ensure that you get the best coverage and value for your money. With the right health insurance policy, you can enjoy peace of mind, financial security, and access to quality healthcare services. We invite you to share your thoughts and experiences with health insurance policies in the comments below and to share this article with others who may be searching for the best health insurance policy options.