Intro

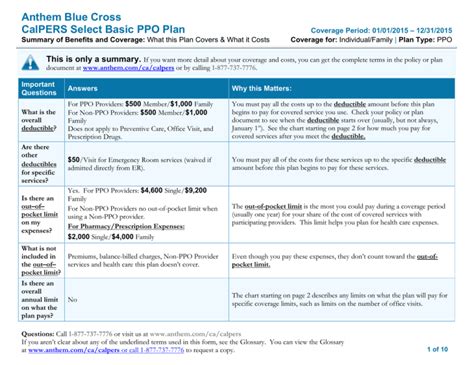

Discover key differences between HMO and PPO health plans, including network flexibility, out-of-pocket costs, and provider choice, to make informed decisions about your healthcare coverage and insurance needs.

The world of health insurance can be complex and overwhelming, with numerous options and plans to choose from. Two of the most popular types of health insurance plans are HMO (Health Maintenance Organization) and PPO (Preferred Provider Organization). Understanding the differences between HMO and PPO plans is crucial to making an informed decision about which type of plan is best for you and your family. In this article, we will delve into the key differences between HMO and PPO plans, exploring their benefits, drawbacks, and what to expect from each.

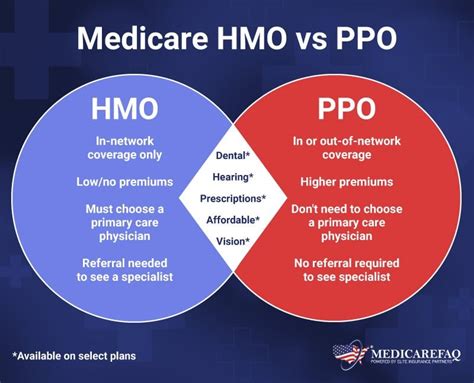

When it comes to health insurance, it's essential to consider your lifestyle, budget, and healthcare needs. HMO and PPO plans cater to different individuals and families, offering unique advantages and disadvantages. For instance, HMO plans are often more affordable and provide a more comprehensive approach to healthcare, while PPO plans offer greater flexibility and freedom to choose healthcare providers. By understanding the differences between these two types of plans, you can make a more informed decision and select the plan that best suits your needs.

The healthcare landscape is constantly evolving, with new technologies, treatments, and innovations emerging every day. As a result, health insurance plans must adapt to meet the changing needs of patients and providers. HMO and PPO plans have been around for decades, but they continue to play a vital role in the healthcare system. By exploring the differences between these two types of plans, we can gain a deeper understanding of the healthcare system and make more informed decisions about our health and wellbeing.

What is an HMO Plan?

Benefits of HMO Plans

Some of the benefits of HMO plans include: * Lower premiums and out-of-pocket costs * Comprehensive approach to healthcare, including preventive care and chronic disease management * Access to a network of providers who have agreed to provide services at a negotiated rate * Often includes additional benefits, such as dental and vision care * Typically requires a primary care physician (PCP) to coordinate care and referralsDrawbacks of HMO Plans

Some of the drawbacks of HMO plans include: * Limited flexibility to choose healthcare providers outside of the network * Often requires a referral from a PCP to see a specialist * May have limited coverage for out-of-network services * Can be more restrictive in terms of provider choice and flexibilityWhat is a PPO Plan?

Benefits of PPO Plans

Some of the benefits of PPO plans include: * Greater flexibility to choose healthcare providers, both in-network and out-of-network * No requirement for a PCP or referrals to see a specialist * Often provides more comprehensive coverage for out-of-network services * Can be more convenient for individuals and families who travel frequently or have providers outside of the networkDrawbacks of PPO Plans

Some of the drawbacks of PPO plans include: * Higher premiums and out-of-pocket costs compared to HMO plans * May have higher deductibles and copays for out-of-network services * Can be more complex and difficult to navigate, with multiple provider networks and coverage levelsKey Differences Between HMO and PPO Plans

Choosing Between HMO and PPO Plans

When choosing between an HMO and PPO plan, it's essential to consider your lifestyle, budget, and healthcare needs. If you value flexibility and choice, a PPO plan may be the better option. However, if you prioritize comprehensive care and lower out-of-pocket costs, an HMO plan may be the better choice. Ultimately, the decision between an HMO and PPO plan depends on your individual circumstances and priorities.Practical Examples and Statistical Data

According to statistical data, HMO plans are often more popular among individuals and families who prioritize comprehensive care and lower out-of-pocket costs. In contrast, PPO plans are often more popular among individuals and families who value flexibility and choice. For example, a study by the Kaiser Family Foundation found that in 2020, 43% of employees with employer-sponsored health insurance were enrolled in an HMO plan, while 56% were enrolled in a PPO plan.

Conclusion and Next Steps

In conclusion, HMO and PPO plans offer distinct advantages and disadvantages, catering to different individuals and families. By understanding the differences between these two types of plans, you can make a more informed decision and select the plan that best suits your needs. Whether you prioritize comprehensive care, flexibility, or affordability, there is a health insurance plan that can meet your needs. We encourage you to take the next step and explore your options, considering your lifestyle, budget, and healthcare needs.What is the main difference between HMO and PPO plans?

+The main difference between HMO and PPO plans is the level of flexibility and choice they offer. HMO plans typically require members to receive care from a specific network of providers, while PPO plans allow members to receive care from any provider, both in-network and out-of-network.

Which type of plan is better for individuals with chronic conditions?

+HMO plans are often better for individuals with chronic conditions, as they provide a more comprehensive approach to healthcare and often include additional benefits, such as disease management programs.

Can I switch from an HMO plan to a PPO plan?

+Yes, you can switch from an HMO plan to a PPO plan, but it's essential to consider the potential changes in premiums, out-of-pocket costs, and provider networks. It's recommended to review your options carefully and consult with a healthcare expert or insurance broker before making a decision.