Intro

Explore Georgia Health Insurance Plans, including individual, family, and group options, with coverage for medical, dental, and vision care, and discover affordable rates and providers.

Georgia, known as the Peach State, is home to over 10 million people, and with its growing population, the demand for quality healthcare has never been more pressing. Having the right health insurance plan is essential for individuals and families to ensure they receive the medical care they need without facing financial hardship. In this article, we will delve into the world of Georgia health insurance plans, exploring the various options available, their benefits, and how to choose the best plan for your needs.

The importance of health insurance cannot be overstated. It provides financial protection against unexpected medical expenses, allowing individuals to seek necessary care without worrying about the cost. Moreover, health insurance plans often cover preventive care services, such as routine check-ups and screenings, which can help prevent illnesses and detect health problems early on. With the ever-increasing costs of healthcare, having a comprehensive health insurance plan is crucial for maintaining both physical and financial well-being.

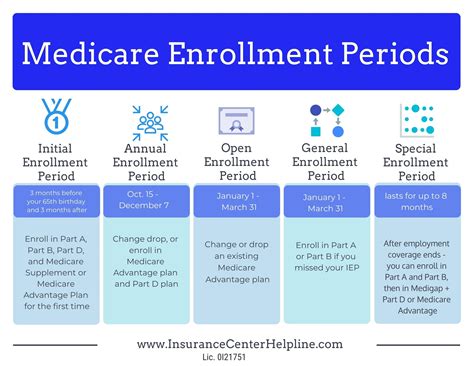

In Georgia, residents have access to a range of health insurance plans, including individual and family plans, group plans, and government-sponsored programs like Medicaid and the Children's Health Insurance Program (CHIP). The state also participates in the Affordable Care Act (ACA) marketplace, where individuals can purchase health insurance plans during the annual open enrollment period or during special enrollment periods if they experience a qualifying life event. Understanding the different types of plans and their benefits is essential for making informed decisions about health insurance.

Understanding Health Insurance Plans in Georgia

When navigating the health insurance landscape in Georgia, it's crucial to understand the different types of plans available. These include Health Maintenance Organization (HMO) plans, Preferred Provider Organization (PPO) plans, Exclusive Provider Organization (EPO) plans, and Point of Service (POS) plans. Each type of plan has its unique characteristics, such as network restrictions and out-of-pocket costs, which can significantly impact the quality and affordability of care.

Types of Health Insurance Plans

- HMO Plans: These plans require policyholders to receive medical care from a specific network of providers, except in emergency situations. HMOs often have lower premiums but less flexibility in terms of provider choice.

- PPO Plans: PPOs offer more flexibility than HMOs, allowing policyholders to see any healthcare provider they choose, both in and out of network, though out-of-network care typically costs more.

- EPO Plans: EPOs combine elements of HMOs and PPOs, offering a network of providers but without the option to go out of network, except in emergencies.

- POS Plans: POS plans allow policyholders to choose between receiving care from in-network providers or going out of network, with the option to self-refer to specialists.

Benefits of Georgia Health Insurance Plans

Georgia health insurance plans offer numerous benefits, including coverage for essential health benefits as mandated by the ACA. These benefits include:

- Ambulatory Patient Services: Coverage for outpatient care.

- Emergency Services: Emergency room visits are covered, even if the hospital is out of network.

- Hospitalization: Inpatient care is covered.

- Maternity and Newborn Care: Prenatal care, childbirth, and postpartum care are covered.

- Mental Health and Substance Use Disorder Services: Including counseling and therapy.

- Prescription Drugs: Most plans cover prescription medications, though the extent of coverage can vary.

- Rehabilitative and Habilitative Services: Physical, occupational, and speech therapy, as well as services to help manage chronic conditions.

Choosing the Right Health Insurance Plan

Selecting the right health insurance plan in Georgia involves considering several factors, including:

- Premium Costs: The monthly cost of the plan.

- Deductible: The amount policyholders must pay out of pocket before insurance coverage kicks in.

- Co-payments and Co-insurance: The amount policyholders pay for healthcare services after meeting the deductible.

- Network: Whether the plan's network includes the policyholder's preferred healthcare providers.

- Maximum Out-of-Pocket (MOOP) Costs: The maximum amount policyholders pay for healthcare expenses in a year.

Georgia Health Insurance Marketplace

The Georgia health insurance marketplace, also known as the exchange, is where individuals and families can purchase health insurance plans during the annual open enrollment period. The marketplace offers plans from various insurance companies, categorized into metal tiers based on their actuarial value: Bronze, Silver, Gold, and Platinum. These tiers indicate the percentage of healthcare costs the plan covers, with Bronze plans covering about 60% and Platinum plans covering about 90%.

Navigating the Enrollment Process

Navigating the enrollment process can seem daunting, but understanding the key steps can make it more manageable:

- Determine Eligibility: Check if you're eligible for a special enrollment period or if you need to wait for the annual open enrollment period.

- Gather Required Documents: Typically, you'll need proof of income, residency, and citizenship or immigration status.

- Compare Plans: Look at the premiums, deductibles, co-payments, and provider networks of the available plans.

- Apply: You can apply through the marketplace website, by phone, or in person with the help of a navigator or broker.

- Enroll: Once your application is approved, you can enroll in a plan and set up your premium payments.

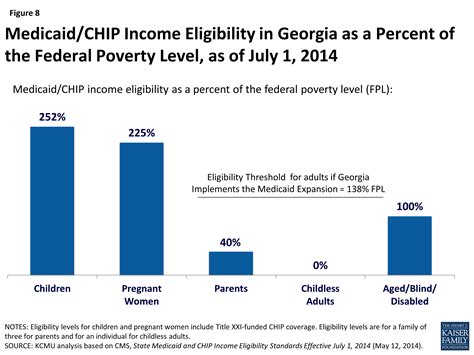

Medicaid and CHIP in Georgia

For low-income individuals and families, Medicaid and the Children's Health Insurance Program (CHIP) offer vital health insurance coverage. Medicaid covers adults, children, pregnant women, elderly adults, and people with disabilities who meet specific income and resource requirements. CHIP provides low-cost health coverage to children in families that earn too much to qualify for Medicaid but cannot afford private coverage.

Eligibility and Application Process

Eligibility for Medicaid and CHIP is based on income and family size, among other factors. The application process typically involves:

- Online Application: Through the Georgia Gateway website.

- Phone Application: By calling the Medicaid Customer Service Center.

- In-Person Application: At a local Division of Family and Children Services (DFCS) office.

- Mail Application: By printing and mailing a paper application.

Conclusion and Next Steps

In conclusion, navigating the complex world of Georgia health insurance plans requires patience, research, and a clear understanding of your healthcare needs and budget. Whether you're looking for individual coverage, family plans, or government-sponsored programs, there are options available to suit a variety of circumstances. By considering the benefits, types of plans, and enrollment processes outlined in this article, you can make informed decisions about your health insurance.

We invite you to share your experiences or ask questions about Georgia health insurance plans in the comments below. Your insights can help others in their search for the right coverage. Additionally, if you found this information helpful, please consider sharing it with friends and family who may be navigating the health insurance marketplace.

What is the difference between HMO and PPO health insurance plans?

+HMO (Health Maintenance Organization) plans require you to receive medical care from a specific network of providers, except in emergency situations, and often have lower premiums. PPO (Preferred Provider Organization) plans offer more flexibility, allowing you to see any healthcare provider you choose, both in and out of network, though out-of-network care typically costs more.

How do I apply for Medicaid in Georgia?

+You can apply for Medicaid in Georgia through the Georgia Gateway website, by phone through the Medicaid Customer Service Center, in person at a local Division of Family and Children Services (DFCS) office, or by mail by printing and mailing a paper application.

What are the metal tiers in the health insurance marketplace, and how do they differ?

+The health insurance marketplace offers plans categorized into metal tiers based on their actuarial value: Bronze, Silver, Gold, and Platinum. These tiers indicate the percentage of healthcare costs the plan covers, ranging from about 60% for Bronze plans to about 90% for Platinum plans, with Silver and Gold plans falling in between.