Intro

Explore health coverage plans options, including individual, family, and group insurance, to find affordable medical, dental, and vision coverage with flexible premium rates and deductibles.

The importance of having a comprehensive health coverage plan cannot be overstated. With the ever-rising costs of medical care, having a reliable health insurance plan can be the difference between financial stability and bankruptcy. In today's fast-paced world, it's crucial to have a health coverage plan that not only protects your physical well-being but also provides you with peace of mind. Whether you're an individual, a family, or a business owner, having the right health coverage plan can help you navigate the complexities of the healthcare system with confidence.

Health coverage plans come in various shapes and sizes, each designed to cater to specific needs and budgets. From individual plans to group plans, and from catastrophic plans to comprehensive plans, the options can be overwhelming. However, with the right guidance, you can make an informed decision that suits your unique circumstances. In this article, we'll delve into the world of health coverage plans, exploring the various options available, their benefits, and what you need to consider when choosing the right plan for yourself or your loved ones.

The healthcare landscape is constantly evolving, with new technologies, treatments, and innovations emerging every day. As a result, health coverage plans must also adapt to keep pace with these changes. With the rise of preventive care, telemedicine, and personalized medicine, health insurance plans are becoming more comprehensive and flexible. Whether you're looking for a plan that covers routine check-ups, chronic condition management, or emergency care, there's a health coverage plan out there that can meet your needs.

Types of Health Coverage Plans

When it comes to health coverage plans, there are several types to choose from. Here are some of the most common types of plans:

- Individual and Family Plans: These plans are designed for individuals and families who are not covered by an employer-sponsored plan. They can be purchased through the health insurance marketplace or directly from an insurer.

- Group Plans: These plans are offered by employers to their employees and are often more affordable than individual plans.

- Medicare and Medicaid Plans: These plans are government-sponsored and provide coverage to seniors, people with disabilities, and low-income individuals.

- Short-Term Plans: These plans provide temporary coverage for a limited period, usually up to 12 months.

- Catastrophic Plans: These plans have lower premiums but higher deductibles and are designed for young adults or those who cannot afford other types of coverage.

Benefits of Health Coverage Plans

Having a health coverage plan provides numerous benefits, including:

- Financial Protection: Health coverage plans protect you from unexpected medical expenses, which can be financially devastating.

- Access to Care: With a health coverage plan, you can access a network of healthcare providers, including primary care physicians, specialists, and hospitals.

- Preventive Care: Many health coverage plans cover preventive care services, such as routine check-ups, screenings, and vaccinations.

- Chronic Condition Management: Health coverage plans can help you manage chronic conditions, such as diabetes, heart disease, and asthma.

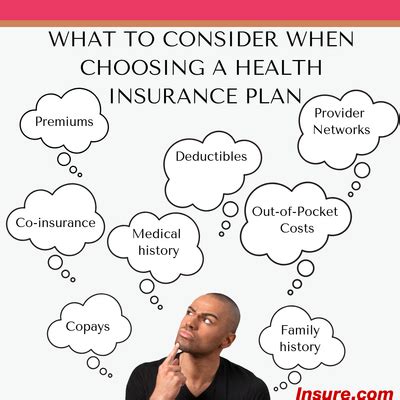

How to Choose the Right Health Coverage Plan

Choosing the right health coverage plan can be a daunting task, but here are some factors to consider:

- Network: Look for a plan with a network of healthcare providers that includes your primary care physician and any specialists you may need to see.

- Deductible: Consider a plan with a deductible that fits your budget.

- Co-payments and Co-insurance: Look for a plan with co-payments and co-insurance that are affordable.

- Maximum Out-of-Pocket: Choose a plan with a maximum out-of-pocket that protects you from high medical expenses.

- Pre-existing Conditions: If you have a pre-existing condition, look for a plan that covers it.

Steps to Enroll in a Health Coverage Plan

Enrolling in a health coverage plan can be a straightforward process, but here are the steps to follow:

- Research: Research different health coverage plans and compare their benefits, deductibles, and premiums.

- Eligibility: Check your eligibility for a health coverage plan, including any subsidies or tax credits you may be eligible for.

- Application: Complete an application for the health coverage plan you've chosen.

- Enrollment: Enroll in the plan and pay your premium.

- Confirmation: Receive confirmation of your enrollment and review your plan documents.

Common Mistakes to Avoid When Choosing a Health Coverage Plan

When choosing a health coverage plan, there are several common mistakes to avoid, including:

- Not researching: Failing to research different health coverage plans and comparing their benefits and premiums.

- Not reading the fine print: Not carefully reading the plan documents and understanding the terms and conditions.

- Not considering pre-existing conditions: Not considering pre-existing conditions and whether the plan covers them.

- Not checking the network: Not checking the network of healthcare providers and ensuring that your primary care physician and specialists are included.

Tips for Managing Your Health Coverage Plan

Managing your health coverage plan requires some effort, but here are some tips to help you get the most out of your plan:

- Keep your plan documents handy: Keep your plan documents, including your ID card and policy documents, in a safe and accessible place.

- Understand your benefits: Understand what benefits are covered under your plan, including preventive care services and chronic condition management.

- Stay in network: Stay in network by using healthcare providers who are part of your plan's network.

- Keep track of your expenses: Keep track of your expenses, including co-payments, co-insurance, and deductibles.

Conclusion and Next Steps

In conclusion, having a comprehensive health coverage plan is essential for protecting your physical and financial well-being. By understanding the different types of plans, their benefits, and what to consider when choosing a plan, you can make an informed decision that suits your unique circumstances. Remember to research, compare, and carefully read the fine print before enrolling in a plan. With the right health coverage plan, you can have peace of mind knowing that you're protected from unexpected medical expenses and can access the care you need to stay healthy.

We invite you to share your thoughts and experiences with health coverage plans in the comments section below. If you have any questions or need further guidance, please don't hesitate to reach out. Share this article with your friends and family to help them make informed decisions about their health coverage.

What is the difference between a deductible and a co-payment?

+A deductible is the amount you must pay out-of-pocket before your health coverage plan kicks in, while a co-payment is a fixed amount you pay for a specific service or treatment after meeting your deductible.

Can I change my health coverage plan after enrollment?

+Yes, you can change your health coverage plan during the annual open enrollment period or if you experience a qualifying life event, such as a change in employment or marriage.

What is the maximum out-of-pocket expense for a health coverage plan?

+The maximum out-of-pocket expense for a health coverage plan varies depending on the plan, but it is typically capped at a certain amount, such as $7,000 or $8,000 per year.