Intro

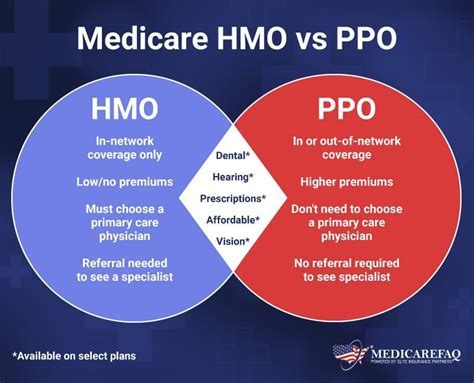

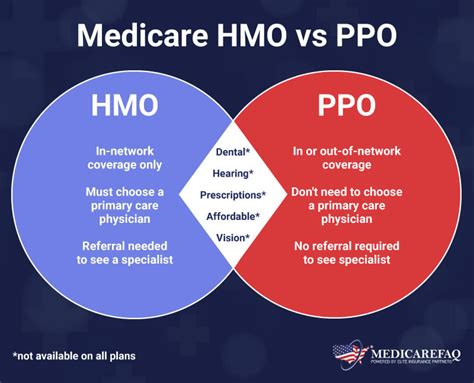

Compare HMO vs PPO health plans, understanding network coverage, out-of-pocket costs, and provider flexibility, to choose the best plan for your needs, considering factors like premiums, deductibles, and copays.

When it comes to choosing a health insurance plan, two of the most popular options are HMO (Health Maintenance Organization) and PPO (Preferred Provider Organization) plans. Both types of plans have their own set of benefits and drawbacks, and understanding the differences between them is crucial to making an informed decision. In this article, we will delve into the world of HMO and PPO health plans, exploring their characteristics, advantages, and disadvantages, to help you make the best choice for your healthcare needs.

The importance of selecting the right health insurance plan cannot be overstated. With the rising costs of medical care, having a comprehensive health insurance plan can provide financial protection and peace of mind. HMO and PPO plans are two of the most common types of health insurance plans offered by employers and insurance companies. While they share some similarities, they also have distinct differences that can impact the quality and cost of care you receive. By understanding the nuances of HMO and PPO plans, you can make an informed decision that meets your healthcare needs and budget.

The healthcare landscape is constantly evolving, with new technologies, treatments, and payment models emerging all the time. As a result, health insurance plans must also adapt to these changes. HMO and PPO plans have been around for decades, but they continue to be popular choices among consumers. In recent years, there has been a shift towards more consumer-directed health plans, such as high-deductible health plans (HDHPs) and health savings accounts (HSAs). However, HMO and PPO plans remain the most widely available and widely used types of health insurance plans.

HMO Health Plans

Benefits of HMO Plans

HMO plans offer several benefits, including: * Lower premiums: HMO plans tend to be less expensive than PPO plans, making them a more affordable option for individuals and families. * Comprehensive coverage: HMO plans typically cover a wide range of healthcare services, including preventive care, hospital stays, and prescription medications. * Emphasis on preventive care: HMO plans encourage patients to take an active role in their healthcare, with a focus on preventive care and early intervention. * Simplified billing: HMO plans often have simplified billing processes, with fewer out-of-pocket costs and less paperwork.Drawbacks of HMO Plans

While HMO plans have several benefits, they also have some drawbacks, including: * Limited provider network: HMO plans typically have a limited network of participating providers, which can limit your access to care. * Referral requirements: HMO plans often require a referral from your PCP to see a specialist, which can delay care. * Less flexibility: HMO plans tend to be less flexible than PPO plans, with fewer options for out-of-network care.PPO Health Plans

Benefits of PPO Plans

PPO plans offer several benefits, including: * Greater flexibility: PPO plans allow you to see any healthcare provider you choose, both in-network and out-of-network. * No referral requirements: PPO plans do not require a referral from a PCP to see a specialist. * Wider provider network: PPO plans typically have a larger network of participating providers, giving you more options for care.Drawbacks of PPO Plans

While PPO plans have several benefits, they also have some drawbacks, including: * Higher premiums: PPO plans tend to be more expensive than HMO plans, with higher premiums and out-of-pocket costs. * More complex billing: PPO plans often have more complex billing processes, with more paperwork and higher out-of-pocket costs.Key Differences Between HMO and PPO Plans

Choosing Between HMO and PPO Plans

Choosing between HMO and PPO plans depends on your individual healthcare needs and budget. If you prioritize affordability and are willing to work within a limited provider network, an HMO plan may be the best choice for you. However, if you value flexibility and are willing to pay more for the freedom to choose your healthcare providers, a PPO plan may be the better option.Cost Comparison Between HMO and PPO Plans

Network Providers and HMO Plans

Specialist Referrals and HMO Plans

HMO plans require a referral from a PCP to see a specialist. This can help ensure that patients receive the right care at the right time, but it can also create barriers to accessing specialist care. If you need to see a specialist, you will need to get a referral from your PCP, which can delay care.Out-of-Network Care and PPO Plans

Emergency Care and PPO Plans

PPO plans cover emergency care, regardless of whether you receive care from an in-network or out-of-network provider. This means that if you need emergency care, you can receive it without worrying about the costs or network restrictions.What is the main difference between HMO and PPO plans?

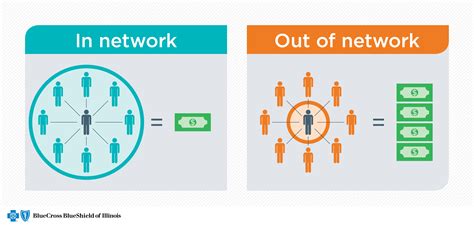

+The main difference between HMO and PPO plans is the level of flexibility and freedom to choose healthcare providers. HMO plans have a limited network of participating providers and require a referral from a PCP to see a specialist, while PPO plans have a larger network of providers and do not require a referral.

Which type of plan is more expensive, HMO or PPO?

+PPO plans tend to be more expensive than HMO plans, with higher premiums and out-of-pocket costs.

Do HMO plans cover out-of-network care?

+HMO plans typically do not cover out-of-network care, except in emergency situations. If you need to receive care from an out-of-network provider, you may face higher costs or limited access to care.

Can I see a specialist with an HMO plan without a referral?

+No, HMO plans typically require a referral from a PCP to see a specialist. If you need to see a specialist, you will need to get a referral from your PCP, which can delay care.

Do PPO plans cover emergency care?

+Yes, PPO plans cover emergency care, regardless of whether you receive care from an in-network or out-of-network provider.

In conclusion, choosing between HMO and PPO health plans depends on your individual healthcare needs and budget. By understanding the differences between these two types of plans, you can make an informed decision that meets your needs and provides the best possible care. We invite you to share your thoughts and experiences with HMO and PPO plans in the comments below. Have you had a positive or negative experience with one of these plans? Do you have any questions or concerns about choosing between HMO and PPO plans? Let us know, and we will do our best to provide you with the information and guidance you need to make the best choice for your healthcare needs.