Intro

Compare HMO or PPO health plans, understanding network coverage, premiums, and out-of-pocket costs, to choose the best insurance option for individual or family needs, considering flexibility, deductibles, and provider choices.

When it comes to choosing a health insurance plan, two of the most popular options are HMO (Health Maintenance Organization) and PPO (Preferred Provider Organization). Both types of plans have their own set of benefits and drawbacks, and understanding the differences between them is crucial to making an informed decision. In this article, we will delve into the details of HMO and PPO health plans, exploring their characteristics, advantages, and disadvantages.

The importance of selecting the right health insurance plan cannot be overstated. With the rising costs of healthcare, having a comprehensive insurance plan can help protect individuals and families from financial ruin in the event of a medical emergency. Moreover, a good health insurance plan can provide peace of mind, allowing individuals to focus on their well-being without worrying about the financial implications of medical treatment. As we navigate the complexities of the healthcare system, it is essential to understand the options available to us, including HMO and PPO health plans.

The healthcare landscape is constantly evolving, with new technologies, treatments, and innovations emerging all the time. As a result, health insurance plans must also adapt to meet the changing needs of patients. HMO and PPO plans have been around for decades, but they continue to play a vital role in the healthcare system. By understanding how these plans work, individuals can make informed decisions about their healthcare and choose the plan that best suits their needs.

What is an HMO Health Plan?

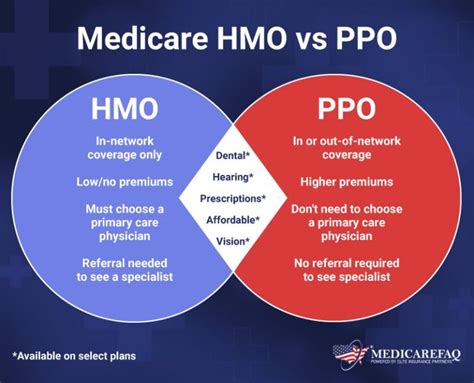

One of the main advantages of HMO plans is their emphasis on preventive care. HMO plans often cover routine check-ups, screenings, and health education programs, which can help prevent illnesses and detect health problems early on. Additionally, HMO plans may offer additional benefits, such as dental and vision coverage, which can be valuable for individuals and families.

Benefits of HMO Health Plans

Some of the benefits of HMO health plans include: * Lower premiums compared to other types of health insurance plans * Emphasis on preventive care, which can help prevent illnesses and detect health problems early on * Coordination of care through a primary care physician, which can help ensure that medical treatment is comprehensive and effective * Additional benefits, such as dental and vision coverage, which can be valuable for individuals and familiesDrawbacks of HMO Health Plans

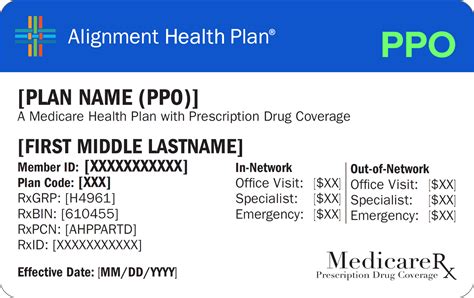

However, HMO plans also have some drawbacks, including: * Limited network of healthcare providers, which can make it difficult to see a specialist or receive care outside of the network * Requirement to choose a primary care physician, which can be restrictive for individuals who prefer to see a specific doctor * More restrictive rules and regulations, which can make it difficult to receive coverage for certain medical servicesWhat is a PPO Health Plan?

One of the main advantages of PPO plans is their flexibility. PPO plans allow individuals to see any healthcare provider they choose, both within and outside of the network. This can be particularly beneficial for individuals who have a preferred doctor or specialist, or who need to see a doctor outside of their network.

Benefits of PPO Health Plans

Some of the benefits of PPO health plans include: * Flexibility to see any healthcare provider, both within and outside of the network * Larger network of healthcare providers compared to HMO plans * No requirement to choose a primary care physician, which can be beneficial for individuals who prefer to see a specific doctor * More comprehensive coverage for medical services, including specialist care and hospital staysDrawbacks of PPO Health Plans

However, PPO plans also have some drawbacks, including: * Higher premiums compared to HMO plans, which can be a significant burden for individuals and families * Higher out-of-pocket costs, including copays and deductibles, which can be a challenge for individuals with limited financial resources * More complex rules and regulations, which can make it difficult to navigate the healthcare systemKey Differences Between HMO and PPO Health Plans

Choosing Between HMO and PPO Health Plans

Ultimately, the choice between an HMO and PPO health plan will depend on individual circumstances and preferences. Here are some factors to consider: * Budget: If cost is a significant concern, an HMO plan may be a more affordable option. * Flexibility: If flexibility is important, a PPO plan may be a better choice. * Healthcare needs: If individuals have specific healthcare needs, such as specialist care or hospital stays, a PPO plan may be more comprehensive. * Personal preferences: If individuals have a preferred doctor or specialist, a PPO plan may be a better choice.Conclusion and Next Steps

If you are considering purchasing a health insurance plan, we encourage you to do your research and compare different options. Consider factors such as cost, flexibility, and healthcare needs, and don't be afraid to ask questions. By taking the time to understand your options and make an informed decision, you can ensure that you have the coverage you need to protect your health and well-being.

What is the main difference between HMO and PPO health plans?

+The main difference between HMO and PPO health plans is the network of healthcare providers. HMO plans have a smaller network of healthcare providers compared to PPO plans, which can make it more difficult to see a specialist or receive care outside of the network.

Which type of health plan is more affordable?

+HMO plans are often more affordable compared to PPO plans, with lower premiums and out-of-pocket costs. However, PPO plans may offer more comprehensive coverage and flexibility, which can be valuable for individuals with specific healthcare needs.

Can I see any doctor I want with a PPO plan?

+Yes, with a PPO plan, you can see any doctor you want, both within and outside of the network. However, you may pay more out-of-pocket for care received outside of the network.