Intro

Navigate Medicare Open Enrollment with ease. Our comprehensive guide covers eligibility, plans, and benefits, including Advantage, Supplement, and Part D, to help you make informed decisions and choose the best coverage for your needs.

The Medicare Open Enrollment period is a crucial time for beneficiaries to review and adjust their coverage to ensure they have the best possible plan for their healthcare needs. With so many options available, it can be overwhelming to navigate the complex world of Medicare. In this article, we will delve into the ins and outs of Medicare Open Enrollment, providing you with a comprehensive guide to help you make informed decisions about your coverage.

As the Medicare Open Enrollment period approaches, it's essential to understand the significance of this time frame. During this period, beneficiaries can make changes to their existing coverage, switch to a new plan, or enroll in a Medicare Advantage plan. This is also an opportunity to review and adjust your prescription drug coverage, ensuring you have the necessary medications at an affordable cost. With the ever-changing landscape of healthcare, it's crucial to stay informed and take advantage of the Open Enrollment period to ensure you're getting the most out of your Medicare coverage.

The Medicare Open Enrollment period typically runs from October 15th to December 7th, with coverage changes taking effect on January 1st of the following year. During this time, beneficiaries can make changes to their coverage, including switching from Original Medicare to a Medicare Advantage plan or vice versa. It's essential to review your current coverage and explore available options to ensure you're making the most of your Medicare benefits. Whether you're new to Medicare or a seasoned beneficiary, understanding the Open Enrollment process is vital to securing the right coverage for your healthcare needs.

Understanding Medicare Open Enrollment

To make the most of the Medicare Open Enrollment period, it's essential to understand the different types of coverage available. Original Medicare, which includes Part A and Part B, provides comprehensive coverage for hospital stays, doctor visits, and other medical services. Medicare Advantage plans, on the other hand, offer an alternative to Original Medicare, often providing additional benefits such as dental, vision, and hearing coverage. Understanding the differences between these plans is crucial to making informed decisions about your coverage.

Types of Medicare Coverage

Medicare coverage can be broadly categorized into two main types: Original Medicare and Medicare Advantage. Original Medicare is the traditional fee-for-service program, which includes Part A (hospital insurance) and Part B (medical insurance). Medicare Advantage plans, also known as Part C, offer an alternative to Original Medicare, often providing additional benefits and services. It's essential to review and compare the different types of coverage to determine which plan best suits your healthcare needs.Preparing for Medicare Open Enrollment

As the Medicare Open Enrollment period approaches, it's essential to prepare by reviewing your current coverage and exploring available options. Here are some steps to help you prepare:

- Review your current coverage: Take a close look at your current Medicare plan, including your premium, deductible, and copayment.

- Research available options: Explore the different types of Medicare coverage, including Original Medicare and Medicare Advantage plans.

- Compare plans: Use online tools or consult with a licensed insurance agent to compare plans and determine which one best suits your healthcare needs.

- Check your prescription drug coverage: Review your prescription drug coverage to ensure you have the necessary medications at an affordable cost.

Medicare Open Enrollment Checklist

To ensure you're fully prepared for the Medicare Open Enrollment period, use the following checklist: * Review your current coverage * Research available options * Compare plans * Check your prescription drug coverage * Consult with a licensed insurance agent (if necessary) * Make changes to your coverage (if necessary)Medicare Advantage Plans

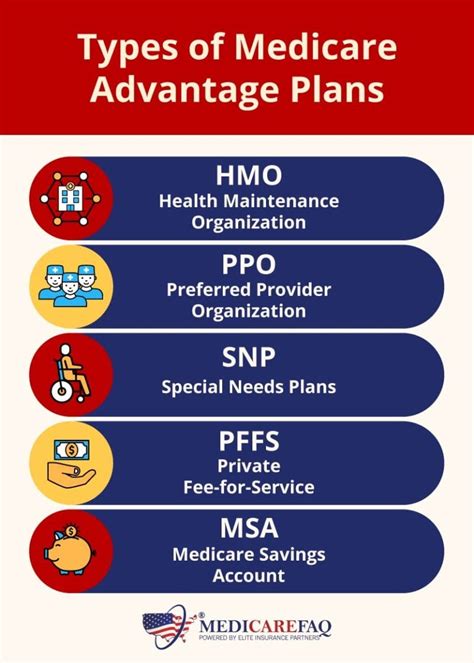

Medicare Advantage plans offer an alternative to Original Medicare, often providing additional benefits and services. These plans are offered by private insurance companies approved by Medicare and may include benefits such as dental, vision, and hearing coverage. When considering a Medicare Advantage plan, it's essential to review the plan's network, coverage, and costs to ensure it meets your healthcare needs.

Benefits of Medicare Advantage Plans

Medicare Advantage plans offer several benefits, including: * Additional benefits: Many Medicare Advantage plans offer additional benefits, such as dental, vision, and hearing coverage. * Lower out-of-pocket costs: Medicare Advantage plans often have lower out-of-pocket costs compared to Original Medicare. * Predictable costs: Medicare Advantage plans typically have predictable costs, making it easier to budget for healthcare expenses.Prescription Drug Coverage

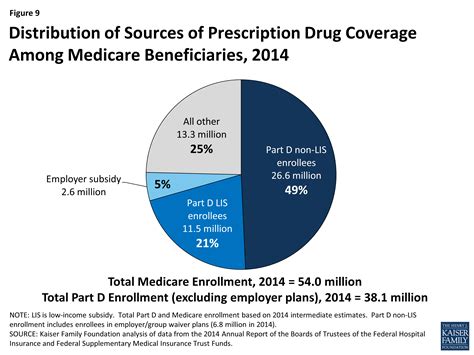

Prescription drug coverage is a critical component of Medicare, ensuring you have access to necessary medications at an affordable cost. During the Open Enrollment period, you can review and adjust your prescription drug coverage to ensure you're getting the best possible coverage. Here are some tips to help you navigate prescription drug coverage:

- Review your current coverage: Take a close look at your current prescription drug coverage, including your premium, deductible, and copayment.

- Research available options: Explore the different prescription drug plans available, including standalone Part D plans and Medicare Advantage plans with prescription drug coverage.

- Compare plans: Use online tools or consult with a licensed insurance agent to compare plans and determine which one best suits your needs.

Prescription Drug Coverage Tips

Here are some additional tips to help you navigate prescription drug coverage: * Check the plan's formulary: Review the plan's formulary to ensure it includes your necessary medications. * Look for plans with low copayments: Choose plans with low copayments to minimize your out-of-pocket costs. * Consider a plan with a $0 deductible: Plans with a $0 deductible can help minimize your upfront costs.Medicare Open Enrollment FAQs

Here are some frequently asked questions about Medicare Open Enrollment:

- What is the Medicare Open Enrollment period?

- Can I change my Medicare coverage during the Open Enrollment period?

- How do I review and compare Medicare plans?

What is the Medicare Open Enrollment period?

+The Medicare Open Enrollment period is the time frame during which Medicare beneficiaries can make changes to their coverage, including switching to a new plan or enrolling in a Medicare Advantage plan.

Can I change my Medicare coverage during the Open Enrollment period?

+Yes, during the Open Enrollment period, you can make changes to your Medicare coverage, including switching from Original Medicare to a Medicare Advantage plan or vice versa.

How do I review and compare Medicare plans?

+You can review and compare Medicare plans using online tools or by consulting with a licensed insurance agent.

In conclusion, the Medicare Open Enrollment period is a critical time for beneficiaries to review and adjust their coverage to ensure they have the best possible plan for their healthcare needs. By understanding the different types of coverage available, preparing for the Open Enrollment period, and reviewing your prescription drug coverage, you can make informed decisions about your Medicare benefits. Remember to take advantage of the Open Enrollment period to review and adjust your coverage, and don't hesitate to consult with a licensed insurance agent if you need guidance. Share this article with friends and family to help them navigate the complex world of Medicare, and leave a comment below with any questions or concerns you may have.