Intro

Discover 5 key facts about FSA, including flexible spending accounts, health savings, and dependent care benefits, to maximize your tax-advantaged savings and optimize your financial wellness strategy.

The importance of understanding the Flexible Spending Account (FSA) cannot be overstated, as it provides individuals with a tax-advantaged way to save for healthcare and childcare expenses. With the ever-increasing costs of medical care and childcare, it's essential for individuals to explore all available options to manage their expenses effectively. The FSA is a valuable tool that can help alleviate some of the financial burdens associated with these expenses. In this article, we will delve into the world of FSAs, exploring their benefits, working mechanisms, and key information that individuals need to know.

As we navigate the complexities of healthcare and childcare expenses, it's crucial to have a comprehensive understanding of the FSA and its role in managing these costs. By providing a tax-advantaged way to save, FSAs can help individuals reduce their out-of-pocket expenses and make the most of their hard-earned money. Whether you're a working professional or a family with dependents, understanding the FSA can help you make informed decisions about your finances and ensure that you're taking advantage of all available benefits.

The world of FSAs can be complex, with various rules and regulations governing their use. However, by breaking down the key components of an FSA and exploring their benefits, individuals can gain a deeper understanding of how these accounts work and how they can be used to manage healthcare and childcare expenses effectively. From the basics of FSA eligibility to the nuances of account management, we will cover it all in this article, providing readers with a comprehensive guide to the world of FSAs.

Introduction to FSA

Benefits of FSA

The benefits of an FSA are numerous, and they can have a significant impact on an individual's financial well-being. Some of the key benefits of an FSA include: * Tax-advantaged savings: Contributions to an FSA are made with pre-tax dollars, which can reduce an individual's taxable income. * Reduced out-of-pocket expenses: By setting aside money in an FSA, individuals can reduce their out-of-pocket expenses for healthcare and childcare. * Increased savings: FSAs can help individuals save money over time by reducing their tax liability and providing a dedicated source of funds for specific expenses.How FSA Works

Types of FSA

There are several types of FSAs, each with its own unique characteristics and benefits. Some of the most common types of FSAs include: * Healthcare FSA: This type of FSA is used to pay for healthcare expenses, such as medical bills, prescriptions, and copays. * Childcare FSA: This type of FSA is used to pay for childcare expenses, such as daycare, after-school programs, and summer camps. * Limited-purpose FSA: This type of FSA is used to pay for dental and vision expenses, and it's often used in conjunction with a health savings account (HSA).FSA Eligibility

FSA Contribution Limits

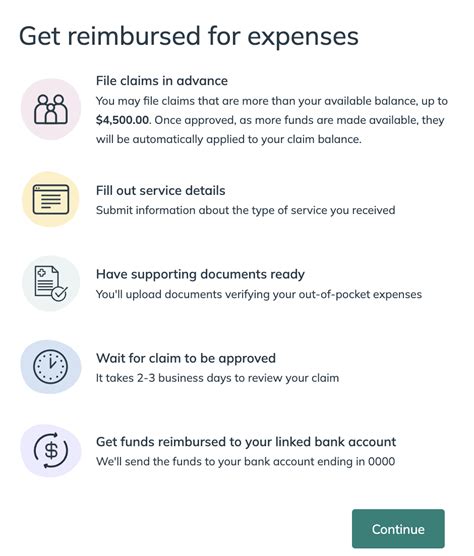

The contribution limits for FSAs can vary depending on the type of FSA and the employer. For the 2022 plan year, the contribution limits for healthcare FSAs are $2,850, and the contribution limits for childcare FSAs are $5,000. It's essential to note that these limits can change over time, so individuals should check with their employer or plan administrator for the most up-to-date information.FSA Claim Submission

FSA Account Management

Managing an FSA account requires some planning and attention to detail. Here are some tips for managing an FSA account: * Track contributions: Individuals track their contributions to ensure they're not exceeding the contribution limits. * Monitor account balance: Individuals monitor their account balance to ensure they have enough funds to cover expenses. * Submit claims promptly: Individuals submit claims promptly to avoid missing deadlines and to ensure timely reimbursement.FSA FAQs

FSA Resources

There are many resources available to help individuals navigate the world of FSAs. Some of the most useful resources include: * Employer: Individuals can contact their employer or plan administrator for information about their FSA. * Plan documents: Individuals can review plan documents, such as the summary plan description (SPD), for information about their FSA. * Online resources: Individuals can use online resources, such as websites and mobile apps, to manage their FSA account and submit claims.Conclusion and Next Steps

What is the main purpose of an FSA?

+The main purpose of an FSA is to provide individuals with a tax-advantaged way to save for healthcare and childcare expenses.

How do I enroll in an FSA?

+Individuals can enroll in an FSA through their employer, typically during open enrollment or when they first become eligible.

Can I use my FSA to pay for expenses incurred by my dependents?

+Yes, individuals can use their FSA to pay for expenses incurred by their dependents, such as childcare expenses or medical bills.