Intro

Unlock expert 5 HSA insurance tips, maximizing health savings accounts, and optimizing medical expense management with flexible spending, deductible planning, and tax-advantaged strategies.

Health Savings Accounts (HSAs) have become increasingly popular as a way to save for medical expenses while also providing tax benefits. With the rising costs of healthcare, it's essential to understand how to maximize the use of an HSA. In this article, we will delve into the world of HSA insurance, exploring its benefits, how it works, and providing valuable tips to help you make the most of your account.

The importance of having a safety net for medical expenses cannot be overstated. Unexpected medical bills can be a significant financial burden, and having an HSA can provide peace of mind. Moreover, HSAs offer a triple tax benefit: contributions are tax-deductible, the funds grow tax-free, and withdrawals for qualified medical expenses are tax-free. This makes HSAs an attractive option for those looking to save for healthcare costs while also reducing their tax liability.

As the healthcare landscape continues to evolve, it's crucial to stay informed about the latest developments and how they may impact your HSA. From changes in contribution limits to new eligible expenses, understanding the intricacies of HSA insurance can help you make informed decisions about your healthcare and financial planning. Whether you're considering opening an HSA or already have one, this article will provide you with the knowledge and insights needed to navigate the world of HSA insurance with confidence.

HSA Insurance Basics

Key Components of HSA Insurance

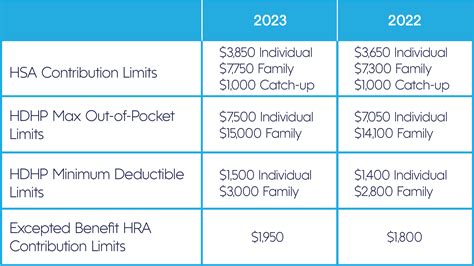

To get the most out of your HSA, it's crucial to understand the key components of HSA insurance. These include: * Contribution limits: The amount you can contribute to your HSA each year * Eligible expenses: The types of medical expenses that can be paid for with HSA funds * Investment options: The ways in which you can invest your HSA funds to grow your account over time * Fees and charges: The costs associated with maintaining and using your HSAHSA Contribution Limits

Catch-Up Contributions

If you're 55 or older, you may be eligible to make catch-up contributions to your HSA. These contributions allow you to set aside an additional $1,000 per year, which can help you build your HSA balance more quickly. Catch-up contributions can be made in addition to the regular annual contribution limit, providing a powerful way to boost your HSA savings.HSA Investment Options

Investment Strategies for HSAs

When it comes to investing your HSA funds, there are several strategies to consider. These include: * Conservative investing: Investing in low-risk assets, such as bonds or money market funds * Moderate investing: Investing in a mix of stocks and bonds to balance risk and potential returns * Aggressive investing: Investing in higher-risk assets, such as stocks or real estate investment trusts (REITs)HSA Fees and Charges

Minimizing HSA Fees

To minimize the fees associated with your HSA, it's essential to carefully review the fee schedule for your account. You may also want to consider shopping around for an HSA provider that offers low or no fees. Additionally, you can minimize fees by: * Keeping a high balance in your HSA to avoid maintenance fees * Investing in low-cost index funds or ETFs * Avoiding frequent withdrawals or transfersHSA Eligible Expenses

Tracking HSA Expenses

To ensure that you're getting the most out of your HSA, it's essential to carefully track your eligible expenses. You can do this by: * Keeping receipts and records of your medical expenses * Using an HSA debit card or checks to pay for eligible expenses * Reviewing your HSA statements regularly to ensure that your expenses are being reimbursed correctlyHSA Insurance Tips

HSA and Retirement

Using HSA Funds in Retirement

When using your HSA funds in retirement, it's essential to consider the following: * Medicare premiums: You can use your HSA funds to pay for Medicare premiums, including Part B and Part D premiums * Long-term care expenses: You can use your HSA funds to pay for long-term care expenses, such as nursing home care or home health care * Medical expenses: You can use your HSA funds to pay for a wide range of medical expenses, including copays, deductibles, and coinsuranceHSA and Taxes

Understanding HSA Tax Benefits

To get the most out of your HSA, it's essential to understand the tax benefits associated with these accounts. This includes: * Tax-deductible contributions: Contributions to your HSA are tax-deductible, reducing your taxable income * Tax-free growth: The funds in your HSA grow tax-free, allowing you to build your balance over time * Tax-free withdrawals: Withdrawals for qualified medical expenses are tax-free, providing a powerful way to save for healthcare costsWhat is an HSA, and how does it work?

+An HSA is a type of savings account that allows you to set aside pre-tax dollars for medical expenses. To be eligible for an HSA, you must have a high-deductible health plan (HDHP). The funds in your HSA can be used to pay for a wide range of medical expenses, including doctor visits, prescriptions, and surgical procedures.

What are the benefits of an HSA?

+The benefits of an HSA include tax-deductible contributions, tax-free growth, and tax-free withdrawals for qualified medical expenses. HSAs also provide a way to build a safety net for future medical expenses, and the funds roll over from year to year.

Can I use my HSA funds for non-medical expenses?

+Yes, you can use your HSA funds for non-medical expenses, but you will be subject to income tax and a 20% penalty on the withdrawal amount. It's essential to carefully consider the potential tax implications before using your HSA funds for non-medical expenses.

How do I contribute to my HSA?

+You can contribute to your HSA through payroll deductions or by making direct contributions to your account. The annual contribution limits for HSAs are set by the IRS and are adjusted each year for inflation.

Can I invest my HSA funds?

+Yes, you can invest your HSA funds in a range of assets, including stocks, bonds, and mutual funds. It's essential to carefully consider your investment options and to consult with a financial advisor if necessary.

In summary, HSAs offer a powerful way to save for healthcare costs while also providing tax benefits. By understanding the basics of HSA insurance, including contribution limits, eligible expenses, and investment options, you can make informed decisions about your healthcare and financial planning. Whether you're considering opening an HSA or already have one, we hope this article has provided you with the knowledge and insights needed to navigate the world of HSA insurance with confidence. We invite you to share your thoughts and experiences with HSAs in the comments below, and to consider sharing this article with others who may benefit from this valuable information.