Intro

Compare PPO vs HMO health plans, understanding network differences, out-of-pocket costs, and flexibility, to choose the best healthcare coverage for your needs.

When it comes to choosing a health insurance plan, two of the most popular options are Preferred Provider Organization (PPO) and Health Maintenance Organization (HMO) plans. Both types of plans have their own unique benefits and drawbacks, and understanding the differences between them is crucial in making an informed decision. In this article, we will delve into the world of PPO and HMO health plans, exploring their characteristics, advantages, and disadvantages.

The importance of selecting the right health insurance plan cannot be overstated. With the rising costs of medical care, having a comprehensive health insurance plan can provide financial protection and peace of mind. PPO and HMO plans are two of the most common types of health insurance plans offered by employers and insurance companies. While they share some similarities, they also have distinct differences that can impact the quality and affordability of care.

As the healthcare landscape continues to evolve, it's essential to stay informed about the latest developments and trends in health insurance. The Affordable Care Act (ACA) has introduced new regulations and requirements for health insurance plans, and understanding how PPO and HMO plans comply with these regulations is vital. Whether you're an individual, family, or employer, choosing the right health insurance plan can have a significant impact on your health and well-being.

PPO Health Plans

One of the primary benefits of PPO plans is the freedom to choose any healthcare provider. This can be particularly beneficial for individuals who have existing relationships with healthcare providers or who require specialized care. PPO plans also often have a wider network of providers, making it easier to find a doctor or hospital that participates in the plan.

How PPO Plans Work

PPO plans typically require members to pay a deductible, which is the amount they must pay out-of-pocket before the plan begins to pay. After meeting the deductible, members usually pay a copayment or coinsurance for healthcare services. Copayments are fixed amounts paid for specific services, such as doctor visits or prescriptions, while coinsurance is a percentage of the total cost of care.HMO Health Plans

One of the primary benefits of HMO plans is the potential for lower costs. HMO plans often have lower premiums than PPO plans, making them a more affordable option for individuals and families. HMO plans also typically have lower out-of-pocket costs, as members are required to pay copayments or coinsurance for healthcare services.

How HMO Plans Work

HMO plans usually require members to pay a copayment for healthcare services, such as doctor visits or prescriptions. Members may also be required to pay a coinsurance for certain services, such as hospital stays or surgical procedures. HMO plans often have a narrower network of providers than PPO plans, which can limit members' choices for healthcare services.Key Differences Between PPO and HMO Plans

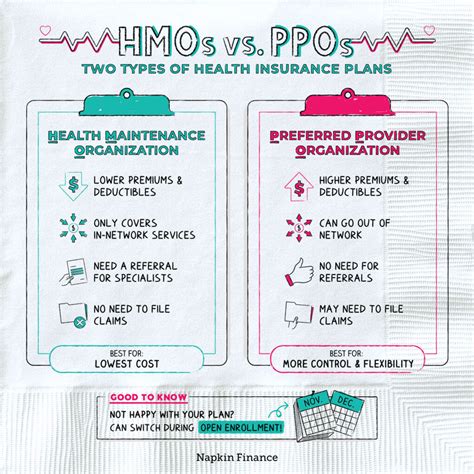

- Network: PPO plans have a larger network of providers, while HMO plans have a smaller network.

- Cost: HMO plans often have lower premiums and out-of-pocket costs, while PPO plans may have higher costs.

- Flexibility: PPO plans offer more flexibility, allowing members to see any healthcare provider they choose, while HMO plans require members to receive care from a specific network of providers.

- Referrals: HMO plans often require members to obtain a referral from their PCP to see a specialist, while PPO plans do not require referrals.

Benefits of PPO Plans

Here are some of the benefits of PPO plans: * **Flexibility**: PPO plans offer more flexibility, allowing members to see any healthcare provider they choose. * **Wider network**: PPO plans have a wider network of providers, making it easier to find a doctor or hospital that participates in the plan. * **No referrals**: PPO plans do not require members to obtain a referral from their PCP to see a specialist.Benefits of HMO Plans

Here are some of the benefits of HMO plans: * **Lower costs**: HMO plans often have lower premiums and out-of-pocket costs. * **Predictable costs**: HMO plans often have predictable costs, making it easier for members to budget for healthcare expenses. * **Preventive care**: HMO plans often emphasize preventive care, such as routine check-ups and screenings.Choosing the Right Plan

- Assess your needs: Consider your healthcare needs and preferences. If you have existing relationships with healthcare providers or require specialized care, a PPO plan may be a better option.

- Compare costs: Compare the costs of PPO and HMO plans, including premiums, deductibles, copayments, and coinsurance.

- Evaluate the network: Evaluate the network of providers for each plan, considering factors such as the number of providers, their locations, and their specialties.

- Consider referrals: Consider whether you need a referral to see a specialist. If you do, an HMO plan may be a better option.

Common Mistakes to Avoid

Here are some common mistakes to avoid when choosing between PPO and HMO health plans: * **Not considering your needs**: Failing to consider your healthcare needs and preferences can lead to choosing a plan that is not a good fit. * **Not comparing costs**: Failing to compare the costs of PPO and HMO plans can lead to choosing a plan that is not affordable. * **Not evaluating the network**: Failing to evaluate the network of providers for each plan can lead to choosing a plan with a limited network.Conclusion and Next Steps

We hope this article has provided you with valuable information and insights to help you choose the right health insurance plan. If you have any questions or comments, please don't hesitate to share them with us. We invite you to comment below, share this article with your friends and family, or take specific actions to learn more about PPO and HMO health plans.

What is the main difference between PPO and HMO plans?

+The main difference between PPO and HMO plans is the flexibility to choose healthcare providers. PPO plans allow members to see any healthcare provider they choose, while HMO plans require members to receive care from a specific network of providers.

Which type of plan is more affordable?

+HMO plans are often more affordable than PPO plans, with lower premiums and out-of-pocket costs. However, the affordability of a plan depends on individual circumstances and healthcare needs.

Do PPO plans require referrals to see a specialist?

+No, PPO plans do not require referrals to see a specialist. Members can see any healthcare provider they choose, including specialists, without a referral.

What is the role of a primary care physician (PCP) in an HMO plan?

+In an HMO plan, a primary care physician (PCP) acts as a gatekeeper, referring members to specialists and other healthcare providers within the network.

Can I change my health insurance plan if I'm not satisfied with my current plan?

+Yes, you can change your health insurance plan if you're not satisfied with your current plan. However, the process and timing of changing plans depend on individual circumstances and the specific plan you have.