Intro

Discover affordable family medical insurance plans, including low-cost options, group health insurance, and individual coverage, to ensure your loved ones well-being without breaking the bank, with benefits like preventive care and flexible deductibles.

The cost of healthcare in the United States continues to rise, making it challenging for families to afford medical insurance. However, having a comprehensive family medical insurance plan is crucial to ensure that your loved ones receive the necessary medical care without breaking the bank. With so many options available, it can be overwhelming to choose the right plan that fits your family's needs and budget. In this article, we will delve into the world of affordable family medical insurance plans, exploring the benefits, types, and steps to find the perfect plan for your family.

Finding the right family medical insurance plan can be a daunting task, especially with the numerous options available in the market. It's essential to consider several factors, including the type of coverage, deductible, copayment, and network of healthcare providers. A comprehensive plan should cover essential health benefits, such as doctor visits, hospital stays, prescription medications, and preventive care. Additionally, it's crucial to evaluate the plan's out-of-pocket costs, including deductibles, copayments, and coinsurance, to ensure that they align with your family's budget.

The importance of having a family medical insurance plan cannot be overstated. Not only does it provide financial protection against unexpected medical expenses, but it also ensures that your family receives timely and necessary medical care. Without insurance, families may be forced to delay or forgo medical treatment, which can lead to more severe health problems and increased healthcare costs in the long run. Moreover, having a family medical insurance plan can provide peace of mind, knowing that your loved ones are protected and cared for.

Affordable Family Medical Insurance Plans: An Overview

When it comes to affordable family medical insurance plans, there are several options to consider. The Affordable Care Act (ACA), also known as Obamacare, has made it possible for families to access affordable health insurance plans. The ACA has expanded Medicaid eligibility, allowing more low-income families to access health insurance. Additionally, the ACA has created health insurance marketplaces, where families can compare and purchase plans from various insurance providers.

Types of Family Medical Insurance Plans

There are several types of family medical insurance plans available, including: * Health Maintenance Organization (HMO) plans: These plans require families to receive medical care from a specific network of healthcare providers. * Preferred Provider Organization (PPO) plans: These plans offer more flexibility, allowing families to receive medical care from both in-network and out-of-network providers. * Exclusive Provider Organization (EPO) plans: These plans combine elements of HMO and PPO plans, offering a network of healthcare providers and some out-of-network coverage. * Point of Service (POS) plans: These plans allow families to choose between HMO and PPO plans, depending on their medical needs.Benefits of Family Medical Insurance Plans

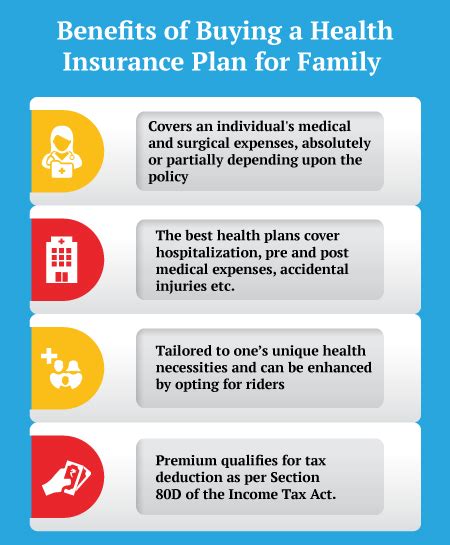

The benefits of family medical insurance plans are numerous. Some of the most significant advantages include:

- Financial protection: Family medical insurance plans provide financial protection against unexpected medical expenses, ensuring that families can afford necessary medical care.

- Access to preventive care: Many family medical insurance plans cover preventive care services, such as routine check-ups, vaccinations, and screenings, which can help prevent health problems and detect them early.

- Network of healthcare providers: Family medical insurance plans often have a network of healthcare providers, including primary care physicians, specialists, and hospitals, which can provide families with access to quality medical care.

- Prescription medication coverage: Many family medical insurance plans cover prescription medications, which can help families afford necessary medications and manage chronic health conditions.

How to Choose the Right Family Medical Insurance Plan

Choosing the right family medical insurance plan can be a daunting task, but there are several steps you can take to make the process easier. Some tips include: * Evaluate your family's medical needs: Consider your family's medical history, current health status, and anticipated medical needs to determine the type of coverage you require. * Compare plans: Research and compare different family medical insurance plans, evaluating factors such as coverage, deductibles, copayments, and network of healthcare providers. * Check the plan's network: Ensure that the plan's network of healthcare providers includes your family's preferred doctors and hospitals. * Read reviews and ask for referrals: Research the insurance provider's reputation and ask for referrals from friends, family, or healthcare providers to get a sense of their customer service and claims process.Steps to Find Affordable Family Medical Insurance Plans

Finding affordable family medical insurance plans requires some research and planning. Some steps to follow include:

- Determine your budget: Evaluate your family's income and expenses to determine how much you can afford to spend on health insurance.

- Explore options: Research and explore different family medical insurance plans, including those offered through the ACA marketplace, employer-sponsored plans, and private insurance providers.

- Evaluate subsidies: If you're eligible, apply for subsidies or tax credits to help reduce the cost of your family medical insurance plan.

- Consider short-term plans: If you're between jobs or waiting for other coverage to start, consider short-term health insurance plans, which can provide temporary coverage.

- Seek professional advice: Consult with a licensed insurance agent or broker to get personalized advice and guidance on choosing the right family medical insurance plan.

Affordable Family Medical Insurance Plans: FAQs

Some frequently asked questions about affordable family medical insurance plans include: * What is the difference between an HMO and PPO plan? * How do I apply for subsidies or tax credits? * Can I purchase a family medical insurance plan if I have a pre-existing condition? * How do I choose the right deductible and copayment for my family's needs?What is the difference between an HMO and PPO plan?

+An HMO plan requires families to receive medical care from a specific network of healthcare providers, while a PPO plan offers more flexibility, allowing families to receive medical care from both in-network and out-of-network providers.

How do I apply for subsidies or tax credits?

+To apply for subsidies or tax credits, you can visit the ACA marketplace website or consult with a licensed insurance agent or broker.

Can I purchase a family medical insurance plan if I have a pre-existing condition?

+Yes, the ACA prohibits insurance providers from denying coverage to individuals with pre-existing conditions, ensuring that families with pre-existing conditions can access affordable health insurance plans.

Conclusion and Next Steps

In conclusion, finding an affordable family medical insurance plan requires careful consideration of your family's medical needs, budget, and options. By evaluating different types of plans, comparing coverage and costs, and seeking professional advice, you can find a plan that meets your family's needs and provides financial protection against unexpected medical expenses. Remember to review and update your plan regularly to ensure that it continues to meet your family's evolving medical needs.

We invite you to share your thoughts and experiences with family medical insurance plans in the comments section below. If you found this article informative and helpful, please share it with your friends and family who may be searching for affordable health insurance options. Additionally, if you have any questions or need further guidance on choosing the right family medical insurance plan, don't hesitate to reach out to a licensed insurance agent or broker for personalized advice.