Intro

Simplify bill payments with our easy bill pay service, featuring online payment processing, automatic bill pay, and payment reminders for hassle-free transactions and financial management.

Paying bills on time is essential to avoid late fees, penalties, and negative impacts on credit scores. However, managing multiple bills with different due dates can be overwhelming and stressful. This is where bill pay services come in, offering a convenient and efficient way to pay bills online or through mobile devices. With the advancement of technology, bill pay services have become increasingly popular, and it's easy to see why. In this article, we'll delve into the world of bill pay services, exploring their benefits, working mechanisms, and key features.

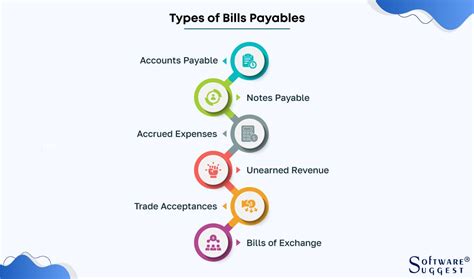

The importance of paying bills on time cannot be overstated. Late payments can lead to a range of negative consequences, including late fees, penalties, and damage to credit scores. Moreover, managing multiple bills with different due dates can be a logistical nightmare, requiring a high degree of organization and time management. Bill pay services simplify this process, allowing users to pay bills with ease and convenience. Whether you're paying rent, utilities, credit card bills, or loan payments, bill pay services provide a streamlined and efficient way to manage your financial obligations.

In recent years, the demand for bill pay services has increased significantly, driven by the growing need for convenience, flexibility, and security. With the rise of online and mobile banking, consumers expect to be able to manage their finances on the go, and bill pay services have responded by providing user-friendly platforms and mobile apps. Whether you're a busy professional, a student, or a retiree, bill pay services offer a range of benefits that can simplify your financial life and reduce stress. In the following sections, we'll explore the benefits, working mechanisms, and key features of bill pay services in more detail.

Benefits of Bill Pay Services

Convenience and Flexibility

Bill pay services offer unparalleled convenience and flexibility, allowing users to pay bills at their convenience. Whether you're paying bills from home, the office, or on the go, bill pay services provide a seamless and efficient experience. With mobile apps and online platforms, users can access their accounts, view bills, and make payments with just a few clicks. This convenience is particularly useful for individuals with busy schedules or those who travel frequently.Security and Reliability

Bill pay services also prioritize security and reliability, using advanced encryption and security protocols to protect user data and transactions. This ensures that sensitive information, such as bank account numbers and payment details, remains confidential and secure. Additionally, bill pay services often provide features such as two-factor authentication, password protection, and transaction monitoring, further enhancing security and reducing the risk of fraud.Working Mechanisms of Bill Pay Services

Setup and Configuration

To set up a bill pay service, users typically need to follow these steps: * Create an account with the bill pay service * Provide account information, including bank account number and payment details * Add billers, such as utility companies or credit card issuers * Set up payment schedules and reminders * Verify account information and payment detailsPayment Processing

Once a user has set up a bill pay service, they can initiate payments by logging into their account, selecting the biller, and entering the payment amount. The bill pay service then processes the payment, either by transferring funds electronically or by mailing a check. Payments are typically processed within 1-3 business days, depending on the biller and the payment method.Key Features of Bill Pay Services

Automatic Payment Scheduling

Automatic payment scheduling allows users to set up recurring payments, ensuring that bills are paid on time, every time. This feature is particularly useful for individuals with regular bills, such as rent, utilities, or loan payments.Payment Reminders

Payment reminders notify users when a payment is due, helping to avoid late payments and associated fees. Reminders can be sent via email, text message, or push notification, depending on the bill pay service.Types of Bill Pay Services

Online Bill Pay Services

Online bill pay services allow users to pay bills through a website or online platform. This type of service is often provided by banks, credit unions, or other financial institutions.Mobile Bill Pay Services

Mobile bill pay services enable users to pay bills using a mobile app or mobile device. This type of service is becoming increasingly popular, as it provides unparalleled convenience and flexibility.Security Measures and Best Practices

Strong Passwords and Two-Factor Authentication

Using strong passwords and two-factor authentication can significantly enhance security and reduce the risk of unauthorized access. Users should choose passwords that are unique, complex, and difficult to guess, and enable two-factor authentication whenever possible.Monitoring Account Activity

Monitoring account activity and transaction history can help users detect suspicious activity and prevent unauthorized payments. Users should regularly review their account statements and transaction history, and report any discrepancies or suspicious activity to the bill pay service.Conclusion and Future Directions

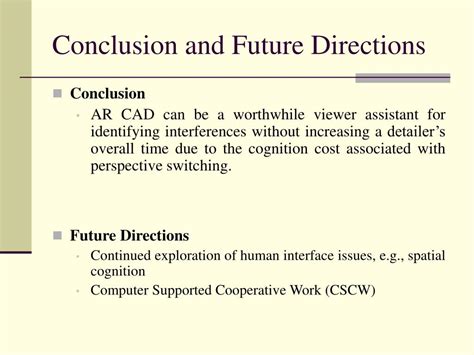

As we look to the future, it's clear that bill pay services will play an increasingly important role in our financial lives. With the rise of mobile payments, contactless payments, and digital wallets, the way we pay bills is changing rapidly. Bill pay services must adapt to these changes, providing innovative solutions that meet the evolving needs of consumers.

We invite you to share your thoughts and experiences with bill pay services. Have you used a bill pay service before? What features do you find most useful? How do you think bill pay services can be improved? Share your comments below, and let's start a conversation about the future of bill pay services.

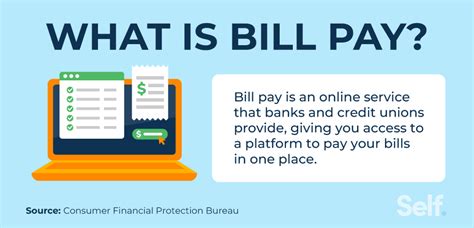

What is a bill pay service?

+A bill pay service is a platform that allows users to pay bills online or through mobile devices.

How do bill pay services work?

+Bill pay services work by connecting users with billers, facilitating payments, and providing features such as automatic payment scheduling and payment reminders.

What are the benefits of using a bill pay service?

+The benefits of using a bill pay service include convenience, flexibility, and security, as well as features such as automatic payment scheduling and payment reminders.